City of Chicago Restaurant Tax Form

What is the City of Chicago Restaurant Tax

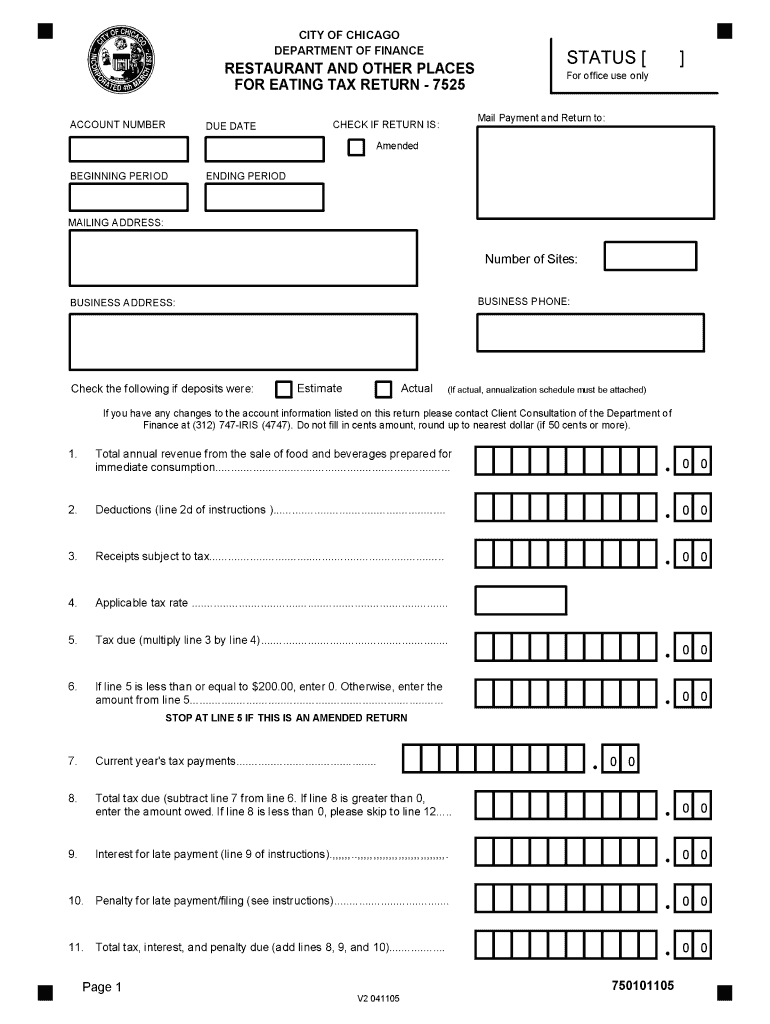

The City of Chicago Restaurant Tax is a specific tax levied on food and beverage sales within the city limits. This tax applies to restaurants, cafes, and other establishments that serve food and drinks. The tax is designed to generate revenue for the city, which can then be used to fund various public services and infrastructure projects. Understanding this tax is essential for business owners operating in the food service industry in Chicago, as it impacts pricing and compliance requirements.

How to use the City of Chicago Restaurant Tax

Using the City of Chicago Restaurant Tax involves accurately calculating the tax on applicable sales and ensuring proper reporting and payment to the city. Businesses must first determine the total amount of taxable sales, which includes food and beverages sold for consumption on the premises or for takeout. The current tax rate must then be applied to this total. It is crucial for restaurant owners to maintain accurate records of all sales to facilitate compliance and reporting.

Steps to complete the City of Chicago Restaurant Tax

Completing the City of Chicago Restaurant Tax involves several key steps:

- Calculate total sales: Determine the total revenue generated from food and beverage sales.

- Apply the tax rate: Multiply the total sales by the current restaurant tax rate set by the city.

- Prepare tax forms: Fill out the necessary tax forms, including the Chicago restaurant tax form 7525.

- Submit the forms: File the completed forms online, by mail, or in person, as per the city’s guidelines.

- Make payment: Ensure timely payment of the calculated tax to avoid penalties.

Legal use of the City of Chicago Restaurant Tax

Legal use of the City of Chicago Restaurant Tax requires adherence to local tax laws and regulations. Businesses must ensure they are registered with the city for tax purposes and are aware of the specific requirements for reporting and payment. Failing to comply with these legal obligations can result in penalties, including fines and interest on unpaid taxes. It is advisable for restaurant owners to consult with tax professionals to ensure full compliance.

Filing Deadlines / Important Dates

Filing deadlines for the City of Chicago Restaurant Tax are crucial for maintaining compliance. Typically, businesses must file their tax returns quarterly, with specific due dates set by the city. It is important for restaurant owners to stay informed about these deadlines to avoid late fees and penalties. Keeping a calendar of important dates related to tax filings can help ensure timely submissions.

Required Documents

To properly complete the City of Chicago Restaurant Tax, certain documents are required. These typically include:

- Sales records: Detailed records of all food and beverage sales.

- Tax forms: The completed Chicago restaurant tax form 7525.

- Payment information: Documentation of any payments made towards the tax.

Having these documents organized and readily available can streamline the filing process and ensure compliance with city regulations.

Quick guide on how to complete city of chicago restaurant tax

Complete City Of Chicago Restaurant Tax effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed materials, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without any holdups. Handle City Of Chicago Restaurant Tax across any platform with airSlate SignNow's Android or iOS applications and enhance your document-related tasks today.

The easiest way to modify and eSign City Of Chicago Restaurant Tax seamlessly

- Obtain City Of Chicago Restaurant Tax and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred delivery method for your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow addresses all your requirements in document management in just a few clicks from any device you choose. Modify and eSign City Of Chicago Restaurant Tax and guarantee effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of chicago restaurant tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the chicago restaurant tax and how does it affect my business?

The chicago restaurant tax is an additional tax imposed on restaurant sales in Chicago. Businesses need to comply with this tax to avoid penalties, making it essential for restaurant owners to stay informed about their tax obligations. Understanding the implications of the chicago restaurant tax can help you manage your finances better and ensure compliance.

-

How can airSlate SignNow help with chicago restaurant tax documents?

AirSlate SignNow allows you to electronically sign and send important documents related to the chicago restaurant tax. Its user-friendly interface simplifies the document management process, ensuring that you can efficiently handle tax forms, invoices, and compliance documents. This helps you maintain accurate records for your restaurant's tax obligations.

-

What features does airSlate SignNow offer for restaurants dealing with Chicago's tax regulations?

AirSlate SignNow provides features such as customizable templates, secure cloud storage, and team collaboration tools specifically designed for restaurant owners. These features streamline the management of documents related to the chicago restaurant tax and ensure that you can easily access, sign, and share necessary paperwork with your team and tax professionals.

-

Is airSlate SignNow cost-effective for small restaurants in Chicago?

Yes, airSlate SignNow offers a cost-effective solution for small restaurants facing the complexities of the chicago restaurant tax. With various pricing plans, you can choose an option that best fits your budget and needs. This flexibility makes it easier for small business owners to manage expenses while ensuring compliance with tax regulations.

-

Can airSlate SignNow integrate with other software used by restaurants?

Absolutely! AirSlate SignNow allows for seamless integration with various software platforms commonly used by restaurants, such as accounting tools and POS systems. This ensures that you can manage your documents related to the chicago restaurant tax efficiently while maintaining your existing workflows and systems.

-

What are the benefits of using airSlate SignNow for managing tax documents in Chicago?

Using airSlate SignNow provides several benefits for managing your chicago restaurant tax documents, including increased efficiency, cost savings, and enhanced security. The platform minimizes the hassle of physical paperwork, allowing you to focus more on running your restaurant. Additionally, features like audit trails ensure that your tax documents are secure and easily retrievable.

-

How does airSlate SignNow ensure the security of my restaurant's tax documents?

AirSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your restaurant's sensitive tax documents. It ensures that your compliance with the chicago restaurant tax is handled securely, safeguarding your data against unauthorized access. You can trust our platform to keep your information private and secure.

Get more for City Of Chicago Restaurant Tax

Find out other City Of Chicago Restaurant Tax

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast