State of Maryland Form 4a

What is the State of Maryland Form 4A?

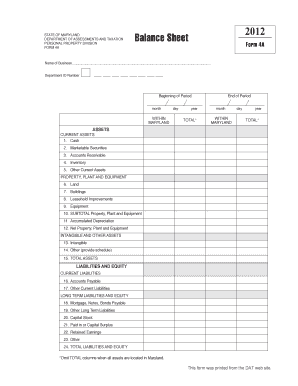

The Maryland personal property tax form 4A is a document used by businesses to report personal property owned as of January first each year. This form is essential for assessing the value of personal property for tax purposes. The information provided on this form helps local governments determine the appropriate tax liability for businesses operating within their jurisdiction. The form requires detailed information about the assets owned, including machinery, equipment, and furniture, which are subject to taxation.

Steps to Complete the State of Maryland Form 4A

Completing the Maryland personal property tax form 4A involves several key steps:

- Gather necessary information: Collect details about all personal property owned as of January first, including descriptions, acquisition dates, and costs.

- Access the form: Obtain the Maryland form 4A from the appropriate state or local tax authority.

- Fill out the form: Enter the required information accurately, ensuring all sections are completed, including asset categories and total values.

- Review your entries: Double-check all information for accuracy to avoid potential penalties or issues with your submission.

- Submit the form: Follow the submission guidelines, which may include online submission, mailing, or in-person delivery to the relevant tax office.

Legal Use of the State of Maryland Form 4A

The Maryland personal property tax form 4A is legally binding when completed and submitted in accordance with state laws. It is crucial for businesses to ensure that all information is truthful and accurate, as providing false information can lead to penalties, fines, or legal repercussions. Compliance with the filing requirements is necessary to maintain good standing with tax authorities and avoid complications during audits.

Key Elements of the State of Maryland Form 4A

Several key elements are essential to the Maryland personal property tax form 4A:

- Business Information: Name, address, and contact details of the business.

- Property Details: A comprehensive list of all personal property owned, including descriptions and acquisition costs.

- Valuation: Total value of the reported personal property, which will be used to calculate tax liability.

- Signature: An authorized representative must sign the form to certify the accuracy of the information provided.

Form Submission Methods for the State of Maryland Form 4A

Businesses can submit the Maryland personal property tax form 4A through various methods:

- Online Submission: Many jurisdictions allow electronic filing through their official websites.

- Mail: The completed form can be mailed to the designated tax authority.

- In-Person: Businesses may choose to deliver the form directly to their local tax office.

Filing Deadlines for the State of Maryland Form 4A

The deadline for submitting the Maryland personal property tax form 4A is typically April fifteenth of each year. It is important for businesses to adhere to this deadline to avoid late fees or penalties. Some jurisdictions may have different deadlines, so checking with the local tax authority is advisable to ensure compliance.

Quick guide on how to complete state of maryland form 4a

Complete State Of Maryland Form 4a effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage State Of Maryland Form 4a on any platform using airSlate SignNow's Android or iOS applications and streamline any document-focused process today.

The easiest way to modify and eSign State Of Maryland Form 4a with ease

- Obtain State Of Maryland Form 4a and click Get Form to initiate.

- Employ the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign State Of Maryland Form 4a and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state of maryland form 4a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maryland personal property tax form 4A?

The Maryland personal property tax form 4A is a document used by businesses to report personal property owned as of January 1st each year. It provides important information that local tax assessors need to accurately compute property taxes. Completing this form accurately ensures compliance with Maryland tax laws.

-

How can airSlate SignNow assist in completing the Maryland personal property tax form 4A?

AirSlate SignNow simplifies the process of completing the Maryland personal property tax form 4A by allowing users to easily fill out, sign, and send the document online. Our platform provides templates and step-by-step guidance to help users complete the form accurately and efficiently. Additionally, electronic signatures make submissions quicker and more secure.

-

Is there a cost associated with using airSlate SignNow for the Maryland personal property tax form 4A?

Yes, airSlate SignNow offers a variety of pricing plans, allowing you to choose the best option that fits your needs. Our plans are cost-effective, ensuring that you have access to the tools necessary for managing the Maryland personal property tax form 4A without breaking the bank. You can explore our pricing page for more details.

-

What are the features of airSlate SignNow that can help with tax documentation like the Maryland personal property tax form 4A?

AirSlate SignNow offers features such as customizable document templates, electronic signatures, and secure cloud storage, all of which are designed to streamline the processing of the Maryland personal property tax form 4A. Our user-friendly interface means you can create, edit, and send documents with ease, helping you stay organized.

-

Are there integration options available with airSlate SignNow for the Maryland personal property tax form 4A?

Absolutely! AirSlate SignNow seamlessly integrates with various applications to enhance your workflow when dealing with the Maryland personal property tax form 4A. Whether you use CRM systems, cloud storage solutions, or other business applications, our platform can connect to help simplify your document management process.

-

What benefits can I expect when using airSlate SignNow for tax forms?

Using airSlate SignNow for preparing the Maryland personal property tax form 4A offers numerous benefits, including improved efficiency and reduced errors. Our electronic signature functionality accelerates the signing process, while automated reminders help ensure deadlines are met. Overall, the platform saves time and minimizes stress related to document handling.

-

How secure is the data submitted through airSlate SignNow for the Maryland personal property tax form 4A?

Data security is a top priority for airSlate SignNow. When you submit the Maryland personal property tax form 4A through our platform, your data is protected with advanced encryption and stringent security protocols. We adhere to industry standards to ensure that your documents and personal information are safe and confidential.

Get more for State Of Maryland Form 4a

Find out other State Of Maryland Form 4a

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement