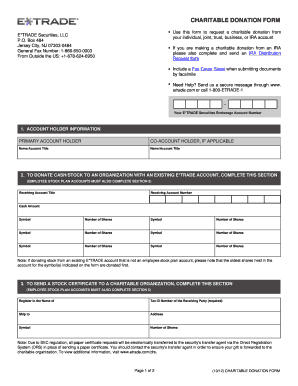

How to Donate Stock to Charity Etrade Form

What is the process for donating stock to charity through E*TRADE?

Donating stock to charity through E*TRADE involves transferring shares from your brokerage account to a qualified charitable organization. This process allows you to support causes you care about while potentially receiving tax benefits. To begin, ensure that the charity is eligible to receive donations of securities. You will need to gather the necessary information about the stock you wish to donate, including the number of shares and the stock's current value.

Steps to complete the E*TRADE stock donation

To successfully donate stock via E*TRADE, follow these steps:

- Log into your E*TRADE account and navigate to the 'Accounts' section.

- Select 'Transfer' and choose the option for transferring securities.

- Enter the details of the stock you wish to donate, including the stock symbol, number of shares, and the recipient charity's information.

- Review the transfer details for accuracy and submit the request for processing.

- Keep a copy of the confirmation for your records, as you will need it for tax purposes.

Legal considerations for E*TRADE charitable donations

When donating stock through E*TRADE, it is essential to comply with IRS regulations regarding charitable contributions. Donations of appreciated securities may allow you to avoid capital gains tax, but you must ensure that the charity is a qualified 501(c)(3) organization. Additionally, you should maintain documentation of the donation, including the stock's fair market value at the time of transfer, to substantiate your tax deduction.

Required documents for stock donations

To complete your stock donation, you will need several documents:

- A completed E*TRADE stock donation request form.

- Documentation from the charity confirming its tax-exempt status.

- Records of the stock's fair market value at the time of donation.

These documents will help ensure that your donation is processed smoothly and that you can claim any applicable tax benefits.

IRS guidelines for donating stock

The IRS has specific guidelines regarding the donation of stock to charities. Generally, you can deduct the fair market value of the donated stock on your tax return if you have held the stock for more than one year. If the stock has appreciated in value, this can result in significant tax savings. Be sure to consult IRS Publication 526 for detailed information on charitable contributions and the necessary documentation required for your tax return.

Examples of using E*TRADE for charitable donations

Using E*TRADE to donate stock can be beneficial in various scenarios. For instance, if you have shares of a company that have significantly increased in value, donating these shares directly to a charity can help you avoid capital gains taxes while providing the charity with valuable resources. Additionally, if you are looking to simplify your year-end charitable giving, using E*TRADE allows for a streamlined process of donating multiple stocks in one transaction.

Quick guide on how to complete how to donate stock to charity etrade

Complete How To Donate Stock To Charity Etrade effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as a superb eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents quickly and efficiently. Manage How To Donate Stock To Charity Etrade on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and electronically sign How To Donate Stock To Charity Etrade with ease

- Obtain How To Donate Stock To Charity Etrade and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your delivery method for the form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign How To Donate Stock To Charity Etrade to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to donate stock to charity etrade

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for making an eTrade charitable donation using airSlate SignNow?

Making an eTrade charitable donation using airSlate SignNow is simple. You can create a donation agreement or acknowledgment letter, eSign it, and send it to the relevant charity directly. This streamlines the process, making it efficient and secure for both donors and charities.

-

Are there any fees associated with eTrade charitable donations through airSlate SignNow?

AirSlate SignNow offers a cost-effective solution for eSigning documents, including those for eTrade charitable donations. While there might be subscription fees for advanced features, sending and signing documents is generally affordable and comes with various pricing plans to suit different needs.

-

What features does airSlate SignNow offer for eTrade charitable donations?

AirSlate SignNow provides a range of features ideal for eTrade charitable donations. These include customizable document templates, secure eSignatures, and real-time tracking of documents. These features ensure that your donations are completed smoothly and securely.

-

How does airSlate SignNow enhance the security of eTrade charitable donations?

Security is paramount with airSlate SignNow, especially for eTrade charitable donations. The platform utilizes bank-level encryption and secure cloud storage to protect your documents. This ensures that all sensitive information related to your charitable donations remains confidential.

-

Can I integrate airSlate SignNow with other platforms for managing eTrade charitable donations?

Yes, airSlate SignNow integrates seamlessly with various platforms, enhancing your experience with eTrade charitable donations. This includes integration with CRM systems, payment processors, and other business applications, allowing for a comprehensive donation management process.

-

What are the benefits of using airSlate SignNow for eTrade charitable donations?

Using airSlate SignNow for eTrade charitable donations offers numerous benefits, such as increased efficiency, reduced paperwork, and faster processing times. The ease of eSigning and document management helps you stay organized and ensures that your charitable efforts are impactful and well-recorded.

-

Is there customer support available for users making eTrade charitable donations?

Absolutely! AirSlate SignNow provides robust customer support for all users, especially those involved with eTrade charitable donations. Whether you need assistance with document creation or troubleshooting, the support team is ready to help you navigate the process.

Get more for How To Donate Stock To Charity Etrade

Find out other How To Donate Stock To Charity Etrade

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement