Computershare W9 Form

What is the Computershare W-9?

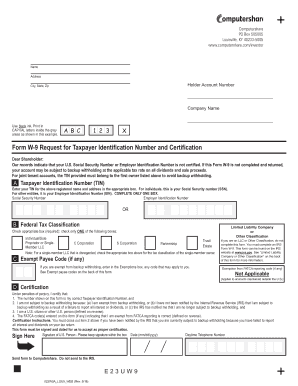

The Computershare W-9 form is a tax document used in the United States by individuals and entities to provide their taxpayer identification information to requesters. This form is essential for ensuring that the correct information is reported to the Internal Revenue Service (IRS) for income tax purposes. By completing the W-9, individuals confirm their status as U.S. persons, which includes citizens and residents, and provide their Social Security Number (SSN) or Employer Identification Number (EIN). This information is crucial for the requester to accurately report any payments made to the individual or business.

Steps to Complete the Computershare W-9

Completing the Computershare W-9 form involves several straightforward steps:

- Download the form: Access the Computershare W-9 form from the official website or request it from the entity requiring it.

- Fill in your information: Provide your name, business name (if applicable), and address. Ensure that the name matches the one associated with your SSN or EIN.

- Tax classification: Select the appropriate tax classification that applies to you or your business, such as individual, corporation, or partnership.

- Taxpayer identification number: Enter your SSN or EIN in the designated field.

- Signature: Sign and date the form to certify that the information provided is accurate.

Legal Use of the Computershare W-9

The Computershare W-9 form serves a critical legal function in the realm of tax compliance. It is used by payers to collect necessary information to report payments made to individuals and businesses to the IRS. The form must be filled out accurately to avoid issues with tax reporting. Failure to provide a completed W-9 may result in backup withholding, where the payer is required to withhold a percentage of payments for tax purposes. It is important to understand that the information provided on the W-9 must be truthful and up to date to ensure compliance with IRS regulations.

How to Obtain the Computershare W-9

Obtaining the Computershare W-9 form can be done through several methods:

- Official website: Visit the Computershare website to download the latest version of the W-9 form.

- Request from the requester: If a company or individual has asked you to complete a W-9, they may provide you with the form directly.

- IRS website: The IRS also provides a standard W-9 form that can be used for Computershare purposes, ensuring compliance with federal requirements.

Form Submission Methods

The completed Computershare W-9 form can be submitted in various ways, depending on the requester's preferences:

- Online submission: Some companies may allow you to submit the W-9 electronically through their secure platforms.

- Mail: You can print the completed form and send it via postal mail to the requester.

- In-person delivery: If applicable, you may also deliver the form in person to the requesting entity.

Key Elements of the Computershare W-9

Understanding the key elements of the Computershare W-9 form is essential for accurate completion:

- Name: The individual or business name must match the IRS records.

- Business name (if applicable): Include this if you operate under a different name.

- Address: Provide the full mailing address where you receive tax documents.

- Tax classification: Clearly indicate your tax status to avoid confusion.

- Taxpayer identification number: This is crucial for the IRS to track your income.

Quick guide on how to complete computershare w9

Prepare Computershare W9 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the features necessary to create, modify, and eSign your documents quickly without delay. Handle Computershare W9 on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

How to alter and eSign Computershare W9 effortlessly

- Find Computershare W9 and then click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent portions of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, laborious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choosing. Modify and eSign Computershare W9 and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the computershare w9

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W9 form and why is it important?

A W9 form is a tax form used in the United States to collect taxpayer information for reporting purposes. It is important because businesses use it to obtain the correct taxpayer identification number to report payments made to independent contractors and freelancers. Using a W9 form helps ensure compliance with IRS regulations.

-

How can I easily fill out a W9 form using airSlate SignNow?

airSlate SignNow offers an intuitive platform where you can quickly fill out and customize your W9 form. The user-friendly interface allows you to enter your information effortlessly, and you can save the document for future use or send it directly to your clients for their records.

-

Is there a cost associated with using airSlate SignNow for W9 forms?

airSlate SignNow offers various pricing plans to suit different business needs, including a cost-effective solution for managing W9 forms. You can choose a plan that fits your budget while taking advantage of features that streamline the document signing process. It's worth checking our website for the latest pricing options.

-

Can I integrate airSlate SignNow with other accounting software for W9 forms?

Yes, airSlate SignNow seamlessly integrates with various accounting and business applications to manage W9 forms efficiently. This integration allows you to automatically sync your documents, making it easier to keep track of tax information and streamline your financial processes.

-

What are the benefits of using airSlate SignNow for electronic W9 forms?

Using airSlate SignNow for electronic W9 forms provides several benefits, including faster processing times and greater accuracy. The platform ensures that all your documents are securely stored and easy to access, helping you maintain compliance with tax regulations while simplifying your workflow.

-

Can I securely store my W9 form on airSlate SignNow?

Absolutely! airSlate SignNow securely stores your W9 forms in a protected environment, ensuring that sensitive information is safe. Our platform uses encryption and other security measures to safeguard your data, giving you peace of mind while maintaining easy access to your documents.

-

What types of businesses can benefit from using W9 forms on airSlate SignNow?

Various types of businesses can benefit from using W9 forms on airSlate SignNow, including freelancers, small businesses, and larger corporations. The platform’s ease of use and efficient document management makes it ideal for any organization that needs to collect taxpayer information efficiently and securely.

Get more for Computershare W9

- Addressamp39 title oregon form

- W oregon gov oregon form

- Form it 635 new york youth jobs program tax credit tax year

- Marketing fee agreement form

- Collections enforcement section150 e gay st 21 form

- Early admission request form eugene school district 4j 4j lane

- Software outsourc contract template form

- Software maintenance contract template form

Find out other Computershare W9

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself