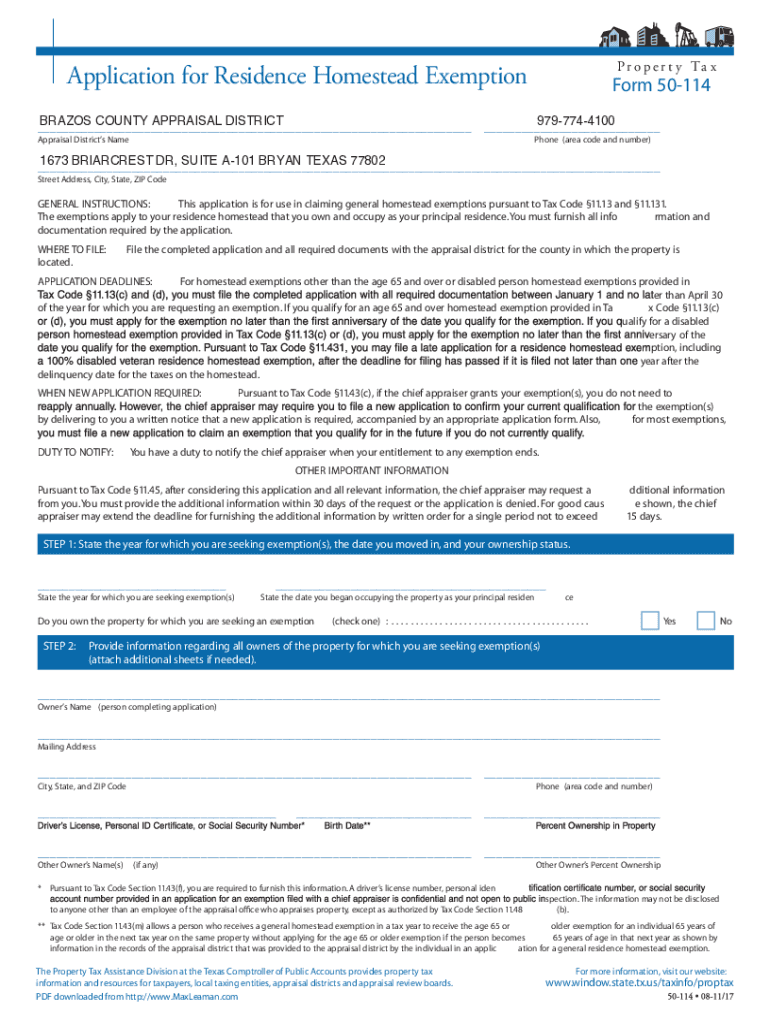

Brazos County Homestead Exemption Form

What is the Brazos County Homestead Exemption

The Brazos County Homestead Exemption is a property tax benefit designed to reduce the taxable value of a homeowner's primary residence. This exemption is available to qualified homeowners in Brazos County, Texas, providing them with financial relief on their property taxes. By applying for this exemption, homeowners can lower their annual tax burden, making homeownership more affordable. The exemption applies to various types of property, including single-family homes, townhouses, and condominiums, as long as they meet specific eligibility criteria.

Eligibility Criteria

To qualify for the Brazos County Homestead Exemption, applicants must meet several criteria:

- The property must be the applicant's primary residence.

- The homeowner must be at least eighteen years old or legally emancipated.

- The applicant must hold legal ownership of the property as of January first of the tax year.

- The property cannot be used for commercial purposes.

Homeowners should also ensure they are not claiming the exemption on more than one property at the same time, as this can lead to penalties.

Steps to Complete the Brazos County Homestead Exemption

Completing the Brazos County Homestead Exemption involves a few straightforward steps:

- Gather necessary documentation, including proof of identity and ownership.

- Obtain the Brazos County Homestead Exemption application form, which can be accessed online or in person at the county appraisal district office.

- Fill out the application form, ensuring all required information is accurate and complete.

- Submit the completed application form along with any required documents to the Brazos County Appraisal District by the specified deadline.

It is essential to keep a copy of the submitted application for personal records.

Required Documents

When applying for the Brazos County Homestead Exemption, several documents may be required to verify eligibility:

- A valid Texas driver's license or state-issued identification card.

- Proof of ownership, such as a deed or property tax statement.

- Any additional documentation that may support the application, such as a utility bill showing the property address.

Having these documents ready can streamline the application process and ensure a timely review.

Form Submission Methods

Homeowners can submit the Brazos County Homestead Exemption application through various methods:

- Online submission via the Brazos County Appraisal District's website, if available.

- Mailing the completed form and documents to the Appraisal District office.

- In-person submission at the Appraisal District office during regular business hours.

Choosing the most convenient method can help ensure that the application is processed efficiently.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Brazos County Homestead Exemption is crucial for homeowners. Applications must typically be submitted by April 30th of the tax year in which the exemption is sought. Late applications may not be considered, so it is advisable to submit all documentation well before the deadline to avoid any issues.

Quick guide on how to complete brazos county homestead exemption

Complete Brazos County Homestead Exemption effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as a perfect eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage Brazos County Homestead Exemption across any platform with the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to edit and eSign Brazos County Homestead Exemption without stress

- Obtain Brazos County Homestead Exemption and click Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive information with features specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Select your preferred method to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form hunting, or mistakes that require you to print out new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Brazos County Homestead Exemption and ensure clear communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the brazos county homestead exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Brazos County Homestead Exemption?

The Brazos County Homestead Exemption is a property tax exemption that reduces the taxable value of a primary residence in Brazos County. This exemption helps homeowners save money on their property taxes, making homeownership more affordable. By applying for this exemption, residents can lower their tax bills based on the assessed value of their homes.

-

How do I apply for the Brazos County Homestead Exemption?

To apply for the Brazos County Homestead Exemption, you must submit an application to the Brazos County Appraisal District. This application typically requires proof of residency and a few supporting documents. It's important to file your application by the January 31st deadline to ensure you receive the exemption for the current tax year.

-

What are the benefits of the Brazos County Homestead Exemption?

The primary benefit of the Brazos County Homestead Exemption is a signNow reduction in your property tax bill. Additionally, the exemption offers financial protection, as it can prevent a drastic increase in taxes if property values rise. By taking advantage of this exemption, homeowners can have more financial security and peace of mind.

-

Is there a cost associated with the Brazos County Homestead Exemption?

No, there is no cost to apply for the Brazos County Homestead Exemption. Homeowners can submit their applications without incurring any fees. However, it's important to ensure that you meet all eligibility requirements to qualify for the exemption.

-

Can I apply for the Brazos County Homestead Exemption if I just purchased my home?

Yes, you can apply for the Brazos County Homestead Exemption as soon as you have purchased your home, provided it will be your primary residence. Applications must be submitted by the January 31st deadline to receive the exemption for that tax year. Make sure to have the necessary documentation ready for a smooth application process.

-

What documentation do I need for the Brazos County Homestead Exemption application?

When applying for the Brazos County Homestead Exemption, you typically need to provide proof of identity, proof of residency, and any supporting documents that validate your ownership of the property. These documents may include a driver’s license, utility bills, or pay stubs. Ensuring that all documentation is complete will facilitate a quicker review of your application.

-

How does the Brazos County Homestead Exemption affect my property taxes?

The Brazos County Homestead Exemption directly affects your property taxes by lowering the taxable value of your home. This reduction results in a decrease in the total amount of property tax you owe each year. Homeowners who qualify for the exemption can enjoy substantial savings over time.

Get more for Brazos County Homestead Exemption

Find out other Brazos County Homestead Exemption

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free