Ui 3 40 Form

What is the UI 340 Form

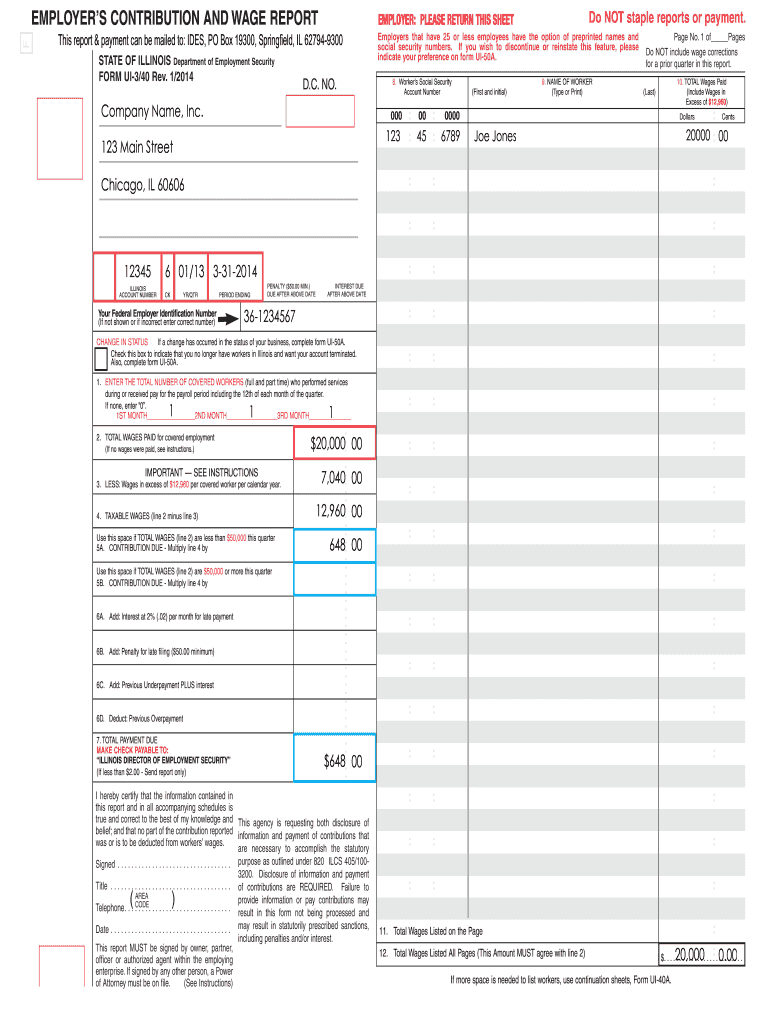

The UI 340 form, also known as the TaxNet Illinois form, is utilized for reporting unemployment insurance contributions in the state of Illinois. This form is crucial for employers as it provides the necessary information regarding their taxable wages and the contributions they owe to the unemployment insurance fund. Accurate completion of this form helps ensure compliance with state regulations and supports the overall functioning of the unemployment system.

How to Use the UI 340 Form

Using the UI 340 form involves several steps that ensure proper reporting of unemployment insurance contributions. Employers must gather relevant payroll information, including total wages paid and the number of employees. Once the necessary data is collected, it is essential to fill out the form accurately, ensuring that all sections are completed to avoid delays or penalties. After completing the form, employers can submit it electronically or via mail, depending on their preference and the guidelines provided by the Illinois Department of Employment Security.

Steps to Complete the UI 340 Form

Completing the UI 340 form requires careful attention to detail. Here are the key steps:

- Gather all necessary payroll records for the reporting period.

- Calculate total taxable wages and the number of employees.

- Fill out each section of the form, ensuring accuracy in reporting.

- Review the completed form for any errors or omissions.

- Submit the form electronically or by mail, following state guidelines.

Legal Use of the UI 340 Form

The UI 340 form holds legal significance as it is required for compliance with Illinois unemployment insurance laws. Submitting this form accurately and on time helps employers avoid penalties and ensures that they are contributing appropriately to the unemployment insurance fund. It is essential for employers to understand the legal implications of the information reported on this form, as inaccuracies may lead to legal consequences or financial liabilities.

Required Documents for the UI 340 Form

To complete the UI 340 form, employers need to prepare several documents, including:

- Payroll records for the reporting period.

- Employee wage information.

- Any previous UI 340 forms submitted for reference.

- Documentation of any adjustments or corrections from previous filings.

Having these documents ready will facilitate a smoother completion process and help ensure compliance with reporting requirements.

Form Submission Methods

The UI 340 form can be submitted through various methods, providing flexibility for employers. Options include:

- Electronic submission via the Illinois Department of Employment Security website.

- Mailing a hard copy of the completed form to the designated address.

- In-person submission at local IDES offices, if necessary.

Employers should choose the method that best suits their operational needs while ensuring timely submission to avoid penalties.

Quick guide on how to complete ui 3 40 form

Fulfill Ui 3 40 Form effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents promptly without delays. Manage Ui 3 40 Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to alter and eSign Ui 3 40 Form with ease

- Obtain Ui 3 40 Form and click on Get Form to initiate.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and eSign Ui 3 40 Form and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ui 3 40 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ui340 feature in airSlate SignNow?

The ui340 feature in airSlate SignNow offers a streamlined user interface that enhances the document signing experience. It simplifies navigation and allows users to access key functionalities quickly, ensuring that you can send and eSign documents efficiently. This intuitive design is aimed at reducing the learning curve for new users.

-

How does pricing work for airSlate SignNow with ui340?

airSlate SignNow offers competitive pricing plans that include access to the ui340 feature. Depending on the plan you choose, you can enjoy a range of functionalities that suit different business needs. It's advisable to review the pricing tiers on our website to find the best fit for your organization.

-

What are the main benefits of using ui340 in airSlate SignNow?

Using the ui340 feature in airSlate SignNow provides numerous benefits, including increased efficiency in document management and enhanced collaboration among team members. The easy-to-use interface allows for quick eSigning and document handling, which can signNowly reduce turnaround times for important agreements. Additionally, users report higher satisfaction levels due to the seamless experience.

-

Can I integrate ui340 with other applications?

Yes, ui340 in airSlate SignNow allows for integration with various applications and software solutions. This feature enables businesses to streamline their workflows by connecting their existing tools with airSlate SignNow’s eSigning capabilities. Users can easily integrate CRMs, document management systems, and more, enhancing productivity.

-

Is there a mobile app for airSlate SignNow that utilizes ui340?

Absolutely! The airSlate SignNow mobile app incorporates the ui340 feature, allowing users to manage documents and eSign on the go. This mobile compatibility ensures that you can stay productive and responsive to client needs, whether you're in the office or traveling. The app is designed to retain the intuitive experience that users appreciate on the desktop version.

-

What types of documents can I eSign with ui340 in airSlate SignNow?

With ui340 in airSlate SignNow, you can eSign a wide variety of documents, including contracts, agreements, and NDAs. The platform supports multiple document formats, making it adaptable to your business needs. Users can easily create, modify, and manage documents directly within the application.

-

How secure is the ui340 feature in airSlate SignNow?

The ui340 feature in airSlate SignNow is built with security as a top priority. It employs advanced encryption protocols to ensure that all documents are securely transmitted and stored. Additionally, the platform complies with industry standards and regulations, giving users peace of mind when handling sensitive information.

Get more for Ui 3 40 Form

Find out other Ui 3 40 Form

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online