Hawaii Property Tax Online Form

What is the Hawaii Property Tax Online

The Hawaii property tax online system allows residents and property owners to manage their property tax obligations conveniently through a digital platform. This system facilitates the assessment, payment, and management of property taxes without the need for in-person visits to local government offices. By utilizing this online service, users can access vital information regarding their property tax assessments, payment history, and current tax rates.

How to use the Hawaii Property Tax Online

To use the Hawaii property tax online system, individuals must first visit the official website designated for property tax management. Users will typically need to create an account or log in using existing credentials. Once logged in, users can navigate through various options, including viewing property tax statements, making payments, and updating personal information. The interface is designed to be user-friendly, ensuring that all necessary functions are easily accessible.

Steps to complete the Hawaii Property Tax Online

Completing the Hawaii property tax online process involves several straightforward steps:

- Access the official Hawaii property tax online portal.

- Create an account or log in with your existing credentials.

- Locate your property by entering the required information, such as your property identification number.

- Review your property tax details, including assessments and payment history.

- Select the option to make a payment or file any necessary documents.

- Follow the prompts to complete your transaction securely.

Legal use of the Hawaii Property Tax Online

The legal use of the Hawaii property tax online system is governed by state regulations that ensure the security and validity of electronic transactions. Users must comply with the terms outlined by the Hawaii Department of Taxation, which includes using the system for its intended purposes, such as filing tax returns and making payments. Electronic submissions are considered legally binding when they adhere to the standards set forth by relevant eSignature laws.

Required Documents

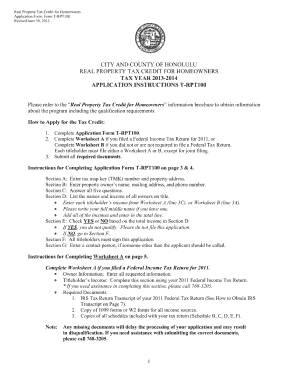

When using the Hawaii property tax online system, certain documents may be required to verify identity and property ownership. Commonly needed documents include:

- Property deed or title documentation.

- Identification, such as a driver's license or state ID.

- Previous tax statements for reference.

- Any additional documentation requested by the tax authority.

Who Issues the Form

The Hawaii property tax online form is issued by the Hawaii Department of Taxation and local county tax offices. These entities are responsible for assessing property values, determining tax rates, and providing the necessary forms for property owners to fulfill their tax obligations. Users can find specific information related to their county's tax office through the state’s official website.

Quick guide on how to complete hawaii property tax online

Effortlessly Prepare Hawaii Property Tax Online on Any Device

Web-based document management has gained traction with both businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents rapidly without any delays. Manage Hawaii Property Tax Online on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Edit and Electronically Sign Hawaii Property Tax Online with Ease

- Obtain Hawaii Property Tax Online and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your updates.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Hawaii Property Tax Online and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hawaii property tax online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow's role in managing Hawaii property tax online?

airSlate SignNow provides a streamlined platform to send and eSign documents related to Hawaii property tax online. This means you can manage your property tax filings and communications quickly and directly from your device.

-

How can airSlate SignNow help simplify Hawaii property tax payments?

With airSlate SignNow, you can easily create and send payment agreements or tax forms, minimizing the time and effort spent on Hawaii property tax online transactions. The electronic signature feature also ensures that your documents are legally binding and secure.

-

Are there any specific features for Hawaii property tax online management?

airSlate SignNow offers features specifically designed for Hawaii property tax online, including document templates tailored for tax filings and automatic reminders for payment deadlines. This user-friendly interface makes tax management easier for property owners.

-

What pricing plans are available for using airSlate SignNow for Hawaii property tax online?

airSlate SignNow offers flexible pricing plans to accommodate various needs. From individuals to large organizations managing multiple properties, you can find an affordable option for efficiently handling Hawaii property tax online.

-

Is airSlate SignNow compatible with other accounting software for Hawaii property tax online?

Yes, airSlate SignNow integrates seamlessly with popular accounting and property management software, making it easier to manage your Hawaii property tax online. These integrations allow for automatic syncing of data, streamlining your overall tax management process.

-

What are the benefits of using airSlate SignNow for Hawaii property tax online?

The primary benefits of using airSlate SignNow for Hawaii property tax online include enhanced efficiency, reduced paperwork, and improved compliance. With easy eSigning and document tracking, managing your property taxes becomes hassle-free.

-

Can I access airSlate SignNow for Hawaii property tax online on mobile devices?

Absolutely! airSlate SignNow is fully optimized for mobile devices. This means you can handle Hawaii property tax online from anywhere, making it convenient to manage your documents while on the go.

Get more for Hawaii Property Tax Online

Find out other Hawaii Property Tax Online

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF