How to Complete Form 13441 a

What is Form 13441 A?

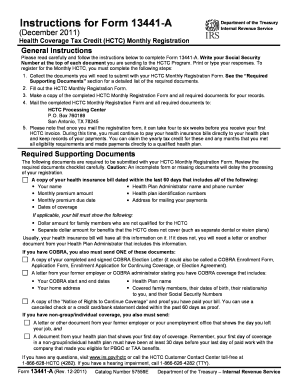

The IRS Form 13441 A is a crucial document for individuals seeking to claim the Health Coverage Tax Credit (HCTC). This form is specifically designed for eligible taxpayers who have lost their jobs due to international trade and are receiving Trade Adjustment Assistance (TAA) benefits. By completing this form, individuals can demonstrate their eligibility for the HCTC, which can significantly reduce their tax liability.

Steps to Complete Form 13441 A

Completing Form 13441 A requires careful attention to detail to ensure accuracy and compliance with IRS guidelines. Here are the essential steps:

- Gather necessary information, including Social Security numbers for all individuals listed on the form.

- Provide details about your qualifying health insurance coverage, including the policy number and the coverage period.

- Indicate the number of months you were eligible for the HCTC during the tax year.

- Sign and date the form to certify that the information provided is accurate and complete.

Legal Use of Form 13441 A

Form 13441 A is legally binding when completed correctly and submitted to the IRS. It is essential to ensure that all information is truthful and accurate, as providing false information can lead to penalties or denial of the tax credit. The form must be submitted along with your tax return to claim the HCTC, making it a vital component of your tax filing process.

Eligibility Criteria for Form 13441 A

To be eligible to use Form 13441 A, you must meet specific criteria set by the IRS. These include:

- Being an eligible TAA recipient.

- Having health insurance coverage that qualifies under the HCTC program.

- Meeting income thresholds as defined by the IRS for the tax year in question.

Required Documents for Form 13441 A

When filling out Form 13441 A, you will need to provide supporting documentation to verify your eligibility. This may include:

- Proof of TAA eligibility, such as a determination letter from the Department of Labor.

- Documentation of health insurance coverage, including policy statements or insurance cards.

- Any prior tax returns that may support your claim for the HCTC.

Form Submission Methods

Form 13441 A can be submitted to the IRS through various methods. Taxpayers have the option to file:

- Online, using e-filing software that supports IRS forms.

- By mail, sending the completed form along with your tax return to the appropriate IRS address.

- In-person, at designated IRS offices during tax filing season.

Quick guide on how to complete how to complete form 13441 a

Complete How To Complete Form 13441 A seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage How To Complete Form 13441 A on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The simplest way to adjust and eSign How To Complete Form 13441 A without hassle

- Locate How To Complete Form 13441 A and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the details and click the Done button to save your edits.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adjust and eSign How To Complete Form 13441 A and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to complete form 13441 a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 13441 a and how can it be used with airSlate SignNow?

Form 13441 a is a crucial document used for various tax-related purposes. With airSlate SignNow, you can easily eSign and send form 13441 a, ensuring a seamless and efficient workflow for your business needs.

-

What features does airSlate SignNow offer for handling form 13441 a?

AirSlate SignNow provides features such as customizable templates, real-time tracking, and secure cloud storage specifically for form 13441 a. These tools simplify the signing process, making it easier to manage and collect signatures on important documents.

-

How does airSlate SignNow ensure the security of my form 13441 a?

AirSlate SignNow uses encrypted data transmission and secure storage protocols to protect your form 13441 a. We prioritize your security, ensuring that all documents are safe from unauthorized access during the signing process.

-

Can I integrate airSlate SignNow with other applications while handling form 13441 a?

Yes, airSlate SignNow offers seamless integrations with popular applications such as Google Drive, Salesforce, and Dropbox, enhancing your experience while working with form 13441 a. This allows for effective document management and collaboration across platforms.

-

What is the pricing structure for using airSlate SignNow for form 13441 a?

AirSlate SignNow offers various pricing plans tailored to fit different business needs when managing form 13441 a. You can choose from flexible monthly or annual subscriptions, ensuring that you find a plan that meets your budget requirements.

-

How can airSlate SignNow improve my workflow with form 13441 a?

By utilizing airSlate SignNow for form 13441 a, you can streamline your document signing process, reduce turnaround times, and improve efficiency. Our user-friendly interface enables you to focus on your business rather than dealing with paperwork.

-

Is there a mobile app for airSlate SignNow to manage form 13441 a?

Yes, airSlate SignNow offers a mobile app that allows you to manage form 13441 a on the go. This ensures that you can eSign and send your documents anytime, anywhere, enhancing your productivity and flexibility.

Get more for How To Complete Form 13441 A

Find out other How To Complete Form 13441 A

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement