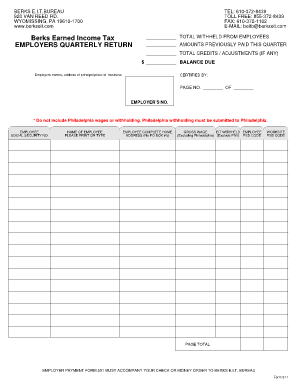

Berks Earned Income Tax Form

What is the Berks Earned Income Tax?

The Berks Earned Income Tax (EIT) is a local tax imposed on individuals who earn income within Berks County, Pennsylvania. This tax is applicable to both residents and non-residents who work in the county. The primary purpose of the Berks EIT is to generate revenue for local municipalities and school districts. The tax rate may vary depending on the specific municipality, and it is important for taxpayers to be aware of their obligations to ensure compliance.

Steps to Complete the Berks Earned Income Tax

Completing the Berks EIT involves several key steps to ensure accurate filing. First, gather all necessary documentation, including W-2 forms, 1099s, and any other income records. Next, determine the applicable tax rate based on your municipality. After that, fill out the Berks EIT form 511, ensuring that all sections are completed accurately. Once the form is filled out, review it for any errors before submitting it. Finally, file the completed form either online, by mail, or in person, depending on your preference.

Legal Use of the Berks Earned Income Tax

The Berks EIT is legally enforceable, meaning that failure to comply with tax obligations can lead to penalties. Taxpayers must ensure that they file their returns accurately and on time to avoid any legal issues. The tax is governed by local ordinances, and it is essential for individuals to understand their rights and responsibilities under these laws. Consulting with a tax professional can provide clarity on legal obligations and help ensure compliance.

Required Documents

To complete the Berks EIT, specific documents are required. These typically include:

- W-2 forms from employers

- 1099 forms for any freelance or contracted work

- Records of other income sources

- Previous year’s tax return, if applicable

Having these documents ready will streamline the process and help ensure that all income is reported accurately.

Filing Deadlines / Important Dates

Filing deadlines for the Berks EIT are crucial to avoid penalties. Typically, the tax return is due on April 15 of the following year, aligning with federal income tax deadlines. However, it is important to check for any local extensions or specific deadlines that may apply. Keeping track of these dates can help taxpayers manage their finances effectively and ensure timely compliance.

Who Issues the Form

The Berks EIT form is issued by the Berks EIT Bureau, which is responsible for administering and collecting the earned income tax in the county. The bureau provides resources and assistance for taxpayers, including information on how to fill out the form and where to submit it. Understanding the role of the Berks EIT Bureau can help taxpayers navigate the process more efficiently.

Quick guide on how to complete berks earned income tax

Complete Berks Earned Income Tax effortlessly on any device

Online document management has gained popularity with companies and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools necessary to generate, alter, and electronically sign your documents swiftly without delays. Manage Berks Earned Income Tax on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centered process today.

How to alter and electronically sign Berks Earned Income Tax easily

- Find Berks Earned Income Tax and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and holds the same legal value as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Leave behind lost or incorrectly placed files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Berks Earned Income Tax and ensure exceptional communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the berks earned income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the berks eit online and how does it improve document signing?

The berks eit online offers a streamlined solution for electronic signatures and document management. It simplifies the signing process, enabling users to send and eSign documents quickly. With its user-friendly interface, businesses can increase efficiency while maintaining a high level of security.

-

What are the key features of the berks eit online platform?

The berks eit online platform includes features such as customizable templates, in-person signing, and real-time tracking of document status. These functionalities enhance user experience and ensure that documents are signed efficiently. Additionally, it integrates with popular applications to further optimize workflow.

-

How much does the berks eit online service cost?

The pricing for the berks eit online service is competitive and designed to fit various business sizes. Subscription plans are available, allowing organizations to select a package that meets their needs. Businesses can benefit from transparent pricing with no hidden fees, making budgeting simple.

-

Is the berks eit online platform secure for signing important documents?

Yes, the berks eit online platform prioritizes document security with advanced encryption and authentication protocols. This ensures that all signatures and documents are protected from unauthorized access. Users can confidently sign legal documents with the assurance that their information remains safe.

-

Can I integrate berks eit online with other software applications?

Absolutely! The berks eit online platform offers seamless integration capabilities with various applications like CRM and cloud storage services. This makes it easy for businesses to incorporate electronic signing into their existing workflows. Integration enhances efficiency and streamlines operations.

-

What benefits does the berks eit online service offer for businesses?

The berks eit online service helps businesses save time and reduce paper waste by facilitating quick electronic signatures. Additionally, it enhances customer satisfaction by providing a fast and convenient signing process. Overall, using this service can lead to increased productivity and happier clients.

-

How does berks eit online compare to traditional paper signing?

Compared to traditional paper signing, the berks eit online solution is signNowly faster and more efficient. It eliminates the need for printing, signing, and scanning, making the entire process quicker. Users can complete transactions in minutes rather than days, enhancing business operations.

Get more for Berks Earned Income Tax

- Application for electric service form

- Authorization reimbursement form

- Harris county gold card form

- Application for disproportionate share hospital program dsh and medicaid kchip screening form 2013

- Where do i mail a change report form to nevada

- Application format for guardianship

- 447 cdl form

- Chip perinatal application form

Find out other Berks Earned Income Tax

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template