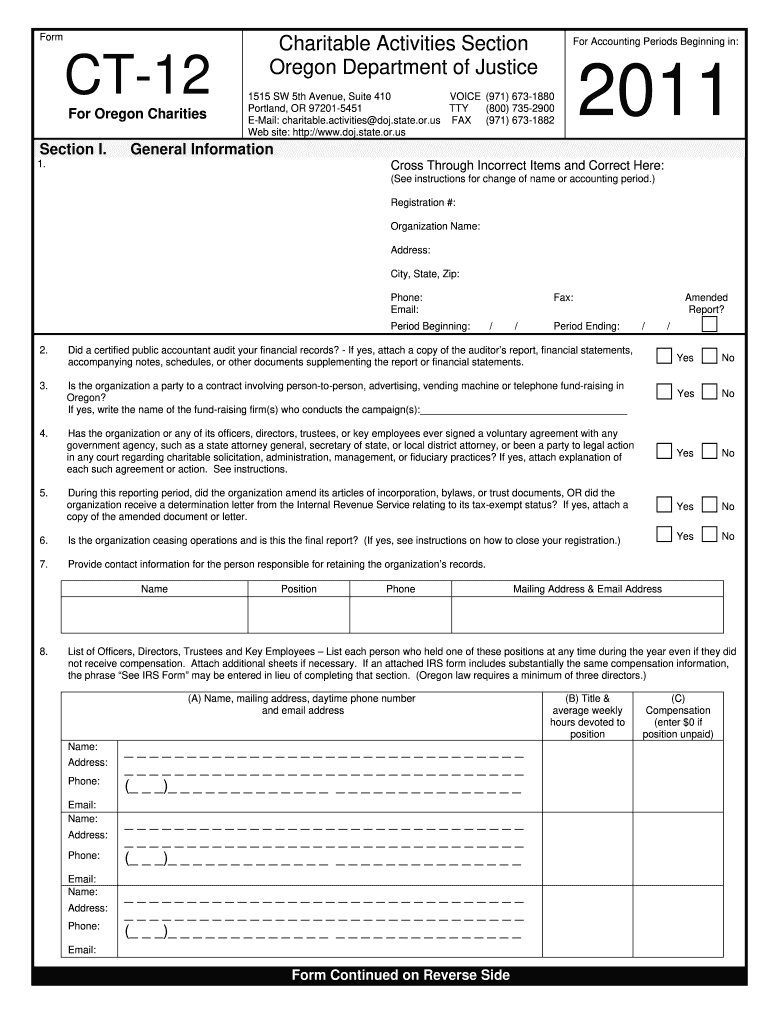

Ct 12 Form

What is the CT 12F?

The CT 12F is a specific form used in Oregon, primarily for reporting certain tax-related information. This form is essential for businesses and individuals who need to comply with state tax regulations. It provides a structured way to report income, deductions, and other relevant financial data to the state authorities. Understanding the purpose and requirements of the CT 12F is crucial for ensuring compliance and avoiding potential penalties.

How to Use the CT 12F

Using the CT 12F involves several steps to ensure accurate completion and submission. Begin by gathering all necessary financial documents, such as income statements and expense records. Carefully follow the instructions provided with the form to fill it out correctly. Each section of the form must be completed with precise information, as inaccuracies can lead to delays or issues with processing. Once completed, review the form to ensure all information is accurate before submission.

Steps to Complete the CT 12F

Completing the CT 12F requires careful attention to detail. Here are the key steps:

- Gather all relevant financial documents.

- Read the instructions accompanying the form thoroughly.

- Fill in your personal or business information as required.

- Report all income and deductions accurately.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Following these steps will help ensure that your CT 12F is completed correctly and submitted on time.

Legal Use of the CT 12F

The CT 12F serves a legal purpose in the context of tax compliance. It must be filled out according to state regulations to be considered valid. The information reported on this form is used by the state to assess tax liabilities and ensure that individuals and businesses are meeting their tax obligations. Failure to use the form correctly can result in legal repercussions, including fines or audits.

Filing Deadlines / Important Dates

Filing deadlines for the CT 12F are crucial to avoid penalties. Typically, the form must be submitted by a specific date each year, coinciding with the state’s tax filing schedule. It is important to check the current year’s deadlines as they may vary. Mark these dates on your calendar to ensure timely submission.

Required Documents

When completing the CT 12F, certain documents are required to support the information reported. These may include:

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Previous year’s tax returns for reference.

Having these documents ready will facilitate a smoother completion process and ensure accuracy in reporting.

Quick guide on how to complete ct 12

Complete Ct 12 effortlessly on any device

Web-based document management has become popular with companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can find the appropriate template and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly without delays. Manage Ct 12 on any device using the airSlate SignNow Android or iOS applications and enhance any document-centered process today.

The easiest way to edit and eSign Ct 12 with minimal effort

- Find Ct 12 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Ct 12 and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 12

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ct 12f feature in airSlate SignNow?

The ct 12f feature in airSlate SignNow allows users to create and manage documents seamlessly. It streamlines the signing process, making it easy to eSign documents efficiently. This functionality helps businesses reduce turnaround time for document approvals.

-

How much does airSlate SignNow with ct 12f cost?

Pricing for airSlate SignNow with ct 12f varies based on the plan selected. We offer several options, including a free trial, which allows users to explore the features before committing. Our plans are designed to provide cost-effective solutions for businesses of all sizes.

-

What are the key benefits of using ct 12f in airSlate SignNow?

Using the ct 12f functionality in airSlate SignNow provides signNow benefits such as enhanced efficiency and reduced paperwork. It simplifies document workflows, allowing teams to collaborate effectively. Additionally, it ensures secure and compliant eSigning processes.

-

Can I integrate airSlate SignNow with other tools while using ct 12f?

Yes, airSlate SignNow offers seamless integrations with various tools and platforms while utilizing the ct 12f feature. Whether you are using CRMs, cloud storage, or other software, integration is straightforward. This interoperability enhances your document management processes.

-

Is training available for using ct 12f in airSlate SignNow?

Absolutely! airSlate SignNow provides training and resources to help users get the most out of the ct 12f feature. We offer tutorials, webinars, and customer support to guide you through the functionalities. This ensures you can fully leverage the platform effectively.

-

What types of documents can I manage with ct 12f?

With the ct 12f feature in airSlate SignNow, you can manage a wide variety of documents. This includes contracts, agreements, forms, and more. The flexibility allows businesses to handle all their important document needs in one place.

-

Is airSlate SignNow with ct 12f suitable for small businesses?

Yes, airSlate SignNow with ct 12f is designed to be ideal for small businesses. Its user-friendly interface and affordable pricing make it accessible for teams of all sizes. Small businesses can benefit from streamlined workflows without costly investments.

Get more for Ct 12

- As requested please find enclosed an application for enrollment omtribe form

- Hasloapplication form

- Wakemed adult volunteer application form

- Reading is fundamental distribution report form

- Section 13 forms and reference septic umn

- The housing choice voucher program is a federally subsidized hialeahhousing form

- Personalfragebogen f r neue mitarbeiter interaktiv pdf schimmel kanzlei schimmel form

- Child protective services intake screening lacks form

Find out other Ct 12

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure