What W8 Form for a Uk Charity

What is the W-8 Form for a UK Charity

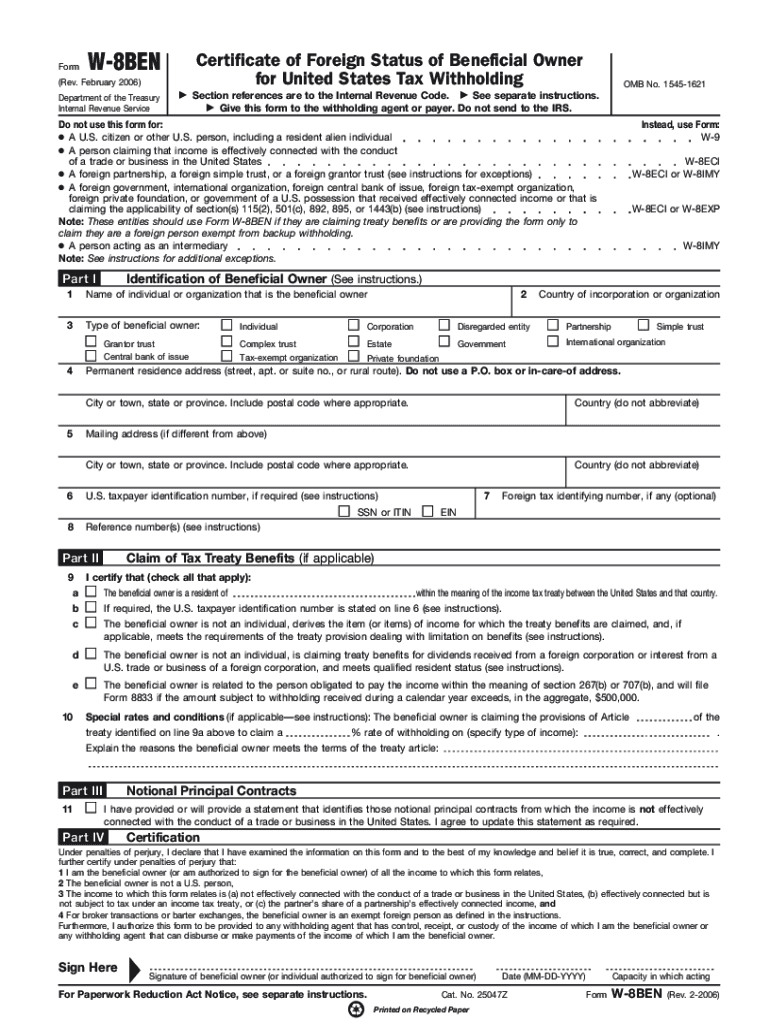

The W-8 form is a tax document used by foreign entities, including UK charities, to certify their foreign status and claim tax treaty benefits. Specifically, the W-8BEN form is often utilized by charities to establish that they are not subject to U.S. tax withholding on certain types of income, such as donations or grants. This form helps ensure that the income received by the charity is not taxed at the source, allowing them to maximize their funding for charitable activities.

How to Use the W-8 Form for a UK Charity

To use the W-8 form, a UK charity must complete the W-8BEN form accurately and submit it to the U.S. entity from which they are receiving income. The form requires the charity to provide information such as its name, country of incorporation, and tax identification number. This information helps the U.S. entity verify the charity's foreign status and apply any applicable tax treaty benefits. Once submitted, the charity should keep a copy of the completed form for their records.

Steps to Complete the W-8 Form for a UK Charity

Completing the W-8BEN form involves several key steps:

- Gather necessary information, including the charity's legal name, address, and tax identification number.

- Fill out Part I of the form, providing the charity's details.

- Complete Part II, selecting the appropriate tax treaty benefits if applicable.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to the U.S. entity requesting it, ensuring that they retain a copy for their records.

Legal Use of the W-8 Form for a UK Charity

The W-8 form is legally recognized by the IRS as a valid means for foreign entities to claim tax exemptions. For a UK charity, using the W-8BEN form correctly is essential to ensure compliance with U.S. tax laws. This form helps the charity avoid unnecessary withholding taxes on income sourced from the United States, which can significantly benefit their operations and funding. It is crucial for charities to understand the legal implications of this form and ensure it is filled out correctly to maintain their tax-exempt status.

Key Elements of the W-8 Form for a UK Charity

Several key elements must be included in the W-8BEN form for it to be valid:

- Identification of the charity: The legal name and address of the charity must be clearly stated.

- Tax identification number: The charity's tax identification number in the UK is required.

- Certification of foreign status: The charity must certify that it is a foreign entity and not subject to U.S. taxation.

- Signature: An authorized representative must sign and date the form to validate it.

Filing Deadlines / Important Dates

There are no specific filing deadlines for the W-8BEN form; however, it should be submitted before the charity receives any income from U.S. sources to avoid withholding taxes. It is advisable for charities to submit the form as soon as they anticipate receiving payments to ensure compliance and to benefit from tax treaty provisions. Additionally, charities should review and update their W-8 forms periodically or whenever there are changes in their status or information.

Quick guide on how to complete what w8 form for a uk charity

Complete What W8 Form For A Uk Charity effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents rapidly without delays. Manage What W8 Form For A Uk Charity on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to alter and eSign What W8 Form For A Uk Charity with ease

- Obtain What W8 Form For A Uk Charity and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or mistakes requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign What W8 Form For A Uk Charity to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the what w8 form for a uk charity

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the W-8 form for a UK charity?

The W-8 form for a UK charity is a document required by the Internal Revenue Service (IRS) for foreign organizations to signNow their foreign status and claim tax exemptions. This form helps UK charities avoid U.S. withholding taxes on income earned from U.S. sources. Understanding what W-8 form for a UK charity is essential for compliance with tax regulations.

-

Why do UK charities need to fill out a W-8 form?

UK charities need to fill out a W-8 form to demonstrate their foreign status to U.S. payers, which helps them access certain tax exemptions. By completing this form correctly, charities can minimize or eliminate withholding taxes applied to income such as donations, grants, or other payments from the U.S. Knowing what W-8 form for a UK charity is crucial for financial efficiency.

-

How does airSlate SignNow assist with W-8 form submissions for charities?

airSlate SignNow simplifies the process of sending and signing W-8 forms electronically, ensuring that UK charities can easily manage their documentation. With our user-friendly platform, charities can quickly send out the W-8 forms for signatures and securely store them for compliance. Understanding what W-8 form for a UK charity is made easier with efficient tools.

-

What features does airSlate SignNow offer for non-profits and charities?

airSlate SignNow provides non-profits and charities with features like document templates, secure eSigning, and customizable workflows. These capabilities streamline the process of managing important documents, including the W-8 form for a UK charity, thus increasing efficiency. Utilizing these features can signNowly enhance a charity's operational workflow.

-

Is there a cost associated with using airSlate SignNow for charities?

Yes, while airSlate SignNow offers a variety of pricing plans, we also provide discounts for charities and non-profit organizations. Understanding what W-8 form for a UK charity entails can help justify the investment in our service, which simplifies document management. Explore our pricing plans to find the best fit for your organization's needs.

-

Can airSlate SignNow integrate with other software used by charities?

Yes, airSlate SignNow integrates seamlessly with various applications such as CRM systems, accounting software, and cloud storage services. This integration allows UK charities to handle their documents, including the W-8 form for a UK charity, in a more connected and efficient manner. Leveraging these integrations can enhance your charity's operational capabilities.

-

What are the benefits of using airSlate SignNow for charities?

Using airSlate SignNow provides UK charities with a cost-effective solution for managing e-signatures and document workflows. It ensures compliance while saving time and resources that can be better used for charitable activities. Understanding what W-8 form for a UK charity helps charities take full advantage of these benefits.

Get more for What W8 Form For A Uk Charity

Find out other What W8 Form For A Uk Charity

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed