Form 709 a

What is the Form 709 A

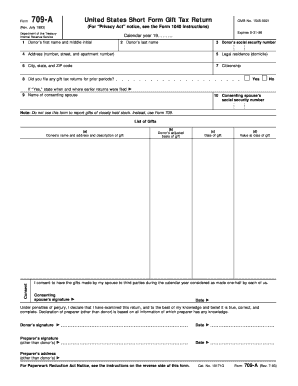

The Form 709 A is an essential document used for reporting gifts made during a calendar year. It is officially known as the IRS Gift Tax Return. This form is required when an individual gives a gift exceeding the annual exclusion limit, which is set by the IRS. The purpose of the form is to ensure that the IRS is informed about the transfer of wealth and to assess any potential gift tax liability. Understanding the nuances of the Form 709 A is crucial for taxpayers who engage in significant gifting, as it helps to maintain compliance with federal tax regulations.

How to use the Form 709 A

Using the Form 709 A involves several steps to accurately report gifts. First, gather all necessary information about the gifts made, including the recipient's details and the value of each gift. Next, complete the form by providing details such as the total amount of gifts, any applicable deductions, and the donor's information. It is important to ensure that all information is accurate to avoid complications with the IRS. Once completed, the form must be filed with the IRS, typically alongside your annual tax return, to ensure proper processing.

Steps to complete the Form 709 A

Completing the Form 709 A requires careful attention to detail. Follow these steps:

- Gather information about all gifts made during the tax year.

- Determine the fair market value of each gift at the time of transfer.

- Fill out the personal information section, including your name, address, and Social Security number.

- List each gift on the form, specifying the recipient and the value.

- Calculate any applicable deductions, such as the annual exclusion amount.

- Sign and date the form before submission.

Legal use of the Form 709 A

The legal use of the Form 709 A is governed by IRS regulations regarding gift taxation. It is legally binding when completed accurately and submitted on time. The form serves as a record of gifts for both the donor and the IRS, ensuring transparency in financial transactions. Failure to file the form when required can lead to penalties and interest on unpaid taxes. Therefore, understanding the legal implications of the Form 709 A is vital for anyone involved in significant gifting activities.

Filing Deadlines / Important Dates

Filing deadlines for the Form 709 A are crucial for compliance. The form is typically due on April fifteenth of the year following the calendar year in which the gifts were made. If April fifteenth falls on a weekend or holiday, the deadline is extended to the next business day. It is essential to adhere to this timeline to avoid penalties. Additionally, if you are filing for an extension for your income tax return, it does not automatically extend the deadline for the Form 709 A, so separate arrangements must be made.

Form Submission Methods (Online / Mail / In-Person)

The Form 709 A can be submitted through various methods, depending on the preference of the filer. The primary submission methods include:

- Mail: The completed form can be printed and sent via postal service to the appropriate IRS address.

- Online: Some taxpayers may have the option to file electronically through authorized e-file providers.

- In-Person: Taxpayers can also deliver the form directly to their local IRS office, though this method is less common.

Choosing the right submission method is important for ensuring timely processing and compliance with IRS regulations.

Quick guide on how to complete form 709 a

Finish Form 709 A effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Form 709 A on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Form 709 A effortlessly

- Find Form 709 A and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive data using the tools that airSlate SignNow offers specifically for this.

- Generate your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose your delivery method for your form: via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate reprinting document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any chosen device. Modify and eSign Form 709 A and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 709 a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 709a form and why do I need it?

The 709a form, also known as the United States Gift (and Generation-Skipping Transfer) Tax Return, is essential for reporting gifts that exceed the annual exclusion amount. By using the 709a form, you can ensure compliance with IRS requirements while effectively managing your tax obligations. It helps document your charitable contributions and lifetime gifts, which can benefit your estate planning.

-

How can airSlate SignNow help me with the 709a form?

AirSlate SignNow offers a streamlined solution for electronically signing and sending your 709a form. With its intuitive interface, you can easily fill out, eSign, and send the form securely to recipients. This saves time and enhances efficiency, making it easier to manage your tax paperwork.

-

Is there a fee associated with using airSlate SignNow for the 709a form?

Yes, airSlate SignNow provides various subscription plans, and the fees depend on the features you choose. However, the cost is often outweighed by the convenience and time savings involved in using the platform to handle documents like the 709a form. Check our pricing page for detailed information on the available options.

-

What features does airSlate SignNow offer for managing the 709a form?

AirSlate SignNow includes features such as template creation, cloud storage, and real-time tracking for documents like the 709a form. Additionally, you can add multiple signers and customize workflows to fit your specific needs. These features enable a straightforward and efficient process for managing your forms.

-

Can I integrate airSlate SignNow with other software for handling the 709a form?

Absolutely! AirSlate SignNow integrates smoothly with various applications, allowing you to import data for the 709a form directly from other sources. This integration increases productivity and reduces errors by enabling seamless workflows between your applications and the airSlate SignNow platform.

-

What are the benefits of using airSlate SignNow for eSigning my 709a form?

Using airSlate SignNow for your 709a form provides numerous benefits, including enhanced security and compliance. The signing process is legally binding and fully compliant with eSignature laws. Moreover, you can complete and track your documents from anywhere, improving both accessibility and convenience.

-

How secure is airSlate SignNow when signing the 709a form?

AirSlate SignNow employs advanced encryption and security protocols to ensure that your 709a form and other documents are protected. Our platform adheres to strict compliance standards, providing peace of mind while you manage sensitive information. You can trust airSlate SignNow to handle your documents securely.

Get more for Form 709 A

- Vons club savings form

- Attention the industrial commission of ohio form

- Application form herndon police

- Helium litigation scholarship form

- Fms 194 form

- Quiet title form

- Instructions for form cg 213 cigarette stamping tax ny gov

- Publication 3676 b en sp rev 12 irs certified volunteers providing tax preparation english spanish form

Find out other Form 709 A

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT