Formulario 1029 API

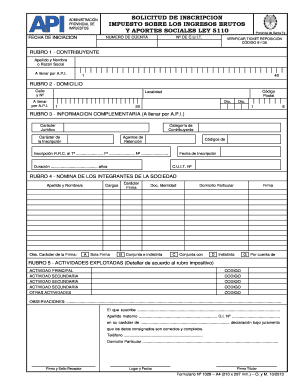

What is the Formulario 1029 Api

The formulario 1029 api is a specific form used in the United States for reporting income and expenses related to various financial activities. This form is essential for individuals and businesses to accurately disclose their earnings and comply with tax regulations. It serves as a standardized method for reporting financial information to the relevant authorities, ensuring transparency and accountability in financial dealings.

How to use the Formulario 1029 Api

Using the formulario 1029 api involves several straightforward steps. First, gather all necessary financial documents, such as income statements and expense receipts. Next, access the digital version of the form through a reliable platform. Fill out the required fields with accurate information, ensuring that all entries are complete and correct. Once completed, review the form for any errors before submitting it electronically or via traditional mail, depending on your preference.

Steps to complete the Formulario 1029 Api

Completing the formulario 1029 api requires careful attention to detail. Follow these steps for a smooth process:

- Collect all relevant financial documents.

- Access the formulario 1029 api through a trusted digital platform.

- Fill in personal and financial information accurately.

- Double-check all entries for accuracy and completeness.

- Submit the form electronically or print it for mailing.

Legal use of the Formulario 1029 Api

The legal use of the formulario 1029 api is governed by various regulations that ensure its validity. To be legally binding, the form must be completed accurately and submitted within the designated timelines. Compliance with federal and state laws is essential, as any discrepancies or late submissions may result in penalties. Utilizing a trusted digital platform can help ensure that the form meets all legal requirements.

Filing Deadlines / Important Dates

Filing deadlines for the formulario 1029 api are crucial to avoid penalties. Typically, the form must be submitted by a specific date each year, often aligned with the tax season. It is advisable to keep track of these dates and plan ahead to ensure timely submission. Marking important dates on a calendar can help in managing the filing process effectively.

Form Submission Methods (Online / Mail / In-Person)

The formulario 1029 api can be submitted through various methods, providing flexibility for users. The most common submission methods include:

- Online Submission: Using a secure digital platform allows for quick and efficient filing.

- Mail: Users can print the completed form and send it via postal service.

- In-Person: Some may choose to deliver the form directly to the relevant office for immediate processing.

Quick guide on how to complete formulario 1029 api

Complete Formulario 1029 Api seamlessly on any device

Online document organization has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing for easy access to the correct form and secure online storage. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Formulario 1029 Api on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered task today.

The easiest way to modify and electronically sign Formulario 1029 Api effortlessly

- Locate Formulario 1029 Api and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important parts of the documents or block out sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow satisfies your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Formulario 1029 Api and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the formulario 1029 api

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the formulario 1029 API and how does it work?

The formulario 1029 API is a powerful tool in airSlate SignNow that allows businesses to automate document workflows efficiently. By leveraging the API, users can seamlessly integrate eSigning capabilities into their applications, simplifying document management. This integration helps streamline processes, saving time and reducing errors.

-

How can I integrate the formulario 1029 API into my application?

Integrating the formulario 1029 API into your application is straightforward with airSlate SignNow. You can access comprehensive documentation and SDKs that guide you through the setup process. With just a few steps, you can easily enhance your application's capabilities with our eSigning features.

-

What are the pricing plans for using the formulario 1029 API?

airSlate SignNow offers flexible pricing plans for the formulario 1029 API to suit businesses of all sizes. Whether you're a startup or an enterprise, we have a plan that fits your budget and needs. For specific pricing details, you can visit our website or contact our sales team.

-

What features are available with the formulario 1029 API?

The formulario 1029 API provides various features that enhance document signing and management. Users can create, send, and track documents for eSignature with ease. Additionally, it supports advanced authentication options and templates, ensuring a secure signing experience.

-

What benefits does the formulario 1029 API offer to businesses?

Using the formulario 1029 API can signNowly boost efficiency and productivity for businesses. It reduces the time spent on manual processes and enhances the accuracy of document handling. Ultimately, this leads to faster transactions and improved customer satisfaction.

-

Is technical knowledge required to use the formulario 1029 API?

While some technical knowledge is beneficial, airSlate SignNow provides resources to help users with varying expertise levels. The documentation is user-friendly, and our support team is available to assist with any questions during the implementation process. Thus, even those with limited technical skills can successfully use the API.

-

Can I customize my documents using the formulario 1029 API?

Absolutely! The formulario 1029 API allows users to customize documents according to their specific needs. You can create templates, add branding elements, and configure workflows to suit your business processes. This flexibility makes it easier to maintain consistency and professionalism in your communications.

Get more for Formulario 1029 Api

- Caade renewal form

- Sanofi patienc connection hippa form

- Signature direction of investment form equity trust company

- Caremark appeal form

- State of florida department of business and professional regulation florida real estate appraisal board businessfirm form

- Resound earmold order form

- Sample acceptable appellantamp39s opening brief criminal case courts oregon form

- Civil form 4 208 new mexico

Find out other Formulario 1029 Api

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now