Form it 635 New York Youth Jobs Program Tax Credit Tax Year 2023

What is the Form IT 635 New York Youth Jobs Program Tax Credit Tax Year

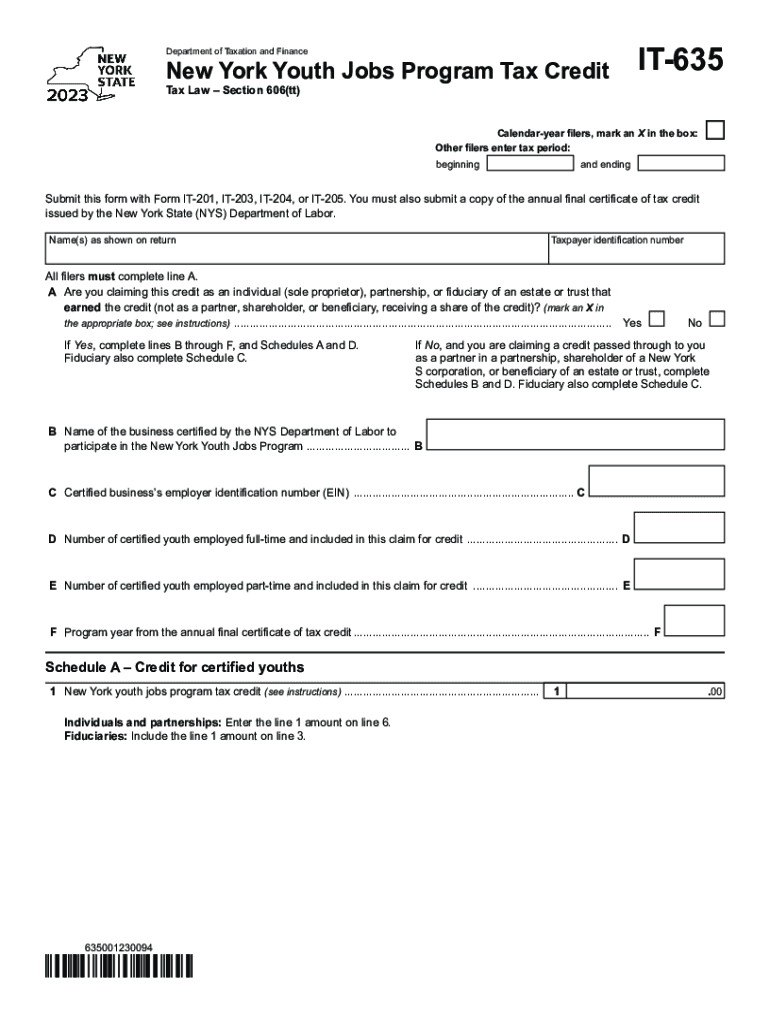

The Form IT 635 is a tax form used in New York to apply for the Youth Jobs Program Tax Credit. This credit is designed to incentivize employers to hire young individuals aged between sixteen and twenty-four who are residents of New York State. The tax credit aims to reduce the financial burden on businesses while providing job opportunities for youth, promoting workforce development in the state. The credit can be claimed for eligible wages paid to qualifying employees during a specific tax year.

Eligibility Criteria

To qualify for the Youth Jobs Program Tax Credit, employers must meet certain criteria. Eligible employers include businesses that hire youth within the specified age range who are residents of New York State. The youth must be employed for a minimum number of hours and earn a qualifying wage. Additionally, the employer must not have any outstanding tax liabilities or be in violation of any state labor laws. It is important for employers to review the specific eligibility requirements outlined by the New York State Department of Taxation and Finance to ensure compliance.

Steps to complete the Form IT 635 New York Youth Jobs Program Tax Credit Tax Year

Completing the Form IT 635 involves several steps. First, employers must gather information about the eligible employees, including their names, Social Security numbers, and the wages paid. Next, employers should fill out the form accurately, providing details about the business and the qualifying youth employees. It is essential to calculate the credit amount based on the wages paid and ensure all required documentation is attached. Once completed, the form should be submitted along with the employer's tax return for the applicable tax year.

Filing Deadlines / Important Dates

Employers must be aware of critical deadlines when filing the Form IT 635. The form must be submitted with the employer's annual tax return, which typically follows the standard filing deadlines set by the IRS. For most businesses, this means the form is due on April fifteenth of the following year. Employers should also keep track of any changes to these dates, as state regulations may adjust deadlines or introduce new requirements.

Form Submission Methods (Online / Mail / In-Person)

The Form IT 635 can be submitted through various methods. Employers have the option to file the form electronically using approved tax software, which can streamline the process and reduce errors. Alternatively, the form can be printed and mailed to the appropriate tax office. In some cases, employers may also have the option to submit the form in person at designated tax offices. It is advisable to verify the preferred submission method based on the latest guidelines from the New York State Department of Taxation and Finance.

Key elements of the Form IT 635 New York Youth Jobs Program Tax Credit Tax Year

Key elements of the Form IT 635 include the identification of the employer, details of the eligible youth employees, and the calculation of the tax credit amount. Employers must provide accurate information about the wages paid to each qualifying employee and ensure that all necessary documentation is included. Additionally, the form requires the employer's tax identification number and may ask for information regarding any previous claims made for the Youth Jobs Program Tax Credit. Understanding these key elements is crucial for successful completion and submission of the form.

Quick guide on how to complete form it 635 new york youth jobs program tax credit tax year

Accomplish Form IT 635 New York Youth Jobs Program Tax Credit Tax Year effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to generate, alter, and eSign your documents swiftly without any holdups. Manage Form IT 635 New York Youth Jobs Program Tax Credit Tax Year on any device with airSlate SignNow's Android or iOS applications and simplify any document-focused process today.

The simplest method to modify and eSign Form IT 635 New York Youth Jobs Program Tax Credit Tax Year effortlessly

- Obtain Form IT 635 New York Youth Jobs Program Tax Credit Tax Year and then click Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides explicitly for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the data and then click the Done button to save your updates.

- Select your preferred method to send your form, whether via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your needs in document management with just a few clicks from any device. Modify and eSign Form IT 635 New York Youth Jobs Program Tax Credit Tax Year and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 635 new york youth jobs program tax credit tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 635 new york youth jobs program tax credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form IT 635 New York Youth Jobs Program Tax Credit Tax Year?

The Form IT 635 New York Youth Jobs Program Tax Credit Tax Year is a tax form that allows eligible businesses to apply for a credit against their taxes for hiring eligible youth. This credit is designed to encourage youth employment and support workforce development in New York. Completing this form accurately is essential to securing the tax benefits allocated for the respective tax year.

-

How can airSlate SignNow help with Form IT 635 New York Youth Jobs Program Tax Credit Tax Year submissions?

airSlate SignNow streamlines the document preparation and eSigning process, making it easier to complete Form IT 635 New York Youth Jobs Program Tax Credit Tax Year. Our solution ensures that documents are completed, signed, and submitted efficiently, reducing the risk of errors and expediting the tax credit application. This enhances productivity and saves time for businesses.

-

Is there a cost associated with using airSlate SignNow for Form IT 635 New York Youth Jobs Program Tax Credit Tax Year?

airSlate SignNow offers cost-effective pricing plans tailored to different business needs. By using our platform to manage Form IT 635 New York Youth Jobs Program Tax Credit Tax Year, businesses can save on paperwork and administrative costs. Moreover, the potential tax savings from the credit can outweigh the cost of using our services.

-

What features does airSlate SignNow offer for filling out Form IT 635 New York Youth Jobs Program Tax Credit Tax Year?

With airSlate SignNow, users have access to features such as document templates, auto-fill options, and real-time collaboration for completing Form IT 635 New York Youth Jobs Program Tax Credit Tax Year. Additionally, our platform allows users to easily track the signing status and store documents securely, ensuring a smooth process from start to finish.

-

Can airSlate SignNow integrate with my existing systems for handling Form IT 635 New York Youth Jobs Program Tax Credit Tax Year?

Yes, airSlate SignNow seamlessly integrates with various business applications to enhance productivity when handling Form IT 635 New York Youth Jobs Program Tax Credit Tax Year. Our integration capabilities allow you to connect your existing tools, ensuring that all your processes work harmoniously together. This flexibility simplifies document management and enhances overall efficiency.

-

What are the benefits of using airSlate SignNow for the tax credit application process?

Using airSlate SignNow for the tax credit application process simplifies the completion and submission of Form IT 635 New York Youth Jobs Program Tax Credit Tax Year. Benefits include reduced turnaround time, enhanced accuracy, and secure storage of important tax documents. Clients also experience improved compliance with tax regulations, ensuring smooth processing of their claims.

-

Who is eligible for the New York Youth Jobs Program Tax Credit?

Eligibility for the New York Youth Jobs Program Tax Credit generally includes businesses that hire youth between the ages of 16 and 24. The program aims to support workforce entry for young individuals, and completing Form IT 635 New York Youth Jobs Program Tax Credit Tax Year correctly is pivotal for businesses to claim the credit. It's advisable to review the specific requirements to ensure compliance.

Get more for Form IT 635 New York Youth Jobs Program Tax Credit Tax Year

- Child care provider form

- Aiac8 tmp this form is applicable for the first no cost extension request academics triton

- Tax file number declaration mtaa super form

- Vermont 8879 vt f fiduciary income tax declaration for tax vermont form

- Consolidated annual form serc

- Esc application procedure for the incoming grade 7 form

- Basic guide to start your own business form

- It05 form jamaica 686683701

Find out other Form IT 635 New York Youth Jobs Program Tax Credit Tax Year

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word