Case Information Statement 2011

What is the Case Information Statement

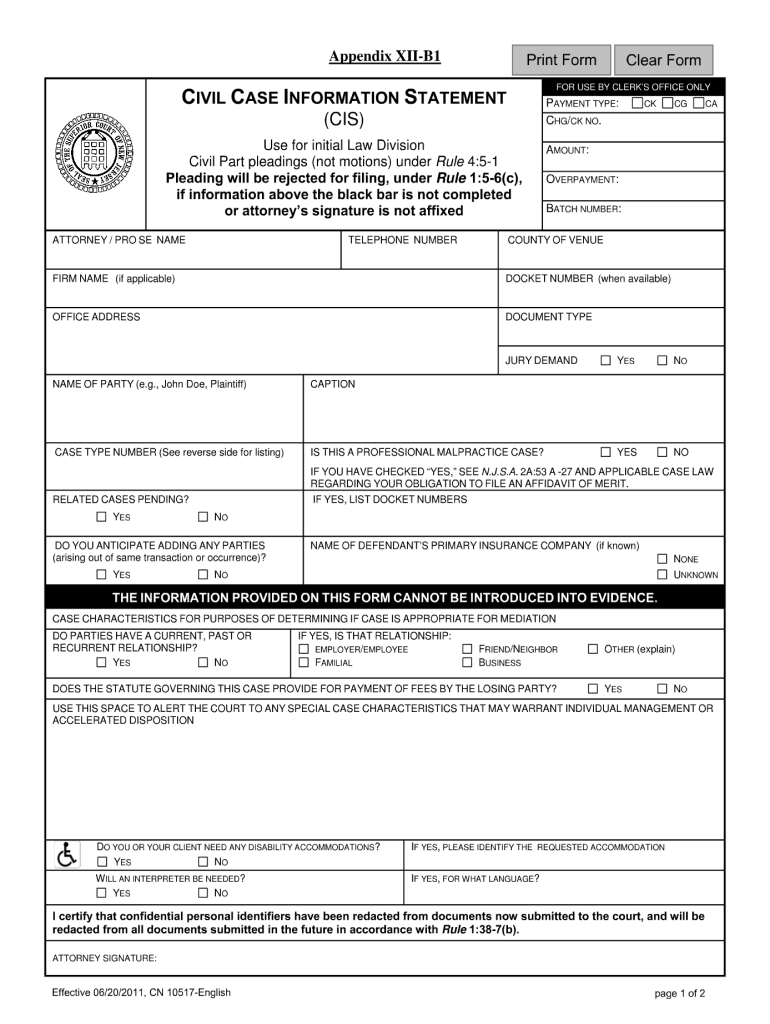

The Case Information Statement is a legal document used primarily in family law cases to provide the court with essential information about the parties involved and the issues at hand. This document typically includes details such as the names and addresses of the parties, the nature of the case, and any relevant financial information. It serves as a foundational tool for the court to understand the context of the case and to facilitate the legal process.

How to use the Case Information Statement

Using the Case Information Statement involves accurately filling out the required fields to ensure the court has all necessary information. This document should be completed before filing a case in court. When preparing the statement, it is important to follow the specific instructions provided by the court or jurisdiction. After completing the form, it must be submitted along with any other required documents to the appropriate court clerk's office.

Steps to complete the Case Information Statement

Completing the Case Information Statement involves several key steps:

- Gather all necessary information about the parties involved, including names, addresses, and contact details.

- Collect financial information, which may include income, expenses, and assets.

- Fill out the form accurately, ensuring all sections are completed as required.

- Review the completed statement for accuracy and completeness.

- Submit the form to the court along with any other required documents.

Legal use of the Case Information Statement

The Case Information Statement is legally binding once filed with the court. It must be completed truthfully, as providing false information can result in legal penalties. Courts rely on this document to make informed decisions regarding the case, including custody arrangements, financial obligations, and other critical issues. Therefore, it is essential to ensure that all information is accurate and up to date.

Key elements of the Case Information Statement

Several key elements are typically included in a Case Information Statement:

- Party Information: Names, addresses, and contact details of all parties involved.

- Case Type: The nature of the case, such as divorce, child custody, or support issues.

- Financial Information: Details regarding income, expenses, assets, and liabilities.

- Children Involved: Information about any children, including names and ages.

- Relief Sought: A brief description of what the filing party is requesting from the court.

State-specific rules for the Case Information Statement

Each state may have its own rules and requirements regarding the Case Information Statement. It is crucial to consult the local court rules or a legal professional to ensure compliance with state-specific guidelines. These rules may dictate the format of the form, the information required, and any filing fees associated with the submission. Understanding these nuances can help avoid delays in the legal process.

Quick guide on how to complete case information statement

Effortlessly Prepare Case Information Statement on Any Device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Case Information Statement on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Way to Modify and eSign Case Information Statement with Ease

- Obtain Case Information Statement and select Get Form to begin.

- Utilize our tools to fill out your form.

- Emphasize vital sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your modifications.

- Decide how you'd like to send your form—via email, SMS, invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Case Information Statement to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct case information statement

FAQs

-

I am a layman. What is Form 16, Income Tax return and the fuss about it?

The filing of Income Tax returns is a mandatory duty along with the payment of Income Tax to the Government of India . As the season closes by (last date of filing return - 5th August for 2014), many new tax-payers are in qualms as to how to go with the procedure as well as do away with the seemingly complicated mechanism behind it .Following are some of the pointers , which I acquired through self-learning (all are written considering the tax procedures for an Individual, and not Companies or other organizations). Here goes :1) Firstly , it is important to understand that Income Tax return is a document which is filed by you stating your Total Income in a Financial Year through various sources of income i.e Salary , business, house property, etc . (Financial Year is the year of your income , and Assessment Year is the year next to it in which the tax is due . Eg - Financial Year 2013-14, Assessment Year 2014-15)It also states the Taxable income on that salary and the Total tax payable with surcharges and Education Cess . The Taxable income has an exemption of upto 2 lakh rupees(For an individual, and not a senior citizen) for this assessment year , and 2.5 lakhs for the next (As per the new budget) . You also get tax exemptions on various other investments/allowances such as HRA , Fixed Deposits , Insurance Policies , Provident Funds , Children's Education , etc under various clauses of Section 80.People should know that return is filed to intimate the Government of your tax statements and it should not be confused with the Tax-refund one gets if there is a surplus tax paid by you to the Government . Return is not Refund .2) Government of India collects Income Tax through three modes :a) TDS - Tax Deduction at Source . TDS is the system in which any corporation/business as an Employer is supposed to deduct the Income tax of an Employee from his/her salary at source and submit it to the GOI before the end of Financial Year . The tax is deducted regularly from the employee's salary in certain percentage so as to overcome the liability of Total Tax to be paid by the employer for the Financial Year.The Employer issues a TDS Certificate in the form of Form 16 or Form 16A to the Employee which would be used to claim the TDS by the employee while filing his/her return . Form 16 is the certificate issued for the tax deducted under the head Salaries . Form 16A is issued for tax deducted for income through other sources such as interests on securities,dividends,winnings,etc.If the employee has some extra income through other sources , he/she should intimate the Employer about it before so as to include it for TDS . The total tax paid by you through TDS is also available online on the TRACES portal which is linked to your Bank Account and PAN No. for your convenience . You can also generate and validate your Form 16 / 16A from the website to file your return online .b) Advance Tax and Self Assessment Tax .Advance Tax may also be called 'Pay as you earn' Tax . In India one has to estimate his income during the financial year.If your projected tax liability of the current Financial year is more than Rs 10000, you are supposed to pay Advance tax !This has to be paid in three instalments. 30 % by 15th Sept,60% minus first instalment by 15th Dec and 100% minus 2nd instalment by 15th March.For individuals who are earning only through salaries , the Advance Tax is taken care of through TDS by the employers and there is hardly any Advance Tax to be paid . But for individuals who have other sources of income , they have to pay Advance Tax .If one forgets to pay he is liable to pay interest @ 1% p.m.Self-Assessment Tax - While filing your Return of Income, one does a computation of income and taxes to be filled in the Return. On computation, sometimes it is noted that the Taxes paid either as Advance Tax or by way of TDS fall short of the Actual Tax Payable . The shortfall so determined is called the Self Assessment Tax which is payable before filing the Return of Income. c) TCS - Tax Collection at Source .Tax Collected at Source (TCS) is income tax collected by a Seller from a Payer on sale of certain items. The seller has to collect tax at specified rates from the payer who has purchased these items : Alcoholic liquor for human consumption Tendu leaves Timber obtained under a forest lease Timber obtained by any mode other than under a forest lease Any other forest produce not being timber or tendu leaves Scrap Minerals being coal or lignite or iron ore Scrap BatteriesSalaried Individuals are not concerned with TCS .3) Online Procedure for Filing your Return , Payment of Tax , and viewing/generating your TDS certificate . a) Filing Income Tax Return :The procedure is as simple as it gets . You have to go to the E-filing homepage of the GOI , i.e https://incometaxindiaefiling.go... and login to your account . If you don't have an account yet , you can create it through the 'Register Yourself' link above it . All you need is a PAN No. (obviously) . After logging in , you have to go to the E-file tab and select the 'Prepare and Submit online ITR' option . Alternatively , you can select the 'Upload Return' option to upload your return through an XML file downloaded from the 'Downloads' tab and filled offline by you .You have to enter your PAN No, select ITR Form name 'ITR1' (Form ITR1 is for salaried individuals, income from house property and other income) , select Assessment year and submit .Now all you have to do is fill the form with the tabs Personal Information , Income Details , Tax Details , Tax Paid and Verification and 80G to complete your Return and submit it to the Income Tax Department .The 'Income Details' tab asks for your Total Income through various sources , and Tax exemptions claimed by you under various clauses of Section 80 . It also computes the Income tax liability of yours for that Financial Year . The 'Tax details' tab asks for the TAN (Tax Deduction Account Number) and Details of Form 16/16A issued by the employer/generated by you for TDS . It also asks for Advance Tax / Self Assessment Tax, if paid and the Challan no. of the payment receipt .The 'Tax Paid and Verification' Tab asks for your Bank Account Number and IFSC code . If there is a surplus tax paid by you in the form of TDS/Advance Tax , you will get its refund with interest in a 4 months period by the Income Tax Department . After submitting the Return , you get a link on your registered E-mail id . This link provides you the ITR-V document (an acknowledgement slip) which you have to download , print , put your signature , and send it to the Bangalore division of the Income Tax Department for completion of your Return Filing . The address is mentioned in the document . Alternatively , you can evade the ITR-V process and opt to digitally sign in the beginning of E-filing , but the process requires you to spend money and is to be renewed every year .b) Payment of Tax - You can pay the TDS (Not required for an individual, it is to be paid by the employer) , Advance Tax or Self Assessment Tax through the portal of Tax Information Network , i.e e-TAX Payment System After filling the required form (ITNS 280 for Income Tax) , you pay the tax through your Bank Account , and get a Challan receipt which will be used during filing your return .c) View/ Generate TDS Certificate online .You can do it by logging on to the TRACES portal of the Tax Deduction System , i.e , Page on tdscpc.gov.in You will have to register yourself before logging in through your PAN no.You can view the details of your TDS deducted by the Employer via From 26AS on the portal .Also , you can generate your TDS Certificate in the form of Form 16/16A by entering the TAN No. of your Employer .

-

How can we fight against the NRA regarding gun control?

Are you sure that the NRA is the problem?Oh, I know that the media and the talking heads are all making them out to be some 500 lb gorilla and the reason psychos shoot up school yards, but have you ever bothered to look into the matter beyond the headlines?I’ll give you an example. In 2017, the push was for a “Universal Background Check”. The idea was to be sure that people buying guns were not criminals. Believe it or not, the NRA wholly supports this and in fact was involved with creating the current NICS (National Instant Check System) that is used.But the bill that was proposed was not what you heard in the media. First, it would not plug any “Gunshow Loophole” because there is no such thing. The only sales at a gun show that the bill covered was private sales. Of course, private sales can occur anywhere, not just gun shows.But the bill didn’t make the NICS easier for private sales. They just required all private sales to be conducted through a licensed dealer. Had this actually passed, a gun show would be an ideal location for such sales as there would be access to many dealer. In effect, you would greatly increase the number of private sales at a gun show by this law.So, what is involved with a sale through a dealer? Well, the dealer would have to do the following:1) Record the transfer in their bound book. This is a book where all the transactions of a firearm is recorded via that dealer. The book is auditable by the BATF and many dealers have faced fines for poorly kept records, so many dealers go to great pains to keep their book neat and accurate.2) Fill out the federal form 4473. This is required by all dealer sales of both new and used guns. It asks for the buyer’s name, address, the make and model of the gun, serial number, and then asks a bunch of questions. The dealer can get fined if the person fills out the form wrong. For example, answering a question with “Y” or “N” instead of “Yes” or “No” is a BATF violation. So the dealer has to carefully examine the form for errors and have the person fill out another if errors are found.3) The dealer then calls into the NICS. NICS can come back with a “Proceed”, “Denied” or “Delay”. A delay can take up to 3 days. Typically this is a name that appears similar to a Prohibited Person and requires some research. If this happens, the transfer is on hold. The dealer has no idea when the result of the research is likely to finish. If you are at a gun show, the show could be over before the approval is made.4) All this paperwork, verification, etc takes time. Time is money. So dealers charge for this service. It is typical for a dealer to charge $25-$40 per gun, but sometimes multiple guns get a discount because the dealer can process up to 4 on a single form, but when more than one gun is transferred, the dealer has to fill out Form 3310 which is supposed to help with gun trafficking.All of this is well and good if you are buying a gun from someone you don’t know and many people will require sales be conducted at a dealer for the piece of mind such protections provide. But friends and family typically do not bother with the hassle and expense.One thing you need to realize is that to get a gun dealer license is not an easy process. Since the federal government cracked down on so called “kitchen table” dealers back in the 1980’s, you now must show a commercially zoned storefront with posted business hours to qualify. Many communities don’t want gun shops, and use zoning laws to make them difficult or unattractive. For example the city of Boston does not have any dealers. In fact, the nearest dealer is 3 towns away. Many rural areas don’t have the traffic to keep a dealer in business and you’ll find they are typically only open in the evening or on a Saturday as they work another full time job. Keep this in mind as we get into the next issue.But the bill didn’t stop at sales. It stated that ALL transfers had to be done in this manner. No exceptions. So, two friends out on a hunt would need to go through the whole process listed above just to swap guns for the afternoon. Oh, and they would have to do it all again to give the gun back. It is very common on a range to try out other people’s guns - such a thing would also require the full transfer and back process. Demo guns at a national event by manufacturers? Same thing.Basically any time a gun were to swap hands, the law would apply. There are private shooting clubs where guns are treated like library books and members take whatever they want. Families regularly swap guns. Heck, some shooting courses provide guns for students to use. All of these events would have been impacted by these new transfer requirements.The NRA balked at this. Essentially the rule would curtail many of the traditions and practices that are very common and virtually never result in any kind of criminal activity. In essence it would criminalize things that simply are not crimes.Not only would it create criminals where no criminal intent existed, but the cost to manage the volume of temporary transfers, the staffing needed to take the calls and do the checks would have cost millions each year. All money that would not go toward actually dealing with criminals.When the issue was brought up, many members of Congress agreed the requirements were too restrictive and the whole bill failed to pass. The supporters of the bill did not even attempt to listen to the complaints and work out a manageable fix.Did you hear any of that in the media?But what about catching criminals?Well, the bill didn’t change anything in regards to enforcing the rules to make sure the people who should not own guns were properly entered into NICS. In fact, other than maybe getting fired, there is NO PENALTY for failing to report a person. We have laws that will jail a teacher or coach that fail to report bullies. We have laws that put priests in prison who fail to report potential inappropriate behaviors in other clergy. But we do not have any laws that punish law enforcement agents that fail to do their job and make sure that dangerous people are reported to the background system. And this bill made no effort to change that.NICS is not open to anyone but federally licensed gun dealers. The left are so worried that the system might be used to check people for things other than guns that they refuse to create a means to allow people to verify someone they are selling a gun to. It would be easy to create an app that takes a photo of the buyer and seller’s ID (or just their faces and type in some data) and then return a simple “Proceed” or “Deny” with no other details. You’d have plenty of information to audit for illegal use. And if someone didn’t have an ID, they could then use a dealer. Heck, you can’t file taxes on-line without submitting some kind of ID, so this isn’t anything unique.And yet, the bill did nothing to address the issue of accessing the NICS for easier private sales.Here is the thing. We have 20,000 gun laws in this country. On the federal side, a prohibited person touching a gun could see them in prison for a minimum of 5 years. And yet, we still see cities with high violent crime rates that have virtually no federal cases. Why isn’t law enforcement using those stiff federal laws to get the violent people off the streets? Such a program called “Project Exile” worked wonders in Richmond, VA to reduce violent crime dramatically.OK, back to the “Universal Background Check” bill.I spent a lot of words above explaining what the bill would have required of people and why the situation would have been a nightmare. You never saw any of this in the news and the media pretty much ignored the issue.When the bill was defeated, it was never reported that a “terrible bill that would have cost millions and made criminals out of the innocent was defeated”, instead, all you ever heard was“The NRA used its influence to defeat the Universal Background Check bill that would have closed the gunshow loophole”Almost everything about that statement is false.So, be careful what you want to “Fight Against”. I suspect that most of what you think about the NRA is highly biased due to the way the organization is treated in the media. When you look at the actual facts, many times their concerns are quite valid. And, they have a lot of rank and file law enforcement on their side which helps them represent real world situations. I’ve found their positions in many cases very well presented. Most of the arguments you get on TV news are highly edited and taken out of context to promote an agenda, not facilitate a debate.Make sure you know what you are fighting for. You might be surprised.

-

How do I fill out the MHT-CET MBA exam application form in detail?

DTE Maharashtra has discharged MHT CET 2018 application form as on January 18 in online mode, can be filled by competitors by following the means said in how to fill MHT CET application frame 2018. Applicants who need to enlist themselves for the selection test should take after the means as given in how to fill MHT CET 2018 application form to maintain a strategic distance from oversights and entire method to go smooth and bother free. The means to fill the application type of MHT CET 2018 incorporates enlistment, filling of required subtle elements, transferring of filtered reports, instalment and affirmation page download. Hopefuls are required to fill the application type of MHT CET 2018 painstakingly to stay away from dismissal by the specialists. It is essential to take the application shape filling methodology of MHT CET genuinely on the grounds that exclusive those hopefuls who will present their structures effectively will get concede cards. Such applicants who will have legitimate MHT CET 2018 concede cards will be permitted to show up in the exam.Competitors must read the means offered underneath to fill and submit MHT CET 2018 application frame in a sorted-out way:Stage 1 – RegistrationApplicants should enrol themselves and give the required details. Candidate should concur whether he or she is an Indian resident or not.Proceeding onward, they will be required to fill the accompanying individual subtle elements:Full name (as showing up on the announcement of characteristics of SSC tenth or proportional exam), Father’s name, Mother’s first name, Last name, Gender, Contact Information, Address for correspondence, House No/Street, Area Name, Town/City , State, District, Pin code, Country, Mobile Number, Primary Email Id (Email will be sent to this email ID), Alternate Email Id (Parent’s Email ID, if accessible), Contact Telephone No. (with STD Code), Permanent Residence in Village/Town/City, Domicile of Maharashtra/Disputed Maharashtra Karnataka Border (MKB)/Outside Maharashtra, Reservation, Category of competitor (Caste perceived in Maharashtra state), Candidates having a place with SC, ST, VJ(A), NT(B), NT(C), NT(D), OBC and SBC classes must have their individual standing authentications, Candidates having a place with Non Creamy Layer (NCL) should create substantial testament upto March 31, 2019, Other DetailsRegardless of whether the candidate has a place with – PWD class or not (competitors qualified who are qualified under this classification ought to have under 40% incapacity), visually impaired, low vision. Orthopedically debilitated and competitors influenced with Cerebral Palsy and Dyslexia, who are not in a situation to compose, can benefit a copyist/author for the MHT-CET 2018 examRegardless of whether the applicant is a J&K vagrant or notReligionOther placement tests that applicant has enrolled for (JEE Main/NEET/None)Add up to Annual Family IncomeAadhaar NumberFinancial balance DetailsName of the record holder according to Bank recordName of the BankName of the Bank BranchKind of Account (Savings/Current)Financial balance NumberIFSC CodePoints of interest of HSC (twelfth/Equivalent Examination)Regardless of whether hopeful has passed/showed up for confirmation in Pharmacy (just for Biology applicants)Place from where hopeful has finished HSC (twelfth)/proportional exam showing up/Passed from school/Jr. School arranged (Maharashtra/Outside Maharashtra)Subtle elements required for MHT-CET 2018Subjects for CET examination (Physics, Chemistry, Mathematics, Biology)Dialect for the exam (English, Marathi, Urdu)Enter secret keyCompetitors should make a secret word (least 8 and most extreme 15 characters and should have one capitalized, one lower case and one numeric)In the wake of entering the secret key, competitors should affirm it. This secret word will be utilized for future logins.Statement by the hopefulApplicants should read the revelation composed and after that tap on “I Agree”Applicants need to enter the security key as gave and after that tap on “Next” catchStage 2 – Confirmation and SubmissionIn the wake of filling the previously mentioned subtle elements, hopefuls will have the capacity to check the data filled and alter certain things in the application frame.Applicants can backpedal and change or alter the accompanying particulars (as noticeable in green shading) before accommodation:Exam focusSubjects pickedDialect of the examIndividual with handicap choiceIn any case, there are particulars (as unmistakable in blue shading) that can’t be altered at this stage once submitted:Father’s nameLast nameDate of birthVersatile numberEmail IDSubsequent to rolling out the improvements, if required, hopefuls should present the shape.Stage 3 – Application number gotApplicants will get a message on the screen in regards to effective enlistment for MHT CET 2018 with their application number. A similar number will be sent to them gave email ID. Competitors can see and check their entered data in this progression.Stage 4 – Edit and Upload photo and markApplicants will have the capacity to alter the points of interest they have filled in the application frame. In any case, regardless they won’t have the capacity to alter their full name, father’s name, last name, date of birth, versatile number and email ID. In the event that candidates would prefer not to alter any points of interest, they can move to the subsequent stage of transferring their photo and mark in the arrangement recommended by the experts.Stage 5 – Uploading photo and markApplicants should transfer their current identification estimate shading photo and mark in the configuration given in the table underneath. On the off chance that, applicants are not ready to transfer the right photographs/marks, they should reload the right records and afterward transfer.Stage 6 – VerificationCompetitors will get a message on their screens with respect to fruitful transferring of photo and mark. They will likewise have the capacity to see a connection saying ” Click here to make payment “. Applicants should tap on the connection to enter the instalment entryway.Stage 7 – Payment gatewayHopefuls will have the capacity to see every one of the subtle elements filled by them alongside their transferred photo and mark on their screens. The application expense sum will likewise be noticeable in this progression, which they should pay in the wake of perusing the revelation. It is to noticed that competitors will have the capacity to change their subjects they are applying for.Applicants will have the capacity to influence application to charge payment through credit/check card, net saving money, plastic (ATM PIN), wallets and then some. They should influence instalment of the application to sum with comfort charge and expense.After instalment of utilisation charge, competitors will have the capacity to see a message on their screen with respect to accomplishment of exchange. Applicants must remove a print from this page.Stage 8 – Acknowledgment pageCompetitors must take a print from the affirmation page and keep it securely for some time later.Hope this Helps!!

-

How much time and money does it take for a new startup (<50 employees) to fill out the paperwork to become a group for the purpose of negotiating for health insurance for their founders and employees?

I'm not sure if this is a purely exploratory question or if you're inferring that you're planning on navigating the group health insurance market without the assistance of a broker. If the latter, I'd caution against it for several reasons (which I'll omit for now for the sake of brevity).To get a group quote, generally all that's needed is an employee census. Some states apply a modifier to the rate depending on the overall health of the group members (for a very accurate quote, employees may need to fill out general health statements).Obtaining rates themselves can take a few minutes (for states like CA which don't have a signNow health modifier) to several days.I suspect your cor question is the time/effort required once you've determined the most appropriate plan design for your company. This is variable depending on how cohesive your employee base is.Best case scenario - if all employees are in one location and available at the same time, I could bring an enrollment team and get all the paperwork done in the course of 1-3 hours depending on the size of your group. In the vast majority of cases, the employer's paperwork is typically around 6 pages of information, and the employee applications about 4-8 pages. Individually none of them take more than several minutes to complete.Feel free to contact me directly if you have specific questions or concerns.

-

How can I add my business location on instagram"s suggested locations?

Making a custom location on Instagram is actually quite easy and gives you an advantage to other businesses because it allows you to drive traffic via location.First off, Facebook owns Instagram; therefore, any location listed on Facebook also appears on Instagram. So you are going to need to create a business location on Facebook.So let’s dive into how to create a business location on Instagram.Make sure that you have enabled location services through the Facebook App or in your phone settings. If you are using an iPhone, select “Settings” → “Account Settings” → “Location” → “While Using The App”You need to create a Facebook check-in status. You do this by making a status and type the name of what you want your location to be called. For example “Growth Hustlers HQ”. Scroll to the bottom of the options and select “Add Custom Location” then tap on it!Now that you’ve created a custom location you need to describe it. It will ask you to choose which category describes your location, which you will answer “Business”.After choosing a category Facebook will ask you to choose a location. You can either choose “I’m currently here” or you can search for a location that you want to create for your business.Finally, publish your status. Congratulations! You have just created a custom location to be used on Facebook and Instagram.Now you are able to tag your business or a custom location on Instagram.If you have any questions about Social Media Marketing for businesses feel free to check out GrowthHustlers.com where you can find tons of resources about growing your Instagram following.

-

How does one prove something in Symbolic Logic?

Let us concentrate on a method that will most likely be left out.One valid proof technique in formal logic is the so called method of truth table construction. For a gentle introduction that method may be a good candidate to start with (and to wet your appetite).The idea of this particular method is the following:take the something that must be proven and decompose it into basic or atomic sub statements whose logical value can be readily established (or evaluated or computed)construct a table with one column per (independent) sentential variable plus one column per each atomic sub statementcombinatorial bit - generate all the possible True/False permutations across all the sentential variablesfor each such permutation compute the logical value of each atomic sub statement (in a row)using the above intermediate logical values compute the logical value of the overall statement or statements (as the case may be)Sample proof.Objective: prove that [math]\text{p AND (q AND r)}[/math] is the same as [math]\text{(p AND q) AND r}[/math](the above is known as the associative law)Proof.Step 1: identify all the independent sentential variables.Here they are: [math]p[/math], [math]q[/math], [math]r[/math].Step 2: identity the basic or atomic sub statements whose logical values can be readily computed.Here it looks like we only have to deal with an [math]\text{AND}[/math].Step3: compute the number of columns in our truth table.Here we shall have [math]3[/math] columns for the sentential variables, one column for the intermediate result [math]\text{(q AND r)}[/math], one column for [math]\text{p AND (q AND r)}[/math], one column for the intermediate [math]\text{(p AND q)}[/math] and one column for [math]\text{(p AND q) AND r)}[/math]. So [math]7[/math] columns total.Note the somewhat recursive nature of the expression [math]\text{p AND (q AND r)}[/math] - it may be rewritten as [math]\text{p AND s}[/math]:where the logical value of [math]s[/math] comes from the atomic sub statement [math]\text{(q AND r)}[/math] whose value we will keep track of in a dedicated column.Step 4: the combinatorial bit. Compute (or at least estimate) the number of rows in the truth table.In this case we have [math]3[/math] variables each of which can take on [math]2[/math] distinct values independently of each other. Thus, our table will have[math]2^3 \tag*{}[/math]rows.Think - one bit of information can only be in the True or False state, that is logically [math]0[/math] or [math]1[/math], and we have [math]3[/math] such bits. How many distinct numbers can we capture that way? Well, [math]2^3[/math]: two choices for the first bit times two choices for the second bit times two choices for the third bit.Step 5: generate a basic table with the inputs pre-filled:Step 6: go to mechanical work - start filling out the columns in the truth table.At this point the value of the previous decomposition of a complex or a compound statement into atomic sub pieces should become evident.If [math]q[/math] and [math]r[/math] are both True then we put the [math]T[/math] in the first blank column number four - that much we can readily do.Move on to the next row - if [math]q[/math] is True but [math]r[/math] is False then in the next row of the column four we write down the [math]F[/math].And so on until the entire column has been filled out:Step 7: move rightward on to the next column (number five).When evaluating the logical value of [math]\text{p AND (q AND r)}[/math] take the value of [math]p[/math] from the leftmost (first) column, which will be the [math]T[/math] for the first row, and take the value of [math]\text{(q AND r)}[/math] from the same row of the column number four - the one that we have just finished filling out. For the first row that value is [math]T[/math] (see the highlighted values in the table below).Repeat for each row until all rows are done:Step 8: fill out the column number six in the same fashion, step by step, row by row:Step 9: fill out the column number seven in the same fashion, step by step, row by row:Step 10: demonstrate that the logical values of the statements in question for all the rows match exactly for each corresponding like input. In the above truth table we see exactly how each intermediate logical value came into existence and how the final result was obtained. We also see that the values of the two columns highlighted in solid gray match row-for-row and input-for-input.We thus conclude that the two statements in question are in fact logically equivalent.[math]\blacksquare[/math]Rejoice.You just officially proved something.But be realistic. The process described above is quite mechanical - it does not require much inventive intellectual effort. The texture of most mathematical proofs is way different as these proofs require way more ingenuity and this is mildly put.(you may, at his point, take a crash course on the rudiments of proofs from this Quora answer)Extra for experts.When we said that the described process is quite mechanical we were not wasting our breath. It turns out that the Boolean strings that we have looked at are Turing Machine-computable: with a slight modification* it is possible to write, say, a C program that implements the Shunting Yard algorithm, due to Dijkstra (a theoretical physicist by training), which is capable of evaluating an arbitrarily parenthesised string of finite length whose composition is not known until run-time.*In this GitHub repository I have implemented (in Java) a Slow Motion Player which allows a person to witness exactly how the Shunting Yard algorithm weaves its magic - one step at a time on user-generated demand (here is a screen shot):*In this GitHub repository you will find the implementation (in Java also) of a simple arithmetic expressions calculator, based on the Shunting Yard algorithm.*And in this GitHub repository you will find the implementation (in Java again) of a Boolean expressions calculator, based on the Shunting Yard algorithm. A silly GUI driver is here.The point being is - do learn the truth table construction approach but then move on to something that requires human ingenuity, something that a Turing Machine can not do (errr … yet).

-

What is wrong with India?

Let me introduce you to The Nile Brothers.They are YouTube vloggers from Germany, who like exploring India and Indian food.Now, let me tell you about a guy named Vikray.He is a 23 year old Shoeshiner from Rajasthan. He came to Mumbai spending all the money his family had, with the goal of earning money to send his sisters (aged 8 and 12 years) to school so that they do not face the same predicament he is facing now.One day The Nile Brothers met Vikray. Vikray asked them if he could polish their shoes, but they denied as they were running out of time. Vikray carried on with his day without heeding much thought.The next day, the brothers met him again. They tried to talk to him about his family and everything (Vikray had learned English by speaking to several people he met in Mumbai). After getting to know about him and his situation, they felt sorry for him.The next day, they asked him about his earnings.Vikray : I earn Rs.100/- per day, on an average. Since I don't have a Shoeshiner box/kit which every Shoeshiner has, people wouldn't accept that I am a Shoeshiner. So, no one comes to me for getting their shoe polished. If I could get a Shoeshiner kit, I can earn Rs.600-700/- everyday.Nile Brothers : How much will that kit cost?Vikray : Rs.1500/-Nile Brothers : Can you afford it?Vikray : No, I cannot.They felt very sad and became emotional.Next day:The Brothers decided to help him. Initially they thought of taking him to a big restaurant and giving him a proper dinner. But later they thought that it will only make him momentarily happy and it won’t help him improve his condition in anyway. Finally, they decided that they wanted to help him earn money which will help him in the long run. Thus, they wanted to gift him a shoeshiner kit as it will help him, his family, and he can send his sisters to school too. It'll change his whole life forever.And so finally they bought a kit and surprised him.His face was completely filled with joy and happiness.At last they gave him a hug, explained what made them do this and gave him a few suggestions.They gave him some money and told him to have a good dinner and enjoy the day.And FAREWELL.Look at how good the brothers are and the really amazing work they did.But you should know what they got in return.One day they were traveling in an auto rickshaw and the ride cost Rs.80. When they signNowed their destination they gave the auto driver Rs.100. The auto driver, instead of giving them their balance of Rs.20, demanded Rs.60 more. He told them that the ride was Rs.80 per person.They knew that they were being fooled but they still had to pay.This happened to them only because they were “FIRANGIS” (Foreigners).They soon faced a similar incident again when they went to a street food shop for having masala dosa.Everything went fine until they had to pay.Guess how much they were asked to pay! Rs.300 ? Rs.400 ??Nah! It's Rs.755 for 3 masala dosas.Only because they were “FIRANGIS” (Foreigners).And it’s not just them. Many people face these kind of situations.This is what is wrong with India.People always try to find ways to cheat others. (Not everyone does, but many do)In our country, many good people don't deserve what they go through. This is just an example.You can find their YouTube channel here: Nile BrothersVikray's video : Helping Him Sending His Sisters To School *emotional**Sorry for grammatical errors (if any)

-

How can Brexit campaigns be held accountable for the information they put out? To be making definitive statements that may affect clinical outcomes is very different in nature to making the case for a particular Brexit outcome.

How can Brexit campaigns be held accountable for the information they put out? To be making definitive statements that may affect clinical outcomes is very different in nature to making the case for a particular Brexit outcome.Simply, NOTHING matters more than Brexit. Your problems are YOURS and should not stand in the way of leaving the EU.If you are on the breadline, and prices go up, you’ll have to work harder.If you are sick and need drugs, you’ll have to suffer for a while until things settle down. it’ll be FINE, really. Any talk of people dying is just “project fear”!If you were going to marry an EU national next year, you can apply for permits and visas and residence and citizenship for your new spouse, it won’t cost much.Just a few dozen forms, and a load of red tape and official obstructiveness like it was before.If your import/export business takes a hit, that’s business. Survival of the fittest!There’s the Leave perspective.Anyone talking that way is, you can be sure, immune to any serious damage from Brexit. They have a financial and situational cushion that means none of the changes, shortages, or extra costs will apply in their own life - and even if they do, the effect is minuscule in proportion to the ability of the cushion to absorb it.None of the false promises that have so far been exposed resulted in any censure of the person who made them. Boris Johnson lies with impunity about what he said pre-Brexit. Positions have shifted like Saharan dunes… hugely, but without drawing attention to themselves.The only constant that you can rely on is the established situation the UK has as part of the EU. Nothing else is certain, reliable, or safe. It’s all up for discussion, distortion, and dismissal… at YOUR cost. No-one is accountable for Brexit’s shortfall from promises.

-

How much to pay in taxes for freelancer?

Your freelance business goes on schedule C. Report revenues on line 1, 80% payouts to subcontractors on line 11, Contract Labor, and other expenses as appropriate. Net profit is carried over to your 1040 income tax return and schedule SE, .where you will pay 12.23% of your net profit. You need to make quarterly income tax payments if your withholding from regular employment (if any) will be less than 90% of your income tax for the year and your income tax for the year will be more than $1000. There is an estimated tax worksheet for this.If you pay a US subcontractor more than $600, you must report it on a 1099 at year end. You don't have to report anything on foreign subcontractors. You will not need an employer ID. You can give clients your SSN for them to put on 1099s. Reseller ID is for sales to customers within your state, if it charges sales tax on custom software services (not to be confused with shrinkwrap software).. Many states do not.Addendum:If your net profit plus other income will be less than $8000 for the year, you will not have file quarterly and your only tax at year end will be the 12% self-employment tax. Your state income tax will probably be zero as well.Self-employment tax is a retirement plan called Social Security. You will get it back when you are old.

Create this form in 5 minutes!

How to create an eSignature for the case information statement

How to make an electronic signature for your Case Information Statement in the online mode

How to make an eSignature for the Case Information Statement in Chrome

How to create an eSignature for putting it on the Case Information Statement in Gmail

How to make an eSignature for the Case Information Statement straight from your mobile device

How to generate an eSignature for the Case Information Statement on iOS devices

How to make an eSignature for the Case Information Statement on Android OS

People also ask

-

What is a Case Information Statement?

A Case Information Statement is a document that provides crucial details about a legal case, including parties involved, the nature of the dispute, and relevant financial information. Using airSlate SignNow, you can easily create, customize, and eSign your Case Information Statement, ensuring all parties have access to the necessary information in a timely manner.

-

How can I create a Case Information Statement using airSlate SignNow?

Creating a Case Information Statement with airSlate SignNow is straightforward. Simply choose from our templates or start with a blank document, fill in the required fields, and customize it according to your specific needs. Once finalized, you can eSign and share the document with relevant stakeholders effortlessly.

-

Is airSlate SignNow cost-effective for creating a Case Information Statement?

Yes, airSlate SignNow offers a cost-effective solution for creating a Case Information Statement. With a variety of pricing plans available, you can choose one that fits your budget while still benefiting from robust features for document management and eSigning.

-

What features does airSlate SignNow offer for Case Information Statements?

airSlate SignNow provides several features specifically beneficial for Case Information Statements, including customizable templates, user-friendly editing tools, eSigning capabilities, and secure document storage. These features streamline the legal process, saving you time and enhancing efficiency.

-

How does airSlate SignNow ensure the security of my Case Information Statement?

Security is a top priority at airSlate SignNow. All Case Information Statements and other documents are protected with bank-level encryption, and we comply with GDPR and HIPAA regulations to ensure your data is safe. You can confidently manage sensitive legal documents knowing they are secure.

-

Can I integrate airSlate SignNow with other applications for managing my Case Information Statement?

Absolutely! airSlate SignNow offers seamless integrations with various applications, including cloud storage services and CRM systems. This allows you to streamline your workflow and efficiently manage your Case Information Statement, all within your preferred tools.

-

What are the benefits of using airSlate SignNow for my Case Information Statement?

Using airSlate SignNow for your Case Information Statement offers several benefits, such as increased efficiency, reduced paperwork, and faster turnaround times. Our platform simplifies the signing process, ensuring that all signers can access and complete the document quickly, which enhances productivity.

Get more for Case Information Statement

Find out other Case Information Statement

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document