E 595e Form

What is the E 595e

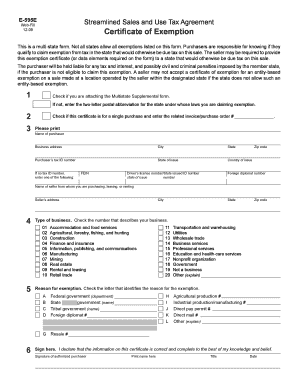

The E 595e form is a crucial document used in the United States for tax exemption purposes. Specifically, it serves as a certificate for sales tax exemption, allowing eligible organizations to purchase goods without incurring sales tax. This form is particularly relevant for non-profit organizations, government entities, and certain educational institutions that meet specific criteria. Understanding the purpose and requirements of the E 595e is essential for organizations looking to benefit from tax exemptions on their purchases.

How to use the E 595e

Using the E 595e form involves several straightforward steps. First, eligible organizations must complete the form by providing necessary information, including the name of the organization, the type of exemption, and the reason for the tax exemption. Once filled out, the form should be presented to vendors at the time of purchase. Vendors will retain a copy for their records, ensuring compliance with tax regulations. It is vital to ensure that the information provided is accurate to avoid any issues with tax authorities.

Steps to complete the E 595e

Completing the E 595e form requires careful attention to detail. Follow these steps for a smooth process:

- Gather necessary information about your organization, including its legal name and address.

- Identify the type of exemption your organization qualifies for, such as non-profit status.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Sign and date the form to validate it.

Once completed, present the E 595e form to vendors during purchases to claim your tax exemption.

Legal use of the E 595e

The legal use of the E 595e form is governed by specific tax regulations in the United States. Organizations must ensure they meet all eligibility criteria to use this form legitimately. Misuse of the E 595e can lead to penalties, including fines or back taxes owed. It is essential to understand that only qualifying purchases can be made using this exemption, and organizations should maintain accurate records to support their claims. Compliance with state-specific laws regarding sales tax exemptions is also critical.

Examples of using the E 595e

Examples of using the E 595e form can help clarify its application. For instance, a non-profit organization purchasing office supplies for its operations can present the E 595e form to the vendor to avoid paying sales tax. Similarly, a government agency acquiring equipment for public service can utilize this form to ensure tax exemption. Understanding these practical applications can assist organizations in maximizing their benefits while adhering to legal requirements.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines regarding the use of the E 595e form. Organizations must familiarize themselves with these guidelines to ensure proper usage. The IRS outlines the types of entities eligible for tax exemption and the documentation required to substantiate claims. Adhering to these guidelines is crucial for maintaining compliance and avoiding potential legal issues related to tax exemptions.

Quick guide on how to complete e 595e

Effortlessly prepare E 595e on any device

Online document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to easily find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage E 595e on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign E 595e with ease

- Find E 595e and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight relevant sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign E 595e and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the e 595e

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the E 595e and how does it benefit my business?

The E 595e is a digital document management solution that simplifies the eSigning process for businesses. By using E 595e, companies can streamline their workflows, reduce paperwork, and achieve faster transaction times. This results in increased productivity and improved customer satisfaction.

-

How much does the E 595e service cost?

The pricing for E 595e varies depending on the selected plan and features. airSlate SignNow offers competitive pricing packages designed to fit different business needs, ensuring you get the most value for your investment. You can find detailed pricing information on our website.

-

What features does E 595e offer?

E 595e includes a range of features such as customizable templates, advanced security measures, and comprehensive tracking. Additionally, E 595e allows for easy integration with popular productivity tools commonly used within businesses. These features make it a powerful tool for managing document workflows.

-

Can E 595e integrate with other software I already use?

Yes, E 595e seamlessly integrates with various popular software applications such as CRM systems, cloud storage services, and project management tools. This compatibility enhances your existing workflows and ensures a smooth transition to digital document signing. Integration capabilities help maximize efficiency within your operations.

-

Is E 595e secure for my sensitive documents?

Absolutely, E 595e prioritizes security with features such as encryption, secure access controls, and audit trails. This ensures that your sensitive documents are protected at all times. Trusting E 595e with your documents means you can focus on your business without worrying about security bsignNowes.

-

What types of documents can I sign using E 595e?

You can sign a wide variety of documents using E 595e, including contracts, agreements, and forms. The platform supports multiple file formats, making it versatile for any business need. E 595e empowers you to handle all your document signing requirements efficiently.

-

How can E 595e improve my team's productivity?

E 595e improves productivity by automating the eSigning process and reducing the time spent on manual document management. With tools like bulk sending and reminders, teams can focus on what matters most—growing the business. The intuitive interface of E 595e also allows for quick onboarding and minimal training.

Get more for E 595e

- A harmonised road transport regulatory system for the esa extranet form

- Form 290

- Hydrafacial consent form skincare by kelly

- Vha fax transmittal automated va form 10 0114r

- 495 lease house form

- Late arrival form heber valley camp hebervalleycamp

- Box office statement template arts texas form

- Change billing mode to form

Find out other E 595e

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement