Form 2031

What is the Form 2031

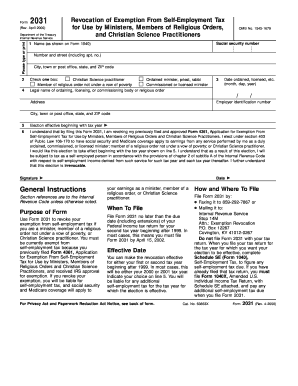

The Form 2031 is a tax document utilized in the United States, primarily for reporting specific financial information to the Internal Revenue Service (IRS). This form is essential for individuals and businesses to ensure compliance with federal tax regulations. It serves various purposes, including income reporting and deductions, making it a crucial element in the tax filing process. Understanding the form's requirements and implications is vital for accurate tax reporting.

How to use the Form 2031

Using the Form 2031 involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents, including income statements and receipts for deductions. Next, fill out the form carefully, ensuring that each section is completed according to IRS guidelines. After completing the form, review it for accuracy before submission. It's important to keep a copy for your records, as it may be needed for future reference or audits.

Steps to complete the Form 2031

Completing the Form 2031 requires attention to detail. Follow these steps:

- Gather all necessary financial documents, such as W-2s, 1099s, and receipts.

- Obtain the latest version of the Form 2031, ensuring it is the correct year.

- Fill out personal information, including your name, address, and Social Security number.

- Report all income accurately, including wages, interest, and dividends.

- List any deductions you are eligible for, ensuring you have supporting documentation.

- Review the completed form for any errors or omissions.

- Submit the form according to the filing instructions provided by the IRS.

Legal use of the Form 2031

The legal use of the Form 2031 is governed by IRS regulations, which stipulate how the form must be completed and submitted. To ensure that the form is legally binding, it must be filled out accurately and submitted by the appropriate deadlines. Additionally, using an electronic signature through a compliant platform can enhance the form's validity. Compliance with federal and state laws is essential to avoid penalties or legal issues related to tax reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Form 2031 are crucial for taxpayers to avoid penalties. Typically, the form must be submitted by April fifteenth of the following tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any state-specific deadlines that may apply. Keeping track of these dates helps ensure timely submission and compliance with tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The Form 2031 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers choose to file electronically through IRS-approved software, which often simplifies the process.

- Mail: The form can be printed and mailed to the appropriate IRS address, ensuring it is postmarked by the filing deadline.

- In-Person: Some taxpayers may prefer to submit the form in person at local IRS offices, allowing for immediate confirmation of receipt.

Quick guide on how to complete form 2031

Finalize Form 2031 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary resources to create, modify, and eSign your documents rapidly without interruptions. Handle Form 2031 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest method to modify and eSign Form 2031 without hassle

- Obtain Form 2031 and click on Get Form to begin.

- Utilize the tools we offer to finalize your form.

- Emphasize pertinent sections of the documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to submit your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 2031 and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2031

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 2031 and how can it be used with airSlate SignNow?

Form 2031 is a specific document often used in various industries for compliance and regulation purposes. With airSlate SignNow, you can easily fill, send, and eSign form 2031, streamlining your processes and ensuring secure delivery and signatures.

-

Is there a cost associated with using form 2031 in airSlate SignNow?

airSlate SignNow offers a cost-effective solution for managing form 2031. Pricing plans vary based on features and user count, providing options for individuals and businesses alike to efficiently utilize form 2031 without breaking the bank.

-

What features does airSlate SignNow offer for form 2031?

AirSlate SignNow provides a range of features for handling form 2031, including digital signatures, customizable templates, and document tracking. These tools enhance efficiency and ensure that your form 2031 is processed seamlessly.

-

Can I integrate form 2031 with other software using airSlate SignNow?

Yes, airSlate SignNow allows integrations with various applications, enabling you to link form 2031 directly with your favorite tools. This interoperability helps maintain a smooth workflow and better organization of your documents.

-

What are the benefits of using airSlate SignNow for form 2031?

Utilizing airSlate SignNow for form 2031 offers numerous benefits, including improved efficiency, reduced paperwork, and enhanced security. The platform's user-friendly interface ensures that you can manage form 2031 effortlessly, saving time and resources.

-

How can I track the status of my form 2031 in airSlate SignNow?

Tracking your form 2031 in airSlate SignNow is simple. The platform includes a document status feature, allowing you to see when your form 2031 is viewed, signed, or completed, ensuring transparency and accountability throughout the process.

-

Is airSlate SignNow easy to use for submitting form 2031?

AirSlate SignNow is designed to be user-friendly, making the submission of form 2031 straightforward. Users can quickly upload, fill out, and eSign form 2031 in just a few clicks, minimizing the learning curve for new users.

Get more for Form 2031

Find out other Form 2031

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast