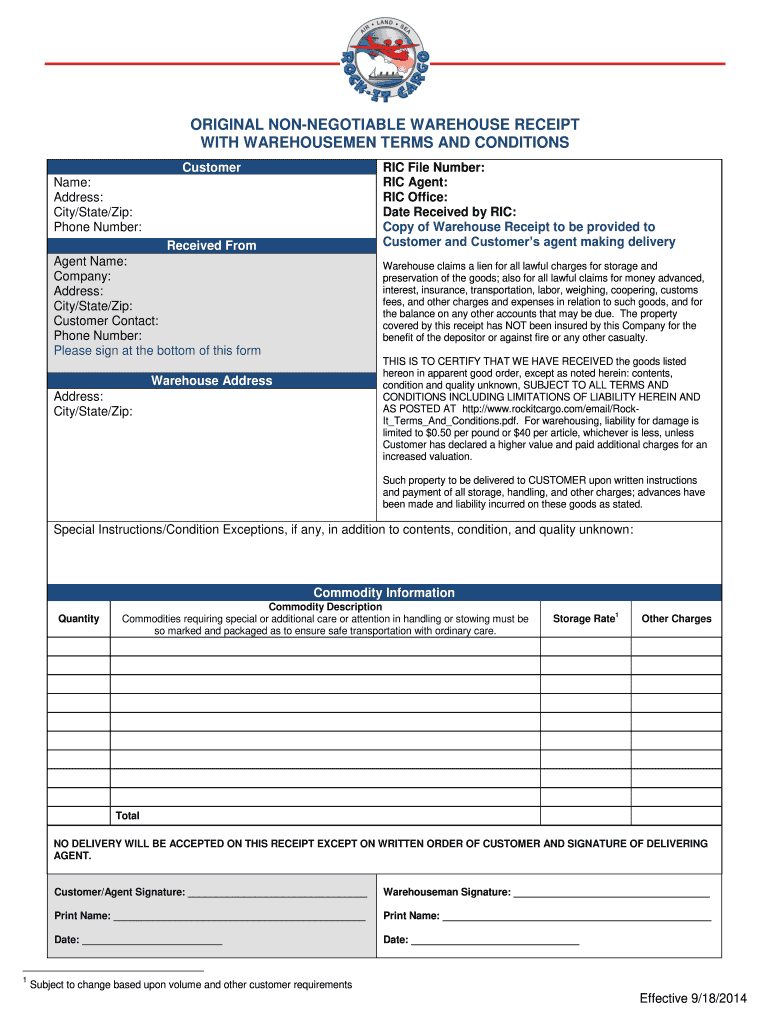

Receipt T&c Form

What is the vahana udambadi karar malayalam form?

The vahana udambadi karar malayalam form serves as an essential document for vehicle registration and ownership transfer in certain regions. This form is often required by local authorities to ensure that vehicle ownership is accurately documented and that all legal obligations are met. It includes vital information about the vehicle, such as its make, model, year, and identification number, as well as details about the current and new owners. Understanding this form is crucial for anyone involved in vehicle transactions.

How to use the vahana udambadi karar malayalam form

Using the vahana udambadi karar malayalam form involves several steps to ensure proper completion and submission. First, gather all necessary information, including personal identification and vehicle details. Next, fill out the form accurately, ensuring that all fields are completed. Once the form is filled, it may need to be signed in the presence of a notary or authorized official, depending on local regulations. Finally, submit the completed form to the appropriate government office, either online or in person, as per the guidelines provided by local authorities.

Steps to complete the vahana udambadi karar malayalam form

Completing the vahana udambadi karar malayalam form requires careful attention to detail. Follow these steps:

- Obtain the form from a reliable source, such as a government website or office.

- Read the instructions carefully to understand the requirements.

- Fill in your personal information, including name, address, and contact details.

- Provide vehicle information, including make, model, year, and VIN.

- Sign the form where required, ensuring that your signature matches your identification.

- Review the completed form for accuracy before submission.

Legal use of the vahana udambadi karar malayalam form

The legal use of the vahana udambadi karar malayalam form is crucial for ensuring that vehicle transactions are recognized by law. This form must be completed in accordance with local regulations to be considered valid. It serves as proof of ownership transfer and may be required in legal disputes or for insurance purposes. Utilizing a trusted electronic signature platform can enhance the legal standing of the completed form, ensuring compliance with eSignature laws.

Key elements of the vahana udambadi karar malayalam form

Several key elements are essential for the vahana udambadi karar malayalam form to be valid:

- Personal Information: Details of both the seller and buyer, including full names and addresses.

- Vehicle Details: Comprehensive information about the vehicle, such as make, model, year, and VIN.

- Signatures: Required signatures from both parties to validate the transaction.

- Date of Transfer: The date on which the ownership transfer is effective.

Form Submission Methods

Submitting the vahana udambadi karar malayalam form can be done through various methods, depending on local regulations. Common submission methods include:

- Online Submission: Many jurisdictions allow for electronic submission through a government portal.

- Mail: The completed form can often be sent via postal service to the relevant authority.

- In-Person: Submitting the form directly at a local government office may be required in some cases.

Quick guide on how to complete receipt tc form

Complete Receipt T&c Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Receipt T&c Form across any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Receipt T&c Form effortlessly

- Obtain Receipt T&c Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and then hit the Done button to save your changes.

- Select how you prefer to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your preference. Modify and eSign Receipt T&c Form and ensure effective communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

If I fill out a money order wrong and don't have the receipt, can I take it back to the post office and get it changed?

Question: If I fill out a money order wrong and don't have the receipt, can I take it back to the post office and get it changed?Probably not.However, you can simply cross out the incorrect information in front of the party to whom you are giving it for payment and that should be sufficient for them to cash it. Or you can do so for someone who has a bank account, have them deposit the money order and then give you the cash to purchase a new one, if necessary. Or the payee can cross your incorrect information, send you a copy of the edits that they made and then deposit it in their account.Everything depends on how “wrong” you filled it out. If you simply put the incorrect payee, then that’s easily fixed. If you put the wrong payee, wrong address and a host of other unnecessary things on the money order, you might have a problem or two. It all depends upon how careless you were (Sorry…but asking before you fill out the money order really is standard operating procedure, just like with checks) when you filled it out.You can try to take it back to the post office. however, if you give them a detailed explanation with too many moving parts, they may simply tell you that there is nothing that they can do. That’s because it’s easier to say “No” than it is to say “Yes.”

-

How do I fill out a money/rent receipt book for house cleaning services?

This is what I'm working with right now until I can get a better suited receipt book to use.

-

How should I fill out Form W-8BEN from Nepal (no tax treaty) for a receipt royalty of a documentary film?

You are required to complete a Form W-8BEN if you are a non-resident alien and earned Royalty income (in this case) from a US-based source.The purpose of the form is to alert the IRS to the fact you are earning income from the US, even though you are not a citizen or a resident of the US. The US is entitled to tax revenues from your US-based earnings and would, without the form, have no way of knowing about you or your income.To ensure they receive their “fair” share, they require the payor to withhold 30% of the payment due to you, before issuing a check for the remainder to you. If they don’t withhold and/don’t report the payment to you, they may not be able to deduct the payment as an expense, and are subject to penalties for failing to withhold - not to mention forced to pay the 30% amount over and above what they pay to you. They therefore will not release any payment without receiving the Form W-8BEN.Now, Nepal happens not to have a tax treaty with the US. If it did and you were subject to Nepalese taxes on that income, you could claim a credit for the taxes paid to another country, up to the entire amount of the tax. Even still, you are entitled to file a US Form 1040N, as the withholding is charged on the gross proceeds and there may be expenses that can be deducted from that amount before arriving at the actual tax due. In that way, you may be entitled to a refund of some or all of the backup withholding.That is another reason why you file the form - it allows you to file a return in order to apply for a refund.In order to complete the form, you can go to the IRS website to read the instructions, or simply go here: https://www.irs.gov/pub/irs-pdf/...

-

Nowadays, every receipt has a survey with a "Chance to Win." Has anyone ever won something from filling out these receipt surveys?

I haven’t, yet.

Create this form in 5 minutes!

How to create an eSignature for the receipt tc form

How to generate an electronic signature for the Receipt Tc Form in the online mode

How to generate an electronic signature for your Receipt Tc Form in Google Chrome

How to generate an eSignature for signing the Receipt Tc Form in Gmail

How to create an eSignature for the Receipt Tc Form right from your smart phone

How to create an eSignature for the Receipt Tc Form on iOS devices

How to make an electronic signature for the Receipt Tc Form on Android

People also ask

-

What is a Receipt T&c Form and how can airSlate SignNow help?

A Receipt T&c Form is a document that outlines the terms and conditions associated with a receipt. airSlate SignNow simplifies the creation and signing of a Receipt T&c Form by providing an easy-to-use platform where users can customize templates, send them for eSignature, and ensure compliance with legal standards.

-

How does airSlate SignNow ensure the security of my Receipt T&c Form?

airSlate SignNow prioritizes the security of your documents, including your Receipt T&c Form, by utilizing advanced encryption methods and secure cloud storage. This ensures that your sensitive information remains protected throughout the signing process, giving you peace of mind.

-

Can I integrate airSlate SignNow with other tools for handling Receipt T&c Forms?

Yes, airSlate SignNow offers seamless integrations with various tools such as Google Drive, Dropbox, and CRM systems. This allows you to manage your Receipt T&c Form alongside your other business documents, streamlining your workflow and enhancing productivity.

-

What are the pricing options for using airSlate SignNow for Receipt T&c Forms?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you are a small business or a large enterprise, you can find a suitable plan for managing your Receipt T&c Form and other documentation at a cost-effective rate.

-

Is it easy to customize a Receipt T&c Form using airSlate SignNow?

Absolutely! airSlate SignNow provides user-friendly tools that make customizing your Receipt T&c Form simple and intuitive. You can easily add your branding, modify text, and adjust layout elements to fit your specific requirements.

-

What are the benefits of using airSlate SignNow for my Receipt T&c Form?

Using airSlate SignNow for your Receipt T&c Form offers numerous benefits, including faster turnaround times, reduced paperwork, and enhanced accuracy. The platform's eSignature capabilities also help ensure that your documents are legally binding and compliant.

-

Can I track the status of my Receipt T&c Form with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking features that allow you to monitor the status of your Receipt T&c Form throughout the signing process. You will receive notifications when the document is viewed, signed, or completed, keeping you informed at every step.

Get more for Receipt T&c Form

Find out other Receipt T&c Form

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free