W 4 and I 9 FORMS

What are the W-4 and I-9 Forms?

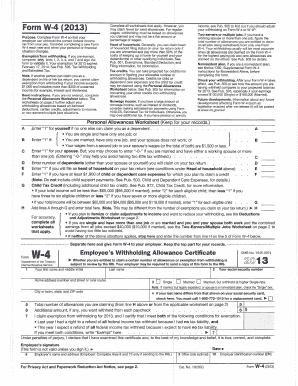

The W-4 and I-9 forms are essential documents used in the employment process in the United States. The W-4 form, officially known as the Employee's Withholding Certificate, is used by employees to indicate their tax situation to their employer. This helps the employer determine the amount of federal income tax to withhold from the employee's paycheck. The I-9 form, or Employment Eligibility Verification, is required to verify an employee's identity and eligibility to work in the U.S. Both forms play a crucial role in ensuring compliance with tax and immigration laws.

Steps to Complete the W-4 and I-9 Forms

Completing the W-4 and I-9 forms involves several straightforward steps:

- Gather necessary information: Collect personal details such as your name, address, Social Security number, and employment information.

- Fill out the W-4 form: Indicate your filing status, number of dependents, and any additional withholding amounts you wish to specify.

- Complete the I-9 form: Provide identification documents that establish your identity and work eligibility. This may include a passport, driver's license, or Social Security card.

- Sign and date: Ensure that you sign both forms and provide the date of completion.

How to Obtain the W-4 and I-9 Forms

Both the W-4 and I-9 forms can be obtained easily:

- W-4 Form: Download the form directly from the Internal Revenue Service (IRS) website or request a copy from your employer.

- I-9 Form: Access the I-9 form on the U.S. Citizenship and Immigration Services (USCIS) website. Employers are also required to provide this form to new hires.

Legal Use of the W-4 and I-9 Forms

Both forms must be filled out accurately and truthfully to comply with U.S. laws. The W-4 form ensures proper withholding of taxes, while the I-9 form protects against unauthorized employment. Falsifying information on either form can lead to penalties, including fines or legal action. Employers must retain completed I-9 forms for a specific period to demonstrate compliance with employment eligibility verification requirements.

Filing Deadlines and Important Dates

Understanding the deadlines associated with the W-4 and I-9 forms is crucial for compliance:

- W-4 Form: Employees should submit a new W-4 form whenever they experience a change in tax situation, such as marriage or the birth of a child.

- I-9 Form: Employers must complete the I-9 form within three days of an employee's start date. It is important to keep track of the expiration dates of documents used for verification.

Penalties for Non-Compliance

Failure to comply with the requirements for the W-4 and I-9 forms can result in significant penalties. Employers may face fines for not verifying employee eligibility or for incorrect tax withholding. Employees may also encounter issues with tax refunds or legal status if their forms are not completed correctly. It is essential to ensure that all information is accurate and submitted on time to avoid these consequences.

Quick guide on how to complete w 4 and i 9 forms

Effortlessly Create W 4 And I 9 FORMS on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the appropriate template and securely store it online. airSlate SignNow equips you with all the tools necessary to draft, modify, and eSign your documents quickly without interruptions. Manage W 4 And I 9 FORMS on any device with airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

How to Modify and eSign W 4 And I 9 FORMS with Ease

- Find W 4 And I 9 FORMS and click Access Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant parts of your documents or redact confidential information with the tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Signature feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and then click the Finish button to save your changes.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that require new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign W 4 And I 9 FORMS and guarantee excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w 4 and i 9 forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are W 4 and I 9 forms?

W 4 and I 9 forms are essential tax documents in the United States. The W 4 form is used by employees to indicate their tax withholding preferences, while the I 9 form verifies employment eligibility. Understanding these forms is crucial for both employers and employees to ensure compliance with tax regulations.

-

How can airSlate SignNow help me manage W 4 and I 9 forms?

airSlate SignNow provides an easy-to-use platform for electronically signing and managing W 4 and I 9 forms. With our solution, you can streamline the document signing process, reduce paper usage, and maintain compliance effortlessly. This enhances efficiency and saves time for both employers and employees.

-

Are there any costs associated with using airSlate SignNow for W 4 and I 9 forms?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. You can choose a plan that best suits your budget while gaining access to features that simplify managing W 4 and I 9 forms. Check our pricing page for more details on plans and options.

-

What features does airSlate SignNow offer for W 4 and I 9 forms?

airSlate SignNow includes features like customizable templates, automated workflows, and real-time tracking for W 4 and I 9 forms. Additionally, the platform supports mobile signing, ensuring that users can handle documents on-the-go. These features make it easier to manage your documentation process efficiently.

-

Can I integrate airSlate SignNow with other software for handling W 4 and I 9 forms?

Absolutely! airSlate SignNow integrates with various applications, including CRM, HR software, and cloud storage services, making it convenient to manage W 4 and I 9 forms. These integrations help centralize your document management for improved workflow and data accuracy.

-

Is airSlate SignNow secure for signing W 4 and I 9 forms?

Yes, airSlate SignNow emphasizes security, employing advanced encryption and secure cloud storage for all documents, including W 4 and I 9 forms. This ensures that sensitive information remains protected during the signing process, giving users peace of mind.

-

How does electronic signing for W 4 and I 9 forms work with airSlate SignNow?

With airSlate SignNow, electronic signing for W 4 and I 9 forms is straightforward. Users can simply upload their documents, add the necessary fields for signatures and information, and send them for signing. Recipients can then sign the documents securely from any device, ensuring a fast and efficient process.

Get more for W 4 And I 9 FORMS

Find out other W 4 And I 9 FORMS

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement