Schedule C Expenses Worksheet Form

What is the Schedule C Expenses Worksheet

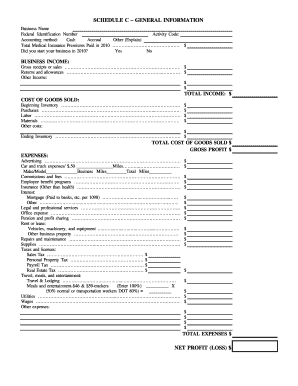

The Schedule C Expenses Worksheet is a crucial document for self-employed individuals and small business owners in the United States. It helps taxpayers report income and expenses related to their business activities on their federal tax returns. This worksheet simplifies the process of calculating deductible expenses, ensuring that all relevant costs are accounted for. By accurately completing this form, taxpayers can maximize their deductions and minimize their tax liabilities.

How to use the Schedule C Expenses Worksheet

Using the Schedule C Expenses Worksheet involves several steps. First, gather all financial records related to your business, including receipts, invoices, and bank statements. Next, categorize your expenses into appropriate sections, such as advertising, car and truck expenses, and office supplies. As you fill out the worksheet, enter the total amounts for each category. This organized approach not only aids in accurate reporting but also provides a clear overview of your business's financial health.

Steps to complete the Schedule C Expenses Worksheet

Completing the Schedule C Expenses Worksheet requires careful attention to detail. Follow these steps:

- Start by entering your business name and identifying information at the top of the worksheet.

- List your income from the business in the designated section.

- Proceed to itemize your expenses, ensuring you include all relevant categories.

- Calculate the total expenses by summing the amounts from each category.

- Subtract the total expenses from your income to determine your net profit or loss.

Review the completed worksheet for accuracy before submitting it with your tax return.

Legal use of the Schedule C Expenses Worksheet

The Schedule C Expenses Worksheet is legally recognized by the IRS as part of the tax filing process for self-employed individuals. To ensure compliance, it is essential to maintain accurate records and receipts for all expenses claimed. This documentation supports the figures reported on the worksheet and can be crucial in the event of an audit. Utilizing reliable tools for electronic completion can further enhance the legal standing of your submitted documents.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule C Expenses Worksheet. These guidelines outline what qualifies as deductible expenses and the necessary documentation to support claims. It is important to familiarize yourself with these rules to avoid errors that could lead to penalties or audits. The IRS website offers resources and publications that detail these guidelines, making them accessible for taxpayers.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule C Expenses Worksheet align with the general tax return due dates. Typically, self-employed individuals must file their tax returns by April fifteenth of each year. However, if additional time is needed, taxpayers can apply for an extension, which grants an additional six months. It is important to keep track of these deadlines to avoid late fees and penalties.

Quick guide on how to complete schedule c expenses worksheet

Prepare Schedule C Expenses Worksheet seamlessly on any device

Digital document management has become widespread among businesses and individuals. It offers an excellent environmentally-friendly substitution for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly and without holdups. Manage Schedule C Expenses Worksheet on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Schedule C Expenses Worksheet with ease

- Obtain Schedule C Expenses Worksheet and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Select pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Decide how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious document searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign Schedule C Expenses Worksheet to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule c expenses worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Schedule C worksheet and how can it help my business?

A Schedule C worksheet is a crucial document for self-employed individuals to track their income and expenses. It simplifies the process of filing taxes by providing a structured format for detailing earnings and deductions, ultimately helping you maximize your tax benefits.

-

How can airSlate SignNow assist with my Schedule C worksheet?

airSlate SignNow enables you to seamlessly gather signatures and manage your Schedule C worksheet digitally. By streamlining document signing, you can ensure that your financial records are organized and easily accessible, improving your tax preparation process.

-

Is there a cost associated with using airSlate SignNow for my Schedule C worksheet?

Yes, airSlate SignNow offers a variety of pricing plans to fit your needs, including options for individuals and small businesses. You can choose a plan that allows you to efficiently handle your Schedule C worksheet without breaking the bank.

-

What features does airSlate SignNow provide for managing my Schedule C worksheet?

airSlate SignNow offers features like customizable templates, secure eSigning, and automatic document storage, all of which can enhance the productivity of managing your Schedule C worksheet. These functionalities help you save time and reduce the stress of organizing tax documents.

-

Can I integrate airSlate SignNow with other accounting software for my Schedule C worksheet?

Absolutely! airSlate SignNow integrates with a variety of accounting tools such as QuickBooks and Xero, making it easier to manage your Schedule C worksheet. This integration allows for seamless data transfer, ensuring your financial information is always up to date.

-

How secure is my information when using airSlate SignNow for my Schedule C worksheet?

Security is a priority for airSlate SignNow. Your data is protected with encryption and complies with industry standards, ensuring that the information in your Schedule C worksheet remains confidential and secure throughout the signing process.

-

Can I access my Schedule C worksheet on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is mobile-friendly, allowing you to access and manage your Schedule C worksheet from any device. You can easily review documents, sign them, and share them directly from your smartphone or tablet, providing flexibility for busy professionals.

Get more for Schedule C Expenses Worksheet

Find out other Schedule C Expenses Worksheet

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself