Checklist for Tax Deductions Form

What is the checklist for tax deductions?

The checklist for tax deductions is a comprehensive guide designed to help individuals and businesses identify and organize all eligible tax-deductible expenses. It includes various items that can reduce taxable income, ultimately lowering the overall tax liability. Common categories on this checklist may include business expenses, home office deductions, medical expenses, and charitable contributions. By using this checklist, taxpayers can ensure they do not overlook any potential deductions when preparing their tax returns.

How to use the checklist for tax deductions

Using the checklist for tax deductions involves several straightforward steps. First, gather all relevant financial documents, such as receipts, invoices, and bank statements. Next, review each item on the checklist, marking those that apply to your situation. It is essential to categorize expenses accurately to ensure compliance with IRS guidelines. After completing the checklist, compile the identified deductions to streamline the tax preparation process. This organized approach can help maximize deductions and minimize the risk of errors during filing.

Key elements of the checklist for tax deductions

The key elements of the checklist for tax deductions typically include:

- Business Expenses: Costs related to running a business, such as supplies, travel, and advertising.

- Home Office Deductions: Expenses for maintaining a home office, including utilities and rent.

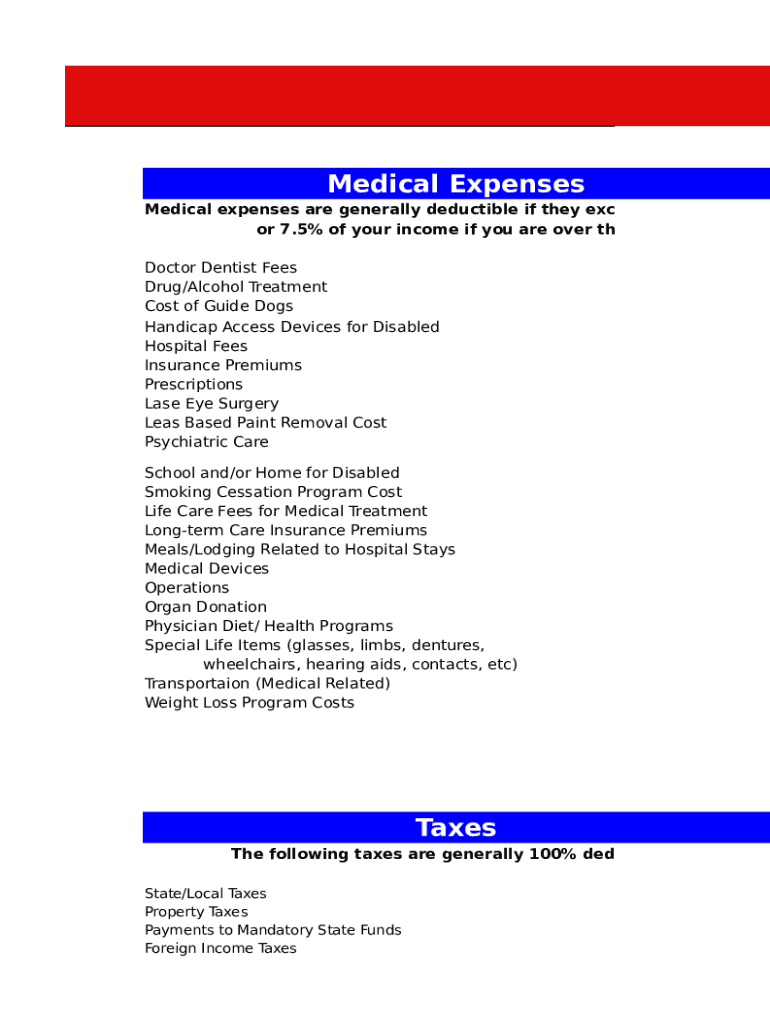

- Medical Expenses: Qualified medical costs that exceed a certain percentage of adjusted gross income.

- Charitable Contributions: Donations made to qualified organizations, which can be deducted from taxable income.

- Education Costs: Tuition and related expenses for education that can qualify for deductions.

Required documents

To effectively utilize the checklist for tax deductions, specific documents are necessary. These may include:

- Receipts for all deductible expenses.

- Bank and credit card statements to verify transactions.

- Invoices for services or products purchased for business use.

- Form W-2 or 1099, depending on employment status.

- Any relevant tax forms that apply to specific deductions.

IRS guidelines

It is crucial to adhere to IRS guidelines when using the checklist for tax deductions. The IRS provides specific rules regarding what qualifies as a deductible expense. This includes ensuring that expenses are both ordinary and necessary for your business or personal tax situation. Additionally, maintaining accurate records and documentation is essential to substantiate claims in case of an audit. Familiarizing yourself with IRS publications related to deductions can provide valuable insights and help ensure compliance.

Filing deadlines / important dates

Awareness of filing deadlines and important dates is vital when using the checklist for tax deductions. Typically, the deadline for filing individual tax returns is April fifteenth each year. However, if this date falls on a weekend or holiday, the deadline may be adjusted. It is also important to note that certain deductions may have specific deadlines for claiming them, particularly for business expenses. Staying informed about these dates can help ensure timely and accurate tax filings.

Examples of using the checklist for tax deductions

Examples of using the checklist for tax deductions can vary widely based on individual circumstances. For instance, a self-employed individual may use the checklist to identify business-related expenses such as office supplies and travel costs. A homeowner may refer to the checklist to ensure they include mortgage interest and property taxes. Additionally, a student may utilize the checklist to capture tuition and textbook expenses. Each example illustrates how the checklist can be tailored to specific tax situations, maximizing potential deductions.

Quick guide on how to complete checklist for tax deductions

Effortlessly Prepare Checklist For Tax Deductions on Any Device

Online document management has become increasingly popular among organizations and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage Checklist For Tax Deductions on any platform with airSlate SignNow's Android or iOS applications and streamline your document-centric processes today.

How to Edit and Electronically Sign Checklist For Tax Deductions with Ease

- Find Checklist For Tax Deductions and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional handwritten signature.

- Review all information and click the Done button to save your changes.

- Choose how you would like to share your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Checklist For Tax Deductions to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the checklist for tax deductions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax deductions sheet and how can it help me?

A tax deductions sheet is a document that helps track eligible expenses for tax deductions. By accurately maintaining a tax deductions sheet, you can maximize your tax savings and ensure compliance with IRS regulations. This tool is essential for both businesses and freelancers looking to streamline their tax filing process.

-

How does airSlate SignNow integrate with tax deductions sheets?

airSlate SignNow allows you to easily upload and eSign your tax deductions sheet, making the process more efficient. Integration with popular accounting software can also help you seamlessly update and manage your expenses. This reduces manual entry errors and ensures all your deduction-related documents are online and accessible.

-

Is there a mobile app for managing my tax deductions sheet?

Yes, airSlate SignNow offers a mobile app that lets you manage your tax deductions sheet on the go. You can easily upload new expenses, sign documents, and view past records directly from your smartphone. This flexibility helps you stay organized and ensures you never miss a deduction opportunity.

-

What features does airSlate SignNow offer for creating a tax deductions sheet?

airSlate SignNow provides a user-friendly platform to create and customize your tax deductions sheet. Key features include template management, the ability to add electronic signatures, and document sharing capabilities. These features are designed to simplify your document workflow and enhance efficiency in managing deductible expenses.

-

Can I collaborate with my accountant using airSlate SignNow and my tax deductions sheet?

Absolutely! airSlate SignNow allows for easy collaboration with your accountant on your tax deductions sheet. You can share the document securely, receive feedback, and make real-time updates, ensuring that you and your accountant are on the same page regarding your deductions. This collaborative process helps enhance accuracy and compliance.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to fit different business needs. From individual freelancers to large enterprises, there is a suitable plan that includes features for managing a tax deductions sheet. All plans are designed to be cost-effective, providing value for the robust functional capabilities they offer.

-

How does airSlate SignNow ensure the security of my tax deductions sheet?

airSlate SignNow prioritizes the security of your documents, including your tax deductions sheet. The platform uses advanced encryption technologies to protect your data, ensuring that sensitive information remains confidential. Compliance with industry standards also helps guarantee that your documents are secure during upload and sharing.

Get more for Checklist For Tax Deductions

- Affidavit of test of casing in well form

- Guardian notice and proof of claim for disability benefits form

- Sealed bid form for surface lease lease no

- California estate 495562657 form

- Workers report of injury or occupational disease form

- International footwear association footwear retailers of fedex form

- Pptc 155 e child general passport application for canadians under 16 years of age applying in canada or the usa 683893656 form

- Texas dps application for copy of driver record form

Find out other Checklist For Tax Deductions

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed