Dp 10 Instructions Form

What are the Dp 10 Instructions?

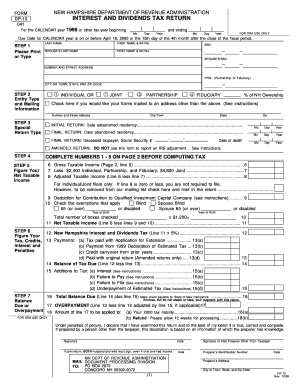

The Dp 10 instructions provide essential guidance for completing the New Hampshire form DP-10, which is used for various tax-related purposes. This form is particularly relevant for individuals and businesses that need to report specific financial information to the state. Understanding the instructions is crucial for ensuring accurate completion and compliance with state regulations.

Steps to Complete the Dp 10 Instructions

Completing the Dp 10 form involves several key steps. First, gather all necessary financial documents, including income statements and expense records. Next, carefully read the instructions to understand what information is required in each section of the form. Fill out the form accurately, ensuring that all figures are correct and that you have included any necessary attachments. Finally, review the completed form for any errors before submission.

Legal Use of the Dp 10 Instructions

The Dp 10 instructions are legally binding and must be adhered to when filling out the form. Compliance with these instructions ensures that the submitted form meets state requirements, which can help avoid penalties or legal issues. It is important to follow the guidelines closely, as any discrepancies may result in delays or rejections of the form.

Required Documents

When completing the Dp 10 form, specific documents are required to support the information provided. These may include:

- Income statements from all sources

- Expense receipts or records

- Previous tax returns, if applicable

- Any additional documentation requested in the instructions

Having these documents ready will streamline the completion process and ensure that all necessary information is included.

Form Submission Methods

The Dp 10 form can be submitted through various methods, depending on the preferences of the filer. Options typically include:

- Online submission via the state’s tax portal

- Mailing a physical copy to the appropriate state department

- In-person submission at designated state offices

Choosing the right submission method can impact processing times and ease of access to support if needed.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Dp 10 form. Typically, the form must be submitted by a specific date each year, which may vary based on individual circumstances or changes in state law. Marking these dates on your calendar can help ensure timely submission and avoid penalties for late filing.

Who Issues the Form

The Dp 10 form is issued by the New Hampshire Department of Revenue Administration. This state agency is responsible for overseeing tax compliance and ensuring that residents and businesses adhere to state tax laws. For any questions regarding the form or its instructions, contacting the department directly can provide clarity and assistance.

Quick guide on how to complete dp 10 instructions

Complete Dp 10 Instructions effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the appropriate form and safely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly and without issues. Manage Dp 10 Instructions on any device using airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

How to alter and eSign Dp 10 Instructions effortlessly

- Find Dp 10 Instructions and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize relevant parts of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or downloading it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require new copies to be printed. airSlate SignNow addresses your document management needs with just a few clicks from your chosen device. Modify and eSign Dp 10 Instructions to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dp 10 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the dp 10 instructions for using airSlate SignNow?

The dp 10 instructions for airSlate SignNow involve a straightforward process of creating, sending, and signing documents electronically. You can easily follow the dashboard prompts to upload your document, add signers, and customize signing fields. Once set up, simply send the document out for eSignature and track the status in real time.

-

Are there any costs associated with following the dp 10 instructions?

Using airSlate SignNow with the dp 10 instructions typically involves a subscription fee, which varies based on the features and user count required. However, airSlate offers a free trial that lets prospective customers test the platform without upfront costs. This enables you to understand how dp 10 instructions work before committing financially.

-

What features should I know about when using dp 10 instructions?

The dp 10 instructions highlight essential features like customizable templates, automated workflows, and real-time tracking of document status. Additionally, you can integrate airSlate SignNow with other applications like CRM systems, enhancing your overall efficiency. Familiarizing yourself with these features will help you maximize the benefits of your eSigning experience.

-

What benefits does airSlate SignNow offer when following dp 10 instructions?

Following the dp 10 instructions for airSlate SignNow allows businesses to streamline their document signing process, saving time and reducing paperwork. You can enjoy enhanced security with encrypted data and legally binding signatures, which is critical for compliance. Ultimately, this improves workflow efficiency and client satisfaction.

-

How can I integrate airSlate SignNow with other tools using dp 10 instructions?

The dp 10 instructions provide guidance on integrating airSlate SignNow with a variety of third-party applications like Google Drive and Zapier. By following these steps, you can automate your workflow, making document management even more efficient. This integration helps maintain a seamless workflow while managing your business's document needs.

-

Is technical support available for users following dp 10 instructions?

Yes, airSlate SignNow offers robust technical support for users following the dp 10 instructions. You can access help through a comprehensive knowledge base, tutorials, and customer support channels. Whether you have questions about features or need guidance on specific instructions, support is readily available to assist you.

-

What industries can benefit from following the dp 10 instructions?

Various industries, including real estate, healthcare, and finance, can benefit from the dp 10 instructions when using airSlate SignNow. The platform's versatility allows it to cater to the unique needs of different sectors, particularly those that require secure and efficient document signing. By adopting these instructions, businesses across industries can streamline their operations signNowly.

Get more for Dp 10 Instructions

- Irs 1120 w 2018 form

- Irs form 1041 2017 2018

- Amount of overpayment to be applied to 2018 estimated tax form

- 1040pr 2017 form

- Arizona form 321 credit for contributions to qualifying charitable organizations

- Property tax or rent rebate claim pa 1000 formspublications 794548134

- Massachusetts form 1 personal income tax return

- Form g 45 periodic general exciseuse tax return rev 794548949

Find out other Dp 10 Instructions

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word