Residence Homestead Exemption Application Fort Bend Form

Understanding the Residence Homestead Exemption Application Fort Bend

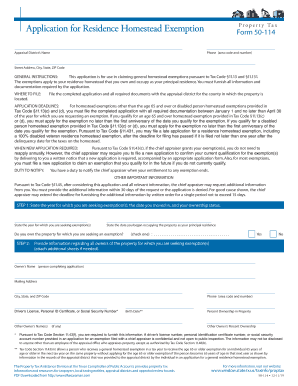

The Residence Homestead Exemption Application for Fort Bend is a crucial document for homeowners seeking tax relief on their primary residence. This exemption reduces the appraised value of a home, thereby lowering property taxes. To qualify, applicants must meet specific criteria, including ownership and occupancy requirements. The exemption is designed to support residents by making homeownership more affordable.

Steps to Complete the Residence Homestead Exemption Application Fort Bend

Completing the Residence Homestead Exemption Application involves several key steps:

- Gather necessary documents, such as proof of identity and property ownership.

- Access the application form, which can be obtained online or through local tax offices.

- Fill out the form accurately, ensuring all required information is provided.

- Review the application for completeness and accuracy before submission.

- Submit the application either online, by mail, or in person at the designated office.

Eligibility Criteria for the Residence Homestead Exemption Application Fort Bend

To qualify for the Fort Bend County homestead exemption, applicants must meet specific eligibility criteria, including:

- Ownership of the property as of January first of the tax year.

- Use of the property as the applicant's primary residence.

- Meeting any additional requirements set by the Fort Bend County Appraisal District.

Required Documents for the Residence Homestead Exemption Application Fort Bend

When applying for the homestead exemption, certain documents are necessary to support your application. These may include:

- A valid Texas driver's license or state-issued ID.

- Proof of property ownership, such as a deed or closing statement.

- Any additional documentation requested by the appraisal district.

Form Submission Methods for the Residence Homestead Exemption Application Fort Bend

The Residence Homestead Exemption Application can be submitted through various methods, ensuring convenience for applicants:

- Online: Access and submit the application via the Fort Bend County Appraisal District website.

- By Mail: Send the completed application to the appropriate tax office address.

- In-Person: Visit the local tax office to submit the application directly.

Legal Use of the Residence Homestead Exemption Application Fort Bend

Understanding the legal implications of the Residence Homestead Exemption Application is essential. The application must be filled out accurately and submitted within the designated timeframe to ensure compliance with local laws. Failure to adhere to these regulations may result in penalties or denial of the exemption. It is advisable to familiarize oneself with the legal requirements to avoid complications.

Quick guide on how to complete residence homestead exemption application fort bend

Complete Residence Homestead Exemption Application Fort Bend effortlessly across any device

Online document administration has become widely used by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the resources necessary to draft, modify, and eSign your documents swiftly without delays. Manage Residence Homestead Exemption Application Fort Bend on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Residence Homestead Exemption Application Fort Bend with ease

- Locate Residence Homestead Exemption Application Fort Bend and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark pertinent sections of your documents or conceal sensitive information with the tools available from airSlate SignNow specifically designed for that purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Residence Homestead Exemption Application Fort Bend to ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the residence homestead exemption application fort bend

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Fort Bend homestead exemption?

The Fort Bend homestead exemption is a property tax benefit available to homeowners in Fort Bend County, Texas. This exemption reduces the taxable value of a primary residence, potentially lowering property taxes signNowly. To qualify, homeowners must apply through the local appraisal district and meet specific eligibility criteria.

-

How can I apply for the Fort Bend homestead exemption?

To apply for the Fort Bend homestead exemption, homeowners must fill out the application form available on the Fort Bend Appraisal District website. It's essential to submit the application by the deadline set for the property tax year. Ensure to include all required documentation, such as proof of identification and residency, to streamline the process.

-

What are the benefits of the Fort Bend homestead exemption?

The Fort Bend homestead exemption provides several benefits, including reduced property taxes and potential savings for homeowners. By lowering the assessed value of your home, you can keep more money in your pocket each year. Additionally, it offers increased financial stability and helps to make homeownership more affordable.

-

Are there any income requirements for the Fort Bend homestead exemption?

There are no specific income requirements for the Fort Bend homestead exemption; however, eligibility is primarily based on your status as a homeowner and your residence being your primary residence. Homeowners should carefully review the criteria set by the Fort Bend Appraisal District to ensure they meet all necessary qualifications.

-

Can I combine the Fort Bend homestead exemption with other exemptions?

Yes, homeowners can combine the Fort Bend homestead exemption with other exemptions available in Texas, such as the over-65 exemption or the disabled person's exemption. By stacking these exemptions, you can maximize your property tax savings. It's advisable to consult with the Fort Bend Appraisal District for guidance on combining exemptions effectively.

-

How does the Fort Bend homestead exemption affect my property taxes?

The Fort Bend homestead exemption directly reduces the amount of property taxes owed by lowering the taxable value of your home. As a result, homeowners may see a noticeable decrease in their annual property tax bills. It's an essential tool for making homeownership more affordable while providing financial relief during tax season.

-

What documents do I need to apply for the Fort Bend homestead exemption?

To apply for the Fort Bend homestead exemption, you typically need to provide proof of identity, such as a driver's license or state ID, and documentation that confirms your residency, like utility bills or mortgage statements. The Fort Bend Appraisal District may require additional information depending on your specific situation. Gathering all necessary documents beforehand can expedite the application process.

Get more for Residence Homestead Exemption Application Fort Bend

Find out other Residence Homestead Exemption Application Fort Bend

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure