Borrowers Form

What is the Borrowers Form

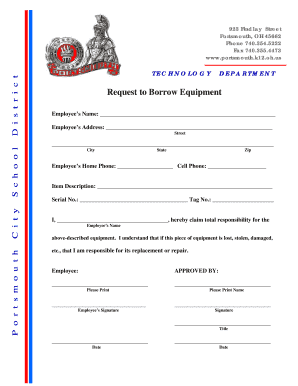

The borrowers form for tools and equipment is a legal document that outlines the terms and conditions under which a borrower can temporarily use specific tools or equipment. This form is essential for both the lender and the borrower, as it establishes clear expectations regarding the use and return of the items. It typically includes details such as the borrower's information, a description of the equipment, the duration of the loan, and any associated fees or penalties for late returns or damages.

How to use the Borrowers Form

Using the borrowers form is a straightforward process. First, the borrower must fill out the form with accurate personal details and specify the tools or equipment being borrowed. Next, both the borrower and the lender should review the terms outlined in the form, ensuring mutual understanding of responsibilities. Once completed, both parties should sign the form electronically, which provides a legally binding agreement. Utilizing a digital platform like signNow can streamline this process, making it easier to manage and store the signed documents securely.

Steps to complete the Borrowers Form

Completing the borrowers form involves several key steps:

- Gather necessary information, including personal identification and details about the equipment.

- Fill in the form with accurate information, ensuring all required fields are completed.

- Review the terms and conditions, including any fees for damages or late returns.

- Sign the form electronically to validate the agreement.

- Keep a copy of the signed form for personal records and provide a copy to the lender.

Key elements of the Borrowers Form

Several key elements must be included in the borrowers form to ensure its effectiveness and legality:

- Borrower Information: Full name, contact details, and identification.

- Equipment Description: Clear identification of the tools or equipment being borrowed, including serial numbers if applicable.

- Loan Duration: Start and end dates for the borrowing period.

- Terms and Conditions: Responsibilities of both parties, including maintenance of the equipment and penalties for damages or late returns.

- Signatures: Digital signatures from both the borrower and lender, confirming agreement to the terms.

Legal use of the Borrowers Form

The borrowers form is legally binding when it meets specific criteria set forth by electronic signature laws, such as the ESIGN Act and UETA. For the form to be considered valid, it must clearly outline the terms of the agreement and be signed by both parties. Using a reputable electronic signature platform ensures compliance with these legal standards, providing both parties with a secure and verifiable document. This legal framework protects the interests of both the borrower and the lender, ensuring accountability and clarity in the borrowing process.

Examples of using the Borrowers Form

There are various scenarios where the borrowers form can be utilized effectively:

- Construction Projects: Contractors borrowing tools like drills or scaffolding for specific job sites.

- Educational Institutions: Schools lending equipment such as computers or projectors to students for projects.

- Event Planning: Event organizers borrowing audio-visual equipment for temporary use during events.

Quick guide on how to complete borrowers form

Effortlessly Prepare Borrowers Form on Any Device

Digital document management has increasingly become favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, enabling you to locate the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, edit, and eSign your documents quickly without delays. Handle Borrowers Form across any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and eSign Borrowers Form with Ease

- Locate Borrowers Form and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or obscure confidential information with the tools airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal authority as a traditional ink signature.

- Review all information and select the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign Borrowers Form while ensuring effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the borrowers form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an example of borrowers form for the tools?

An example of borrowers form for the tools is a customizable document designed to collect essential information from borrowers. It typically includes fields for borrower details, loan specifics, and signatures. Using templates like this can streamline your loan processing workflow.

-

How does airSlate SignNow simplify the eSigning process for borrowers?

airSlate SignNow simplifies the eSigning process by allowing users to create an example of borrowers form for the tools effortlessly. With intuitive drag-and-drop features, you can add fields, adjust layouts, and ensure a fluid signing experience. This ultimately reduces the time spent managing documents.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to accommodate different business needs. You can start with a basic plan that includes access to features like the example of borrowers form for the tools, or opt for premium plans that provide advanced functionality. The cost-effective pricing ensures that even small businesses can benefit.

-

Can I customize the example of borrowers form for the tools?

Yes, you can fully customize the example of borrowers form for the tools on airSlate SignNow. The platform allows you to modify templates to fit your branding, add specific questions, and tailor the document structure. This ensures your form meets the unique needs of your business and clients.

-

What integrations does airSlate SignNow support?

airSlate SignNow supports a wide range of integrations with popular tools like CRM systems, cloud storage services, and productivity applications. This means that you can generate an example of borrowers form for the tools directly from your existing platforms, making the workflow seamless. Integration helps in keeping all your documents in sync.

-

How secure is using airSlate SignNow for sensitive documents?

Using airSlate SignNow is highly secure, as it employs top-notch encryption and complies with industry standards to protect sensitive information. When working with an example of borrowers form for the tools, you can rest assured that borrower data will remain confidential and protected. Our security measures ensure that all transactions are safe.

-

What are the key benefits of using airSlate SignNow for document management?

The key benefits of using airSlate SignNow include increased efficiency, cost savings, and enhanced security. By utilizing tools like the example of borrowers form for the tools, businesses can reduce paperwork and expedite the signing process. This results in faster transactions and improved client satisfaction.

Get more for Borrowers Form

Find out other Borrowers Form

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF