Ky Llet Form

What is the Ky Llet

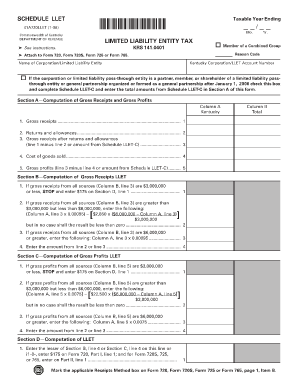

The Kentucky Llet is a specific form required for certain tax filings within the state of Kentucky. It serves as a declaration for various income sources and is essential for ensuring compliance with state tax regulations. The Llet number is unique to each taxpayer and is used to identify their tax records within the Kentucky Department of Revenue.

How to obtain the Ky Llet

To obtain a Kentucky Llet number, individuals must first complete the necessary application process. This typically involves submitting specific documentation to the Kentucky Department of Revenue. Applicants may need to provide personal identification, proof of residency, and any relevant financial information. Once the application is processed, the Llet number will be issued, allowing taxpayers to file their returns accurately.

Steps to complete the Ky Llet

Completing the Kentucky Llet involves several important steps:

- Gather required documents, including identification and financial records.

- Fill out the Llet form accurately, ensuring all information is complete.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the Kentucky Department of Revenue either online or by mail.

Legal use of the Ky Llet

The Kentucky Llet is legally binding when completed according to state regulations. It is essential for individuals to understand the legal implications of their submissions. Proper completion ensures that the form is recognized by the state for tax purposes, and any discrepancies may lead to penalties or audits. Compliance with all guidelines outlined by the Kentucky Department of Revenue is crucial for valid use.

Filing Deadlines / Important Dates

Timely submission of the Kentucky Llet is critical to avoid penalties. The filing deadlines typically align with the federal tax deadlines, but it is important for taxpayers to verify specific dates each year. Late submissions may incur fines, so keeping track of these deadlines is essential for compliance.

Required Documents

When applying for or completing the Kentucky Llet, certain documents are necessary to ensure a smooth process. These may include:

- Government-issued identification (such as a driver's license or passport)

- Proof of residency (utility bills, lease agreements)

- Financial records (W-2s, 1099s)

Form Submission Methods (Online / Mail / In-Person)

The Kentucky Llet can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission via the Kentucky Department of Revenue's website

- Mailing the completed form to the appropriate state office

- In-person submission at designated state offices

Quick guide on how to complete ky llet

Prepare Ky Llet effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents quickly without delays. Handle Ky Llet on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Ky Llet with ease

- Obtain Ky Llet and click Get Form to begin.

- Use the tools we provide to complete your form.

- Select important sections of the documents or redact sensitive information with tools that airSlate SignNow has designed especially for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional documents. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Alter and eSign Ky Llet and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ky llet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to llet?

airSlate SignNow is a versatile eSignature solution that allows users to send and eSign documents seamlessly. It provides businesses with a cost-effective way to manage their documentation processes, making the experience of handling llet much simpler and more efficient.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow is designed to be affordable, catering to various business needs. Our llet plans start with a basic option for small teams and scale up to advanced features for larger organizations, ensuring that everyone can find a suitable plan.

-

What key features does airSlate SignNow offer?

airSlate SignNow boasts features such as intuitive eSigning, document tracking, and customizable templates, all of which support the efficient handling of llet. These tools help simplify workflows and enhance collaboration across teams.

-

Is airSlate SignNow secure for signing sensitive documents?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your llet. This ensures that all eSigned documents are transmitted safely, giving you peace of mind when handling sensitive information.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers various integrations with popular applications and platforms to enhance your workflow. Whether you're looking to connect with CRM systems or cloud storage solutions, our llet integration options make it easy to streamline document management.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow can signNowly boost efficiency by eliminating the need for physical paperwork and reducing turnaround times. This not only saves time but also lowers operational costs, making it an invaluable llet solution for any organization.

-

How can I get started with airSlate SignNow?

Getting started with airSlate SignNow is straightforward. Simply sign up for a free trial, explore the platform's llet features, and discover how easily you can send and eSign documents in no time.

Get more for Ky Llet

- Fresno hospital forms

- Safety training forms

- Printable appendix c to sec 1910134 osha medical evaluation questionnaire mandatory form

- Summer youth volunteer program james a haley veterans hospital application form

- Chemotherapy order form

- Generic radiology order form

- Critical care skills checklist form

Find out other Ky Llet

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF