Aramark W2 Form

What is the Aramark W-2?

The Aramark W-2 is a tax form that reports an employee's annual wages and the amount of taxes withheld from their paycheck. This form is essential for employees to accurately file their federal and state income tax returns. The W-2 includes important information such as the employee's Social Security number, employer identification number, and the total earnings for the year. Understanding this form is crucial for ensuring compliance with tax regulations and for determining any potential tax refunds or liabilities.

How to Obtain the Aramark W-2

Employees can obtain their Aramark W-2 through several methods. The most common way is by accessing the Aramark online portal, where employees can log in to their accounts to download the form. Alternatively, employees may receive a physical copy of the W-2 by mail, typically sent out by the end of January each year. If an employee has not received their W-2 by mid-February, they should contact Aramark's human resources department for assistance.

Steps to Complete the Aramark W-2

Completing the Aramark W-2 involves several key steps. First, ensure that all personal information, including your name and Social Security number, is accurate. Next, review the earnings and tax withholding sections to confirm that they reflect your actual earnings for the year. If any discrepancies are found, contact your employer for corrections. Once verified, the form can be used to fill out your federal and state tax returns. It is advisable to keep a copy of the completed W-2 for your records.

Legal Use of the Aramark W-2

The Aramark W-2 is legally binding and must be used in accordance with IRS guidelines. Employees are required to report the information on the W-2 when filing their taxes. Failure to accurately report earnings can lead to penalties and interest charges from the IRS. It is important to ensure that the W-2 is filled out correctly and submitted by the appropriate deadlines to avoid any legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the Aramark W-2 are crucial for compliance. Employees must submit their tax returns by April 15 each year, which is typically the deadline for filing individual income tax returns. The W-2 forms should be distributed by Aramark no later than January 31, allowing employees sufficient time to prepare their tax filings. It is important to be aware of these dates to avoid late fees and penalties.

Key Elements of the Aramark W-2

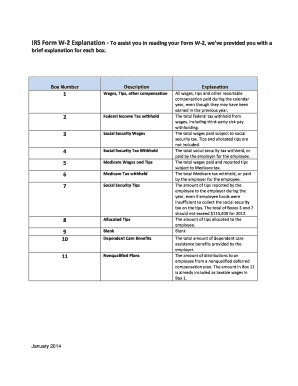

The key elements of the Aramark W-2 include various boxes that report different types of income and taxes withheld. Key boxes to note are Box 1, which shows total taxable wages, Box 2 for federal income tax withheld, and Box 16 for state wages. Understanding these elements is essential for accurately reporting income and ensuring compliance with tax laws. Each box serves a specific purpose and contributes to the overall tax calculation.

Quick guide on how to complete aramark w2

Complete Aramark W2 with ease on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Aramark W2 on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Aramark W2 effortlessly

- Obtain Aramark W2 and select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically designed by airSlate SignNow for that task.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal value as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Modify and eSign Aramark W2 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the aramark w2

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to access my Aramark tax form?

To access your Aramark tax form, you need to log in to your account. Once logged in, navigate to the 'Documents' section where you will find your Aramark my tax form available for download. If you encounter issues, ensure your profile information is up to date and signNow out to support for assistance.

-

Why is it important to review my Aramark tax form?

Reviewing your Aramark my tax form is essential to ensure accuracy before filing your taxes. Any discrepancies can lead to delays or issues with the IRS, so double-check all entries. By confirming the information, you protect yourself from future complications.

-

Are there any fees associated with obtaining my Aramark tax form?

No, obtaining your Aramark my tax form is free of charge. airSlate SignNow allows you to access and eSign your documents without hidden fees. This cost-effective solution ensures that managing your tax forms is budget-friendly.

-

Can I eSign my Aramark tax form using airSlate SignNow?

Yes, you can easily eSign your Aramark my tax form using airSlate SignNow. The platform provides a user-friendly interface for signing documents electronically, which streamlines the process. This allows for quick submission and efficient handling of your tax documentation.

-

Is my Aramark tax form secure with airSlate SignNow?

Absolutely, your Aramark my tax form is secured with high-level encryption and compliance measures. airSlate SignNow prioritizes the confidentiality of your information, ensuring that only authorized users have access. Your data is protected throughout the entire signing process.

-

What should I do if I can't find my Aramark tax form?

If you cannot find your Aramark my tax form, first check your account settings to verify that your information is correct. If it's still missing, contact Aramark's support team for guidance. They can help track down your tax form and ensure you have what you need for tax season.

-

What are the benefits of using airSlate SignNow for my Aramark tax form?

Using airSlate SignNow to manage your Aramark my tax form offers numerous benefits, including ease of use and efficiency. The platform allows you to access, eSign, and save your documents securely from any device. This streamlines your tax preparation process and saves you valuable time.

Get more for Aramark W2

Find out other Aramark W2

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online