Form 1040 Schedule Eic 2018

What is the Form 1040 Schedule EIC

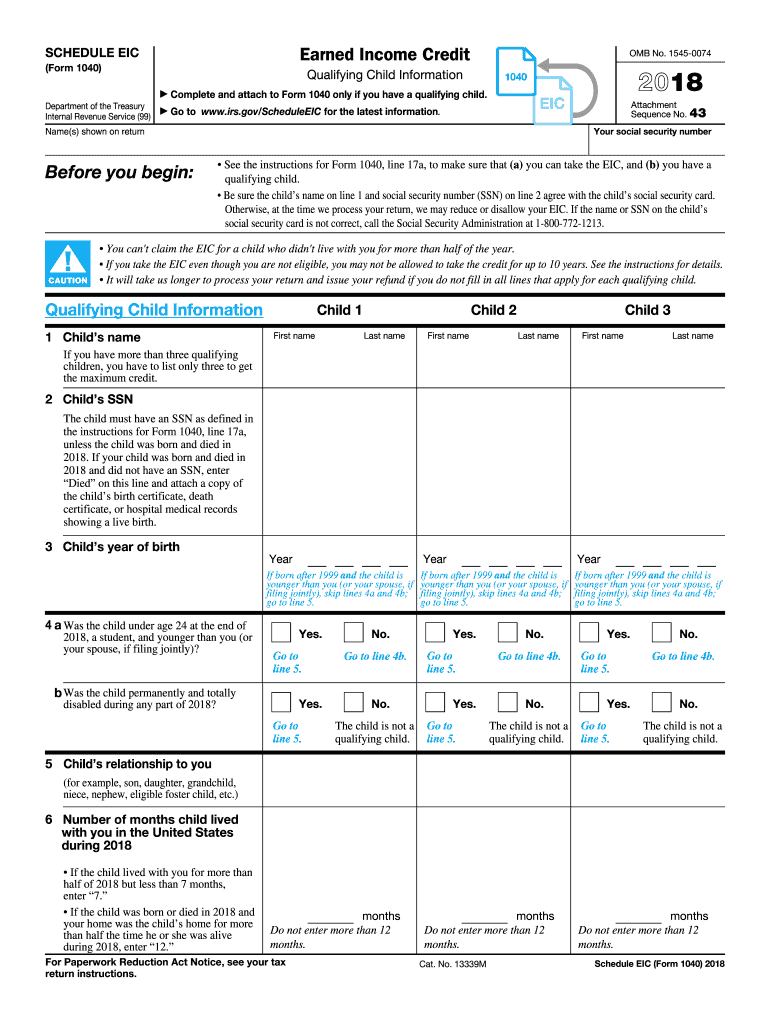

The Form 1040 Schedule EIC is a supplemental form used by eligible taxpayers to claim the Earned Income Credit (EIC) when filing their federal income tax returns. This credit is designed to assist low to moderate-income working individuals and families by reducing the amount of tax owed and potentially providing a refund. The EIC is particularly beneficial for those with qualifying children, as the amount of the credit increases with the number of dependents. Understanding the purpose and benefits of this form is essential for maximizing tax refunds and ensuring compliance with IRS regulations.

How to use the Form 1040 Schedule EIC

Using the Form 1040 Schedule EIC involves several steps. First, taxpayers must determine their eligibility based on income levels, filing status, and the number of qualifying children. Once eligibility is confirmed, the taxpayer should complete the form by providing necessary information, including income details and dependent information. After filling out the Schedule EIC, it should be attached to the main Form 1040 when submitting the tax return. It is crucial to review the form for accuracy to avoid delays in processing and ensure the correct credit amount is claimed.

Steps to complete the Form 1040 Schedule EIC

Completing the Form 1040 Schedule EIC requires careful attention to detail. Here are the key steps:

- Check eligibility: Review the IRS guidelines to confirm that you meet the income and dependent requirements.

- Gather documentation: Collect necessary documents such as W-2 forms, tax returns, and Social Security numbers for qualifying children.

- Fill out the form: Enter your income details, filing status, and information about your dependents in the appropriate sections.

- Review: Double-check all entries for accuracy and completeness.

- Attach and file: Attach the completed Schedule EIC to your Form 1040 and submit it by the tax deadline.

Eligibility Criteria

To qualify for the Earned Income Credit using the Form 1040 Schedule EIC, taxpayers must meet specific criteria. These include:

- Having earned income from employment or self-employment.

- Filing as a single, head of household, or married filing jointly.

- Meeting income limits that vary depending on filing status and the number of qualifying children.

- Having valid Social Security numbers for all qualifying children.

- Being a U.S. citizen or resident alien for the entire tax year.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for taxpayers using the Form 1040 Schedule EIC. The general deadline for filing federal income tax returns is April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any changes to deadlines for specific tax years. Filing early can help ensure that taxpayers receive their refunds sooner, especially if they are eligible for the EIC.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers can submit the Form 1040 Schedule EIC through various methods. The most common submission methods include:

- Online filing: Many taxpayers choose to file electronically using tax software, which often includes features for completing the Schedule EIC.

- Mail: Taxpayers can print the completed forms and mail them to the appropriate IRS address based on their location and filing status.

- In-person: Some individuals may opt to file in person at designated IRS offices or through authorized tax preparers.

Quick guide on how to complete earned income credit worksheet 2017 2018 2019 form

Uncover the easiest method to complete and endorse your Form 1040 Schedule Eic

Are you still squandering time preparing your official documents on physical copies instead of handling them online? airSlate SignNow offers a superior way to complete and endorse your Form 1040 Schedule Eic and associated forms for public services. Our intelligent electronic signature tool provides you with everything needed to manage documents swiftly and in compliance with official standards - robust PDF editing, organizing, safeguarding, signing, and sharing instruments all accessible through a user-friendly interface.

Only a few steps are necessary to finalize the completion and endorsement of your Form 1040 Schedule Eic:

- Load the editable template into the editor with the Retrieve Form button.

- Verify what details you must include in your Form 1040 Schedule Eic.

- Move between the sections using the Next button to avoid missing anything.

- Utilize Text, Checkbox, and Cross tools to fill in the gaps with your details.

- Revise the content with Text boxes or Images from the upper toolbar.

- Emphasize what is essential or Obscure sections that are no longer relevant.

- Hit Sign to generate a legally binding electronic signature using any method you prefer.

- Include the Date next to your signature and finalize your task with the Finish button.

Store your completed Form 1040 Schedule Eic in the Documents folder of your profile, download it, or transfer it to your preferred cloud storage. Our solution also provides versatile form sharing. There’s no need to print out your forms when they need to be sent to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it today!

Create this form in 5 minutes or less

Find and fill out the correct earned income credit worksheet 2017 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

Which ITR form should an NRI fill out for AY 2018–2019 if there are two rental incomes in India other than that from interests?

Choosing Correct Income Tax form is the important aspect of filling Income tax return.Lets us discuss it one by one.ITR -1 —— Mainly used for salary income , other source income, one house property income ( upto Rs. 50 Lakhs ) for Individual Resident Assessees only.ITR-2 —- For Salary Income , Other source income ( exceeding Rs. 50 lakhs) house property income from more than one house and Capital Gains / Loss Income for Individual Resident or Non- Resident Assessees and HUF Assessees only.ITR 3— Income from Business or profession Together with any other income such as Salary Income, Other sources, Capital Gains , House property ( Business/ Profession income is must for filling this form) . For individual and HUF Assessees OnlySo in case NRI Assessees having rental income from two house property , then ITR need to be filed in Form ITR 2.For Detail understanding please refer to my video link.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

Create this form in 5 minutes!

How to create an eSignature for the earned income credit worksheet 2017 2018 2019 form

How to generate an eSignature for the Earned Income Credit Worksheet 2017 2018 2019 Form online

How to create an electronic signature for your Earned Income Credit Worksheet 2017 2018 2019 Form in Google Chrome

How to create an eSignature for signing the Earned Income Credit Worksheet 2017 2018 2019 Form in Gmail

How to generate an electronic signature for the Earned Income Credit Worksheet 2017 2018 2019 Form from your smart phone

How to make an electronic signature for the Earned Income Credit Worksheet 2017 2018 2019 Form on iOS devices

How to make an eSignature for the Earned Income Credit Worksheet 2017 2018 2019 Form on Android devices

People also ask

-

What is the Form 1040 Schedule Eic?

The Form 1040 Schedule Eic is an essential tax form used to claim the Earned Income Tax Credit (EITC) for eligible taxpayers. This schedule allows you to provide necessary information about your qualifying children and your income to determine your eligibility for the credit, which can signNowly reduce your tax liability.

-

How can airSlate SignNow help me with my Form 1040 Schedule Eic?

With airSlate SignNow, you can easily create, send, and eSign your Form 1040 Schedule Eic online, streamlining your tax filing process. Our intuitive platform simplifies document management, ensuring you have all required signatures and forms organized, allowing you to focus on maximizing your tax benefits.

-

Is airSlate SignNow cost-effective for filing the Form 1040 Schedule Eic?

Yes, airSlate SignNow offers a cost-effective solution for managing your Form 1040 Schedule Eic and other tax documents. Our pricing plans are designed to cater to different needs, ensuring that you receive excellent value while efficiently handling your document signing and management tasks.

-

What features does airSlate SignNow offer for tax forms like the Form 1040 Schedule Eic?

airSlate SignNow provides features such as customizable templates, secure eSignatures, and document tracking, specifically tailored for handling tax forms like the Form 1040 Schedule Eic. These features ensure that your documents are completed accurately and submitted on time, minimizing errors and delays.

-

Can I integrate airSlate SignNow with other tax software for Form 1040 Schedule Eic filing?

Absolutely! airSlate SignNow seamlessly integrates with popular tax software to facilitate easier filing of your Form 1040 Schedule Eic. This integration allows you to import data directly into your forms, reducing manual entry and enhancing the overall efficiency of your tax preparation.

-

What benefits does using airSlate SignNow provide for managing Form 1040 Schedule Eic?

Using airSlate SignNow for managing your Form 1040 Schedule Eic offers numerous benefits, including enhanced security, reduced paperwork, and faster processing times. Our eSigning solution not only simplifies the signing process but also helps you stay organized, ensuring you never miss a deadline.

-

Is there customer support available for issues related to Form 1040 Schedule Eic on airSlate SignNow?

Yes, airSlate SignNow offers robust customer support to assist you with any issues related to your Form 1040 Schedule Eic. Our team is available to provide guidance and answer any questions you may have, ensuring you have a smooth experience while using our platform.

Get more for Form 1040 Schedule Eic

Find out other Form 1040 Schedule Eic

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now