Rfthi Form

What is the Rfthi Form

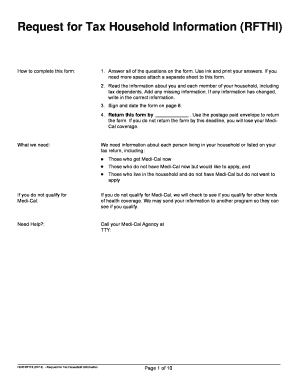

The Rfthi form, also known as the request for tax household information, is a crucial document used primarily for tax-related purposes. It is designed to collect essential information about a taxpayer's household, which may impact eligibility for various tax benefits and programs. This form is particularly relevant for individuals applying for Medi-Cal, as it helps determine the household's income and size, which are key factors in assessing eligibility for assistance.

How to Use the Rfthi Form

Using the Rfthi form involves several straightforward steps. First, gather all necessary information regarding your household, including details about income, family members, and any other relevant financial data. Next, accurately fill out the form, ensuring that all sections are completed to avoid delays in processing. Once completed, you can submit the form electronically through a secure platform or by mailing it to the appropriate agency. It is essential to keep a copy of the submitted form for your records.

Steps to Complete the Rfthi Form

Completing the Rfthi form requires careful attention to detail. Follow these steps for a smooth process:

- Gather necessary documents, such as income statements and identification.

- Fill out the personal information section, including names and addresses of all household members.

- Provide accurate income details, including wages, benefits, and any other sources of income.

- Review the completed form for accuracy and completeness.

- Submit the form through the designated method, either online or via mail.

Legal Use of the Rfthi Form

The Rfthi form holds legal significance as it is used to verify information for tax purposes. To ensure its legal validity, it must be completed accurately and submitted in compliance with established regulations. The use of electronic signatures is permissible, provided that the signing process adheres to relevant eSignature laws, such as the ESIGN Act and UETA. This ensures that the form is recognized as legally binding by government agencies and courts.

Required Documents

When completing the Rfthi form, certain documents are required to support the information provided. These may include:

- Proof of income, such as pay stubs or tax returns.

- Identification documents for all household members, like Social Security cards or driver’s licenses.

- Any additional documentation that verifies household size or expenses, if applicable.

Form Submission Methods

The Rfthi form can be submitted using various methods, ensuring flexibility for users. Common submission options include:

- Online submission through a secure electronic platform, which allows for immediate processing.

- Mailing a physical copy of the form to the designated agency, ensuring it is sent to the correct address.

- In-person submission at local government offices, where assistance may be available if needed.

Quick guide on how to complete rfthi form

Complete Rfthi Form effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the needed form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without delays. Manage Rfthi Form on any device with the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Rfthi Form seamlessly

- Find Rfthi Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign feature, which only takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate issues of lost or mislaid documents, cumbersome form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management requirements in a few clicks from your chosen device. Modify and eSign Rfthi Form and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rfthi form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is rfthi and how does it work with airSlate SignNow?

rfthi is a powerful feature within airSlate SignNow that streamlines the eSignature process. By utilizing rfthi, businesses can send, receive, and sign documents efficiently, ensuring that transactions are completed quickly and securely. This feature is designed to enhance user experience while maintaining compliance with legal regulations.

-

How much does the rfthi feature cost in airSlate SignNow?

The rfthi feature is included in the various pricing plans offered by airSlate SignNow. We provide flexible pricing options to cater to businesses of all sizes, ensuring that you get the best value for your investment. Please visit our pricing page for detailed information regarding the rfthi costs and subscription plans.

-

What are the key benefits of using the rfthi feature in airSlate SignNow?

Utilizing the rfthi feature in airSlate SignNow enables faster document turnaround time with legally binding eSignatures. This efficiency not only enhances productivity but also improves customer satisfaction as users can complete transactions without delays. Moreover, rfthi helps in reducing paper usage, contributing to a more eco-friendly business operation.

-

Can I integrate rfthi with other software solutions?

Yes, airSlate SignNow's rfthi feature supports integration with various third-party applications, enhancing its functionality. Whether you are using CRMs, project management tools, or cloud storage services, rfthi can seamlessly connect, allowing for a smoother workflow. Check our integrations page for a complete list of compatible services.

-

Is rfthi secure and compliant with data protection regulations?

Absolutely, rfthi in airSlate SignNow is designed with strong security measures to protect your documents and data. We adhere to global eSignature laws, ensuring compliance with regulations such as eIDAS and ESIGN. This guarantees that your signatures and documents are not only secure but also legally valid.

-

What types of documents can I send using rfthi?

With rfthi, you can send a wide range of document types including contracts, agreements, and forms. The flexibility of airSlate SignNow allows businesses to manage all essential documents through one platform. This versatility is essential for ensuring that you can handle various business needs efficiently.

-

How do I get started with rfthi in airSlate SignNow?

Getting started with rfthi in airSlate SignNow is simple. Just sign up for an account on our website and follow the guided setup process. Once you're set up, explore the rfthi features and begin sending documents for eSignature in no time!

Get more for Rfthi Form

- Fdny security benefit fund form

- Health care flexible spending account claim form

- Incarceration form 72077 2010

- Hsmv 84901 form

- Blue cross blue shield of illinois and ivig form

- Prime therapeutics prior authorization fax number 2008 form

- Redstone mwr form

- Promotional forms usjf form 20 united states judo federation

Find out other Rfthi Form

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request