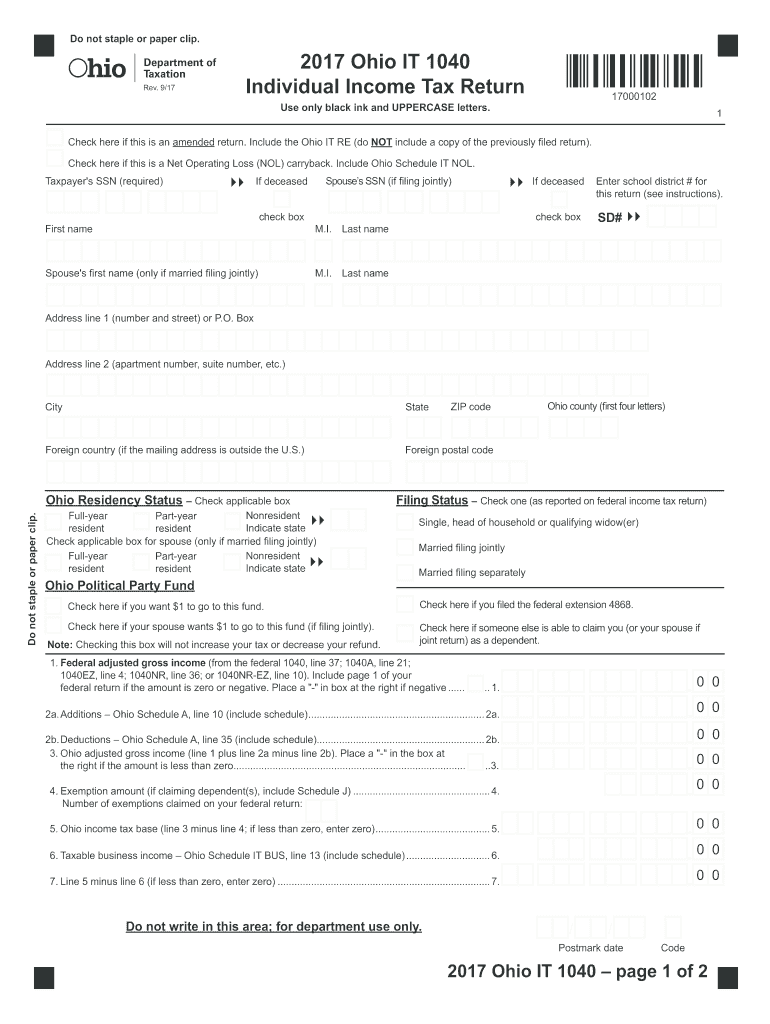

Ohio it 1040 Individual Income Tax Return Ohio Department Form

What is the Ohio IT 1040 Individual Income Tax Return?

The Ohio IT 1040 is the official form used by residents of Ohio to report their individual income tax to the Ohio Department of Taxation. This form is essential for individuals who earn income in the state, as it allows them to calculate their tax liability based on their income, deductions, and credits. The IT 1040 is typically filed annually, and it is crucial for ensuring compliance with state tax laws.

Steps to Complete the Ohio IT 1040 Individual Income Tax Return

Completing the Ohio IT 1040 involves several key steps to ensure accuracy and compliance:

- Gather all necessary documentation, including W-2 forms, 1099 forms, and any other income statements.

- Determine your filing status, which can affect your tax rate and eligibility for certain credits.

- Calculate your total income by adding all sources of income reported on your documentation.

- Identify and apply any deductions or credits you may qualify for, which can reduce your overall tax liability.

- Complete the IT 1040 form by entering your calculated figures in the appropriate sections.

- Review your completed form for accuracy before submission.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the Ohio IT 1040 to avoid penalties. Typically, the deadline for filing is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions that may be available and the dates associated with them.

Required Documents

To complete the Ohio IT 1040, taxpayers will need to gather several documents:

- W-2 forms from employers detailing annual earnings.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental income or dividends.

- Documentation for any deductions or credits being claimed, such as receipts for charitable contributions or educational expenses.

Form Submission Methods

Taxpayers in Ohio have multiple options for submitting their IT 1040 form:

- Online submission through the Ohio Department of Taxation's website, which is often the quickest method.

- Mailing a paper form to the appropriate address provided by the Ohio Department of Taxation.

- In-person submission at designated tax offices, which may be available during tax season.

Penalties for Non-Compliance

Failure to file the Ohio IT 1040 by the deadline can result in penalties. The Ohio Department of Taxation may impose a late filing fee, which can accumulate over time. Additionally, interest may accrue on any unpaid taxes, increasing the overall amount owed. It is essential for taxpayers to file on time to avoid these financial repercussions.

Quick guide on how to complete 2017 ohio it 1040 individual income tax return ohio department

Complete Ohio IT 1040 Individual Income Tax Return Ohio Department effortlessly on any gadget

Online document management has gained traction with businesses and individuals alike. It presents an ideal environmentally friendly substitute to conventional printed and signed paperwork, enabling you to locate the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without hindrances. Administer Ohio IT 1040 Individual Income Tax Return Ohio Department on any system with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Ohio IT 1040 Individual Income Tax Return Ohio Department with ease

- Find Ohio IT 1040 Individual Income Tax Return Ohio Department and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your selection. Alter and electronically sign Ohio IT 1040 Individual Income Tax Return Ohio Department and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Can you use a ‘white out’ on your signature and redo it in your 1040 individual income tax return form?

Yes. You can also write your return in pencil and then photocopy the final result, after making changes along the way.

-

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

Create this form in 5 minutes!

How to create an eSignature for the 2017 ohio it 1040 individual income tax return ohio department

How to generate an eSignature for your 2017 Ohio It 1040 Individual Income Tax Return Ohio Department in the online mode

How to make an eSignature for the 2017 Ohio It 1040 Individual Income Tax Return Ohio Department in Chrome

How to generate an eSignature for putting it on the 2017 Ohio It 1040 Individual Income Tax Return Ohio Department in Gmail

How to create an eSignature for the 2017 Ohio It 1040 Individual Income Tax Return Ohio Department from your smart phone

How to generate an electronic signature for the 2017 Ohio It 1040 Individual Income Tax Return Ohio Department on iOS devices

How to generate an electronic signature for the 2017 Ohio It 1040 Individual Income Tax Return Ohio Department on Android OS

People also ask

-

What is the Ohio IT 1040 Individual Income Tax Return?

The Ohio IT 1040 Individual Income Tax Return is a form used to report personal income to the Ohio Department of Taxation. It is essential for individuals residing in Ohio to accurately complete this form to comply with state tax laws and determine their tax liability. Understanding this form is crucial for ensuring that you meet all necessary tax obligations.

-

How can airSlate SignNow help with the Ohio IT 1040 Individual Income Tax Return?

airSlate SignNow streamlines the process of completing and submitting the Ohio IT 1040 Individual Income Tax Return by allowing users to eSign and send documents securely. This eliminates the need for printing and mailing, saving time and ensuring that your tax returns are submitted promptly to the Ohio Department. Our platform offers an easy-to-use interface to simplify your tax preparation.

-

What features does airSlate SignNow offer for tax documentation?

airSlate SignNow offers a variety of features designed for managing tax documentation, including customizable templates for the Ohio IT 1040 Individual Income Tax Return and secure eSigning capabilities. Additionally, users can track document status in real-time, ensuring they know when their forms are completed and submitted to the Ohio Department. These features enhance efficiency and reduce errors in tax filing.

-

Is airSlate SignNow affordable for individuals filing the Ohio IT 1040 Individual Income Tax Return?

Yes, airSlate SignNow provides a cost-effective solution for individuals filing the Ohio IT 1040 Individual Income Tax Return. Our pricing plans are designed to fit various needs, making it accessible for anyone looking to streamline their tax filing process without breaking the bank. With its competitive pricing, airSlate SignNow offers great value for managing important tax documents.

-

Can I integrate airSlate SignNow with other tax software for the Ohio IT 1040 Individual Income Tax Return?

Absolutely! airSlate SignNow easily integrates with various tax software and accounting tools, making it simple to manage your Ohio IT 1040 Individual Income Tax Return alongside other financial documentation. These integrations help streamline your workflow, ensuring all your tax-related information is in one place for efficient filing with the Ohio Department.

-

What benefits does eSigning provide for the Ohio IT 1040 Individual Income Tax Return?

eSigning the Ohio IT 1040 Individual Income Tax Return offers numerous benefits, such as enhanced security, reduced processing time, and the convenience of signing from anywhere. Using airSlate SignNow, you can quickly eSign your tax returns, ensuring that they are sent immediately to the Ohio Department, thus preventing any potential delays in your filing process.

-

How secure is airSlate SignNow when filing the Ohio IT 1040 Individual Income Tax Return?

Security is a top priority for airSlate SignNow, especially when handling sensitive information like the Ohio IT 1040 Individual Income Tax Return. We comply with industry-standard security protocols, including encryption and secure access controls, ensuring your data is protected throughout the eSigning and submission process to the Ohio Department.

Get more for Ohio IT 1040 Individual Income Tax Return Ohio Department

- Michigan department of licensing and regulatory affairs board of nursing michigan form

- Tr52 form

- Bdvr form

- Application for sign specialist examination state of michigan michigan form

- Michigan department of revenue form 4430

- Application for liquid industrial waste transportation michigan form

- Fis 1028 form

- Missouri employer withholding tax form

Find out other Ohio IT 1040 Individual Income Tax Return Ohio Department

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe