Blank W8 Form

What is the Blank W8

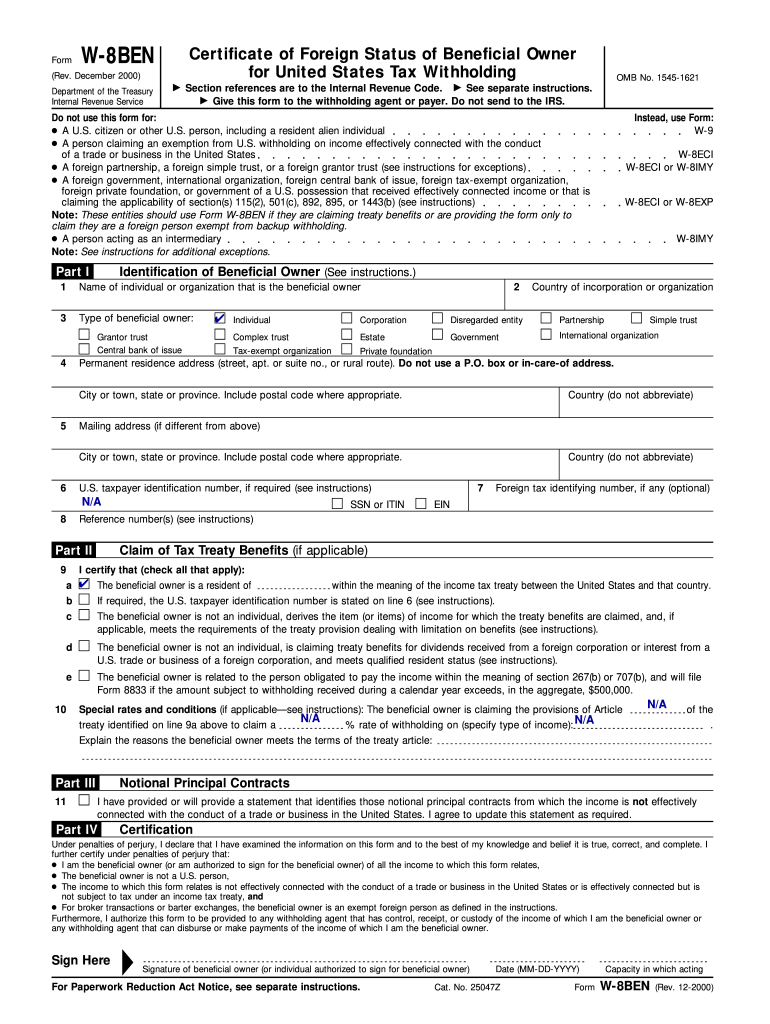

The blank W-8 form is a crucial document used by foreign individuals and entities to certify their foreign status for tax purposes in the United States. This form is primarily utilized by non-U.S. residents who receive income from U.S. sources, such as dividends, interest, or royalties. By completing the blank W-8, individuals can claim a reduced rate of withholding tax or exemption from withholding, depending on their country of residence and applicable tax treaties with the U.S.

How to Use the Blank W8

Using the blank W-8 form involves several steps to ensure accurate completion and compliance with IRS regulations. First, individuals must identify the specific type of W-8 form that applies to their situation, such as W-8BEN for individuals or W-8BEN-E for entities. After selecting the appropriate form, they should fill in their personal information, including name, country of citizenship, and address. It is essential to provide accurate information to avoid issues with withholding tax. Once completed, the form should be submitted to the U.S. payer or financial institution requesting it, not to the IRS directly.

Steps to Complete the Blank W8

Completing the blank W-8 form requires careful attention to detail. Follow these steps:

- Obtain the correct version of the blank W-8 form based on your status (individual or entity).

- Fill in your full name and country of citizenship in the designated fields.

- Provide your permanent address, ensuring it is outside the U.S.

- Include your U.S. taxpayer identification number (if applicable) or foreign tax identifying number.

- Sign and date the form to certify that the information provided is accurate.

Legal Use of the Blank W8

The legal use of the blank W-8 form is essential for ensuring compliance with U.S. tax laws. By submitting this form, foreign individuals and entities can establish their non-resident status, which allows them to benefit from reduced withholding tax rates as outlined in tax treaties. It is important to keep the form updated and submit a new one if there are changes to your circumstances, such as a change in residency or tax status, to maintain compliance and avoid potential penalties.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the blank W-8 form, outlining the requirements for completion and submission. These guidelines emphasize the importance of accurate information and the necessity of submitting the form to the appropriate U.S. payers. The IRS also specifies the retention period for the form, which is typically valid for three years, unless there are changes in the information provided. Understanding these guidelines is crucial for foreign individuals and entities to navigate U.S. tax obligations effectively.

Eligibility Criteria

To be eligible to use the blank W-8 form, individuals must be foreign persons or entities receiving income from U.S. sources. This includes non-resident aliens, foreign corporations, and partnerships. It is important to note that U.S. citizens and residents are not eligible to complete this form. Additionally, the income must be of a type that is subject to withholding tax under U.S. tax law, such as interest, dividends, and royalties. Meeting these eligibility criteria is essential for proper tax compliance.

Quick guide on how to complete blank w8

Prepare Blank W8 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals alike. It offers a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly and without delays. Manage Blank W8 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Blank W8 with ease

- Obtain Blank W8 and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Focus on important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you want to send your form: via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, time-consuming form searches, and errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Blank W8 and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the blank w8

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a blank W8 form, and why do I need it?

A blank W8 form is a tax form used by foreign individuals and entities to signNow their foreign status and claim tax treaty benefits. It is essential for businesses that work with international clients to ensure compliance with IRS regulations and avoid unnecessary tax withholding.

-

How can I easily fill out a blank W8 form?

Filling out a blank W8 form is straightforward with airSlate SignNow. Our platform provides an intuitive interface that guides users step-by-step, ensuring that you accurately complete required fields and submit the form seamlessly.

-

Is airSlate SignNow affordable for small businesses needing blank W8 forms?

Yes, airSlate SignNow offers a cost-effective solution for small businesses needing blank W8 forms. With competitive pricing plans, we ensure that you get the best value for document signing and management without breaking the bank.

-

What features does airSlate SignNow provide for managing blank W8 forms?

airSlate SignNow provides various features like customizable templates, real-time tracking, and secure cloud storage for managing blank W8 forms efficiently. These features enhance user experience by making document management simple and effective.

-

Can I integrate airSlate SignNow with other software to manage blank W8 forms?

Absolutely! airSlate SignNow integrates seamlessly with popular applications such as Google Drive, Salesforce, and more, making it easy to manage blank W8 forms and other documents across your existing workflows.

-

How secure is the information I enter in a blank W8 form on airSlate SignNow?

Security is a top priority at airSlate SignNow. We employ industry-leading encryption and compliance measures to ensure that all information entered in your blank W8 forms is protected and remains confidential throughout the signing process.

-

How can I track the status of my blank W8 form submissions?

With airSlate SignNow, tracking the status of your blank W8 form submissions is easy. Our platform allows you to monitor when your documents are viewed, signed, or completed, giving you real-time updates on your workflow.

Get more for Blank W8

- Form 8 consent decree of dissolution of marriage divorce with children effective jan 1 2009

- Blank pretrial statement form arizona

- Florida petition emancipation form

- Petition for divorce with children form in texas

- Issue on g325 online forms

- Ptax 401 form

- Sample response fax form

- Illinois department of corrections website form

Find out other Blank W8

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast