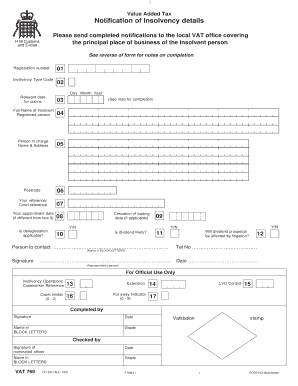

Vat769 Form

What is the Vat769

The Vat769 form is a crucial document used in the United States for specific tax-related purposes. It is primarily utilized by businesses to report and reconcile value-added tax (VAT) obligations. Understanding the Vat769 is essential for compliance with federal and state tax regulations. This form ensures that businesses accurately report their VAT liabilities, which can affect their overall financial standing and legal obligations.

How to use the Vat769

Using the Vat769 form involves several key steps to ensure accurate completion and submission. First, gather all necessary financial records related to VAT transactions. This includes invoices, receipts, and any relevant documentation that supports your VAT claims. Next, carefully fill out the form, ensuring that all sections are completed accurately. It's important to double-check calculations and ensure that the information aligns with your financial records. Finally, submit the completed Vat769 form through the appropriate channels, whether electronically or via mail, depending on your specific requirements.

Steps to complete the Vat769

Completing the Vat769 form requires attention to detail and adherence to specific guidelines. Follow these steps for a smooth process:

- Gather necessary documents, including financial records and previous VAT filings.

- Fill out the form, ensuring all required fields are completed.

- Review the form for accuracy, checking calculations and information consistency.

- Sign and date the form, confirming the validity of the information provided.

- Submit the form according to the guidelines set by the relevant tax authority.

Legal use of the Vat769

The legal use of the Vat769 form is governed by various tax laws and regulations. It is essential for businesses to understand the legal implications of submitting this form. Proper use ensures compliance with federal and state tax requirements, which can help avoid penalties and legal issues. The Vat769 serves as a formal declaration of VAT obligations, and incorrect or fraudulent submissions can lead to serious consequences.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for the completion and submission of the Vat769 form. These guidelines outline the necessary information to include, deadlines for submission, and the consequences of non-compliance. It is crucial for businesses to stay informed about any updates or changes to these guidelines to ensure ongoing compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Vat769 form are critical for maintaining compliance with tax regulations. Businesses must be aware of the specific dates by which the form must be submitted to avoid penalties. Typically, these deadlines align with quarterly or annual tax reporting periods. Keeping a calendar of important dates related to the Vat769 can help ensure timely submissions and avoid unnecessary complications.

Quick guide on how to complete vat769

Complete Vat769 effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Vat769 on any platform through airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Vat769 effortlessly

- Locate Vat769 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal significance as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies your document management requirements in just a few clicks from any device you prefer. Modify and eSign Vat769 and ensure exceptional communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat769

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the VAT769 form and why is it important?

The VAT769 form is a crucial document for businesses involved in VAT transactions in certain regions. It helps to report and manage VAT obligations efficiently, ensuring compliance with tax regulations. Understanding the VAT769 form is essential for accurate financial reporting and avoiding penalties.

-

How can airSlate SignNow assist with the VAT769 form?

airSlate SignNow provides a seamless platform for businesses to electronically sign and send the VAT769 form. With its user-friendly interface, users can quickly complete the form and ensure it's submitted on time. This simplifies the process and enhances efficiency in managing VAT documentation.

-

Is there a cost associated with using airSlate SignNow for VAT769 form processing?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business needs, including processing the VAT769 form. These plans are designed to provide a cost-effective solution for managing electronic signatures and document workflows. You can choose a plan that best suits your business requirements.

-

What features does airSlate SignNow offer for the VAT769 form?

airSlate SignNow provides features like customizable templates, real-time tracking, and secure storage, which are beneficial for managing the VAT769 form. These functionalities streamline the signing process and ensure that all parties involved can access the necessary documents anytime, anywhere. Furthermore, these enhancements contribute to overall operational efficiency.

-

Can I integrate airSlate SignNow with other tools to manage the VAT769 form?

Absolutely! airSlate SignNow offers various integration options with popular software tools such as CRM and accounting systems. This capability allows users to seamlessly manage the VAT769 form alongside their existing workflows, enhancing productivity and reducing manual data entry.

-

What are the benefits of electronically signing the VAT769 form using airSlate SignNow?

Using airSlate SignNow to electronically sign the VAT769 form offers numerous benefits, including faster turnaround times and increased security. Electronic signatures create a legally binding agreement while reducing the time spent on paperwork. Additionally, the digital nature of the solution minimizes the risk of lost documents.

-

Is airSlate SignNow compliant with regulations related to the VAT769 form?

Yes, airSlate SignNow is designed to comply with industry regulations, ensuring that the electronic signatures applied to the VAT769 form are legally valid. This compliance gives businesses confidence when sending sensitive documents. By using our platform, you can rest assured that your document management complies with applicable laws.

Get more for Vat769

Find out other Vat769

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation