Bus 415 Form

What is the Bus 415

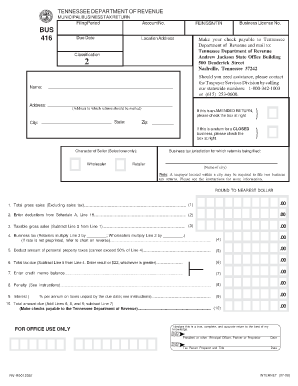

The Bus 415 form is a tax document used primarily in the United States for reporting certain business income and expenses. This form is essential for businesses that need to report their earnings accurately to the Internal Revenue Service (IRS). It serves as a means to ensure compliance with federal tax laws and regulations. The Bus 415 form is particularly relevant for various business entity types, including sole proprietorships, partnerships, and corporations, making it a vital tool for tax reporting.

How to use the Bus 415

Using the Bus 415 form involves several steps to ensure accurate reporting of business income and expenses. First, gather all necessary financial documents, including income statements, receipts, and any other relevant records. Next, fill out the form by entering your business information, including your name, address, and taxpayer identification number. Be sure to report all applicable income and deduct eligible expenses to minimize your tax liability. Once completed, review the form for accuracy before submitting it to the IRS.

Steps to complete the Bus 415

Completing the Bus 415 form requires careful attention to detail. Follow these steps for a smooth process:

- Collect all relevant financial documents, including income statements and expense receipts.

- Provide your business name, address, and taxpayer identification number at the top of the form.

- Report all sources of income accurately, ensuring that no income is omitted.

- List all deductible expenses related to your business operations.

- Double-check all entries for accuracy to avoid potential issues with the IRS.

- Sign and date the form before submission.

Legal use of the Bus 415

The legal use of the Bus 415 form is crucial for maintaining compliance with IRS regulations. This form must be filed accurately and on time to avoid penalties. The IRS requires businesses to report their income and expenses to ensure that all tax obligations are met. Failure to file the Bus 415 form or inaccuracies in reporting can lead to audits, fines, or other legal consequences. Therefore, it is essential to understand the legal implications and ensure that the form is completed correctly.

Filing Deadlines / Important Dates

Filing deadlines for the Bus 415 form are critical for maintaining compliance with tax regulations. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for most businesses. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is important to stay informed about any changes to tax deadlines and ensure that the form is filed on time to avoid penalties.

Required Documents

To complete the Bus 415 form, several documents are required to provide accurate information. These include:

- Income statements detailing all sources of revenue.

- Receipts for deductible expenses related to business operations.

- Taxpayer identification number or Social Security number.

- Previous year’s tax returns for reference.

Having these documents ready will streamline the process of filling out the Bus 415 form and ensure that all necessary information is reported accurately.

Quick guide on how to complete bus 415

Effortlessly Prepare Bus 415 on Any Device

Electronic document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, alter, and electronically sign your documents quickly and without complications. Manage Bus 415 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign Bus 415 Without Stress

- Find Bus 415 and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize signNow sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes just a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form retrieval, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in a few clicks from your chosen device. Edit and eSign Bus 415 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bus 415

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the bus 415 form?

The bus 415 form is a specialized document used within certain industries and sectors to facilitate the electronic signing and submission of essential forms. It simplifies the process of acquiring signatures, ensuring that all parties involved can submit the necessary documentation quickly and efficiently.

-

How does airSlate SignNow support the bus 415 form?

airSlate SignNow offers a seamless eSignature solution that simplifies the process of filling out and signing the bus 415 form. With user-friendly features, you can prepare, send, and sign the form, enabling efficient workflows for businesses of all sizes.

-

Is there a cost associated with using the bus 415 form on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans, which are affordable and designed to meet the needs of different businesses looking to utilize the bus 415 form. You can choose a plan that suits your requirements and budget while enjoying features that enhance document management.

-

What features does airSlate SignNow provide for the bus 415 form?

airSlate SignNow includes key features such as template creation, in-person signing, and automated reminders for the bus 415 form. These tools help increase efficiency, minimize paperwork, and streamline the signing process.

-

Are there integration options for the bus 415 form with other applications?

Yes, airSlate SignNow supports numerous integrations with popular applications, making it easy to manage the bus 415 form alongside your existing software. These integrations enhance productivity by allowing you to use the form within your preferred tools.

-

What are the benefits of using airSlate SignNow for the bus 415 form?

Using airSlate SignNow for the bus 415 form provides several benefits, including reduced processing time and increased accuracy. Additionally, it helps you maintain compliance and track document statuses in real time, ensuring a streamlined workflow.

-

Can multiple users sign the bus 415 form through airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to sign the bus 415 form, making it ideal for collaborative efforts. This feature ensures that all necessary signatures can be obtained efficiently in one seamless process.

Get more for Bus 415

- Columbia southetn university form

- Secured party creditor card form

- Form 15068 o1ence 0311indd johnson controls

- In state residency trinidad state junior college trinidadstate form

- Nj civil court flowchart form

- Physical exam formpdf castro valley high school castrovalleyhigh

- T shirt hoodie order form

- New jamestown lp candlestick heights tenant income certification questionnaire one form per adult member of the household

Find out other Bus 415

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure