Oregon Form 243

What is the Oregon Form 243

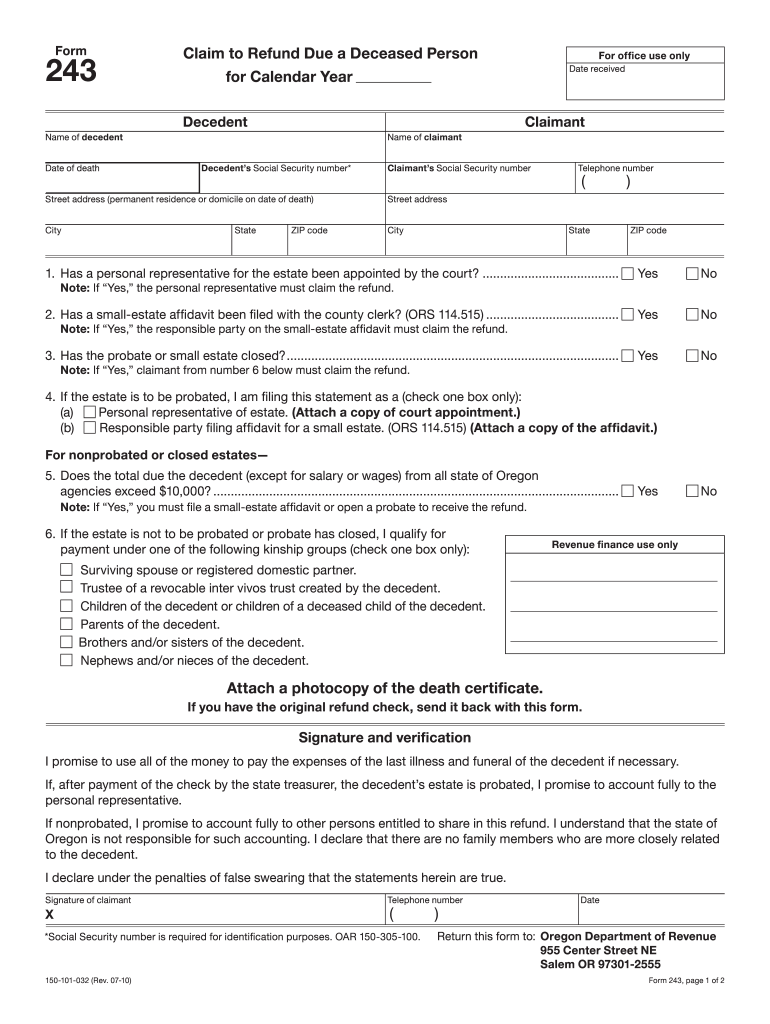

The Oregon Form 243 is a state-specific tax form used for reporting certain income and tax credits. This form is essential for individuals and businesses operating within Oregon, as it helps ensure compliance with state tax regulations. It is particularly relevant for those who need to report specific types of income or claim credits that are unique to Oregon's tax system.

How to use the Oregon Form 243

Using the Oregon Form 243 involves several key steps. First, gather all necessary financial documents, including income statements and previous tax returns. Next, carefully fill out the form, ensuring all information is accurate and complete. After completing the form, review it for any errors or omissions before submission. It is important to follow the specific instructions provided with the form to ensure proper filing.

Steps to complete the Oregon Form 243

Completing the Oregon Form 243 requires a systematic approach. Begin by downloading the form from the official Oregon Department of Revenue website. Fill in your personal information, including your name, address, and Social Security number. Next, report your income as instructed, ensuring you include any applicable deductions or credits. Once all sections are filled out, sign and date the form. Finally, submit the form either electronically or via mail, depending on your preference.

Legal use of the Oregon Form 243

The legal use of the Oregon Form 243 is governed by state tax laws. To be considered valid, the form must be completed accurately and submitted by the designated deadlines. Failure to comply with these regulations may result in penalties or delays in processing your tax return. It is crucial to maintain records of your submission for future reference and potential audits.

Key elements of the Oregon Form 243

Key elements of the Oregon Form 243 include your personal identification information, income details, and any applicable tax credits. The form typically requires you to disclose various sources of income, such as wages, self-employment income, and interest. Additionally, it allows you to claim specific credits that may reduce your overall tax liability, making it an important tool for effective tax management.

Filing Deadlines / Important Dates

Filing deadlines for the Oregon Form 243 are critical to avoid penalties. Generally, the form must be submitted by April 15 of each year, aligning with the federal tax filing deadline. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to the filing schedule each tax year.

Who Issues the Form

The Oregon Form 243 is issued by the Oregon Department of Revenue. This agency is responsible for administering tax laws and ensuring compliance among taxpayers in the state. They provide resources and guidance for individuals and businesses to help them understand their tax obligations and properly complete the necessary forms.

Quick guide on how to complete oregon form 243

Effortlessly Prepare Oregon Form 243 on Any Device

The management of digital documents has become increasingly popular among companies and individuals alike. It serves as a perfect environmentally friendly alternative to traditional printed and signed documents since you can obtain the correct form and securely keep it online. airSlate SignNow provides all the tools necessary for you to create, modify, and electronically sign your documents promptly without delays. Handle Oregon Form 243 on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Simplest Way to Modify and Electronically Sign Oregon Form 243 Effortlessly

- Obtain Oregon Form 243 and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important parts of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Don't worry about lost or misfiled documents, tedious form searching, or errors requiring you to print new copies of documents. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Oregon Form 243 to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oregon form 243

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oregon Form 243?

The Oregon Form 243 is a specific document used for various legal and administrative purposes in the state of Oregon. It is essential for compliance with state regulations, and using airSlate SignNow can streamline the eSigning process for this form.

-

How can I fill out the Oregon Form 243 electronically?

You can fill out the Oregon Form 243 electronically using airSlate SignNow's user-friendly interface. Our platform allows you to easily input information, save your changes, and prepare the document for eSignature without any hassle.

-

Is airSlate SignNow compatible with Oregon Form 243?

Yes, airSlate SignNow is fully compatible with the Oregon Form 243. Our platform supports various document types, enabling you to upload, manage, and eSign your Oregon Form 243 seamlessly.

-

What are the costs associated with using airSlate SignNow for the Oregon Form 243?

airSlate SignNow offers competitive pricing for businesses looking to manage their documentation, including the Oregon Form 243. Subscription plans are available to suit different needs, ensuring a cost-effective solution tailored to your requirements.

-

What features does airSlate SignNow provide for the Oregon Form 243?

AirSlate SignNow provides features like customizable templates, eSignature capabilities, and document tracking specifically for the Oregon Form 243. These tools enhance efficiency and ensure your form is processed smoothly.

-

Can I integrate airSlate SignNow with other applications for the Oregon Form 243?

Absolutely! AirSlate SignNow supports integrations with numerous applications, making it easy to manage the Oregon Form 243 alongside other tools you may use. This ensures a streamlined workflow without data loss.

-

What are the benefits of using airSlate SignNow for the Oregon Form 243?

Using airSlate SignNow for the Oregon Form 243 speeds up the signing process, enhances document security, and improves organization. Businesses benefit from having an efficient, paperless solution that simplifies compliance.

Get more for Oregon Form 243

- Prwgzgings pampquotlamp39amp39iampquot b ncbi nlm nih form

- Patient safety statement lakeside behavioral health system form

- Wilderness volunteer fire department inc company profile form

- Cplr 2105 form

- Dance studio contract template form

- Plumb service contract template form

- Plumb work contract template form

- Plumber contract template form

Find out other Oregon Form 243

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast