Liberty Mutual Life Insurance Beneficiary Form

What is the Liberty Mutual Life Insurance Beneficiary Form

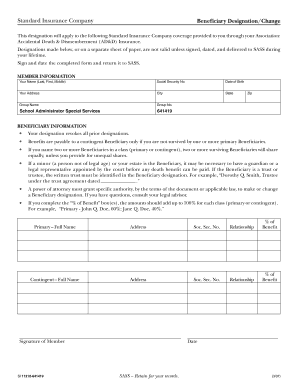

The Liberty Mutual Life Insurance Beneficiary Form is a crucial document that allows policyholders to designate individuals or entities as beneficiaries of their life insurance policy. This form ensures that in the event of the policyholder's passing, the specified beneficiaries receive the benefits without unnecessary delays. The form typically requires essential information such as the policy number, the names of the beneficiaries, their relationship to the policyholder, and their contact details. It is important to complete this form accurately to avoid any complications during the claims process.

Steps to Complete the Liberty Mutual Life Insurance Beneficiary Form

Completing the Liberty Mutual Life Insurance Beneficiary Form involves several straightforward steps:

- Gather necessary information, including your Liberty Mutual policy number and the details of your chosen beneficiaries.

- Access the beneficiary form through Liberty Mutual’s official website or request a physical copy from your insurance agent.

- Fill out the form carefully, ensuring all required fields are completed, including beneficiary names, relationships, and contact information.

- Review the form for accuracy and completeness before submission.

- Submit the form according to the instructions provided, whether online, by mail, or in person.

How to Obtain the Liberty Mutual Life Insurance Beneficiary Form

The Liberty Mutual Life Insurance Beneficiary Form can be obtained in several ways. Policyholders can visit the official Liberty Mutual website to download a digital copy of the form. Alternatively, they may contact their insurance agent or customer service representative to request a physical form. It is essential to ensure that you are using the most current version of the form to avoid any issues during processing.

Legal Use of the Liberty Mutual Life Insurance Beneficiary Form

To ensure the legal enforceability of the Liberty Mutual Life Insurance Beneficiary Form, it must be completed in accordance with state laws and regulations. This includes providing accurate information and obtaining the necessary signatures. Additionally, the form should be submitted to Liberty Mutual for processing as soon as possible to ensure that the beneficiary designations are recognized. It is advisable to keep a copy of the completed form for personal records.

Key Elements of the Liberty Mutual Life Insurance Beneficiary Form

Several key elements must be included in the Liberty Mutual Life Insurance Beneficiary Form to ensure its validity:

- Policy Number: This identifies the specific life insurance policy.

- Beneficiary Information: Names, relationships, and contact details of all designated beneficiaries.

- Policyholder Signature: The form must be signed by the policyholder to validate the changes.

- Date of Submission: The date when the form is completed and submitted.

Examples of Using the Liberty Mutual Life Insurance Beneficiary Form

Using the Liberty Mutual Life Insurance Beneficiary Form can vary based on individual circumstances. For instance, a policyholder may use the form to designate a spouse as the primary beneficiary while naming children as contingent beneficiaries. In another scenario, a policyholder might choose to name a trust as the beneficiary to manage the funds for minor children. Each example highlights the importance of clearly defining beneficiary roles to ensure that the intended recipients receive the benefits as planned.

Quick guide on how to complete liberty mutual life insurance beneficiary form

Easily Manage Liberty Mutual Life Insurance Beneficiary Form on Any Device

Digital document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Liberty Mutual Life Insurance Beneficiary Form on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

Effortlessly Modify and Electronically Sign Liberty Mutual Life Insurance Beneficiary Form

- Locate Liberty Mutual Life Insurance Beneficiary Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Craft your signature with the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all information and click the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Liberty Mutual Life Insurance Beneficiary Form to ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the liberty mutual life insurance beneficiary form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a liberty mutual policy number example, and why is it important?

A liberty mutual policy number example is a unique identifier assigned to your insurance policy by Liberty Mutual. This number is crucial as it helps you reference your specific coverage details, file claims, and manage your account efficiently without confusion.

-

How can I find my liberty mutual policy number example?

You can find your liberty mutual policy number example on your insurance card, billing documents, or through your online account by logging into the Liberty Mutual website. If you're unable to locate it, contacting customer support can also assist you in retrieving this important information.

-

Are there any benefits tied to understanding your liberty mutual policy number example?

Yes, understanding your liberty mutual policy number example allows you to easily manage your policy, update your coverage, and file claims efficiently. Being familiar with this number also helps when communicating with customer service to resolve any issues.

-

What features does airSlate SignNow offer for managing documents related to my liberty mutual policy number example?

AirSlate SignNow offers features such as eSigning, document tracking, and secure storage, which make managing documents related to your liberty mutual policy number example seamless. This enables you to send and sign important insurance documents quickly, ensuring compliance and peace of mind.

-

Can I use airSlate SignNow to share my liberty mutual policy number example with agents?

Absolutely! With airSlate SignNow, you can securely share your liberty mutual policy number example and related documents with your agents. The platform's eSignature capabilities ensure that exchanges are legally binding and efficient.

-

How does pricing for airSlate SignNow work in relation to managing my liberty mutual policy number example?

Pricing for airSlate SignNow is based on a subscription model that offers various plans tailored to meet the needs of users managing documents, including those containing a liberty mutual policy number example. This flexible structure allows businesses to choose a plan that aligns with their document management requirements.

-

Are there integrations available with airSlate SignNow that can help me manage my liberty mutual policy number example?

Yes, airSlate SignNow offers integrations with various platforms that can streamline the management of your liberty mutual policy number example. These integrations enhance your workflow, allowing you to synchronize data and automate document processes effectively.

Get more for Liberty Mutual Life Insurance Beneficiary Form

Find out other Liberty Mutual Life Insurance Beneficiary Form

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter