Tribal Exemption Form Az

What is the Tribal Exemption Form AZ

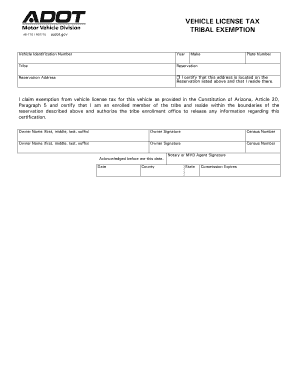

The Tribal Exemption Form AZ, commonly referred to as the 48 7701 form, is a document that allows Native American individuals to claim tax exemptions on certain transactions within the state of Arizona. This form is particularly relevant for individuals who are members of federally recognized tribes and seek to benefit from specific tax privileges. The exemptions may apply to various taxes, including sales tax and vehicle license tax, depending on the individual's tribal affiliation and the nature of the transaction.

How to Use the Tribal Exemption Form AZ

Using the Tribal Exemption Form AZ involves a straightforward process. First, individuals must ensure they meet the eligibility criteria, which typically include being a member of a recognized tribe. Once eligibility is confirmed, the form can be completed with necessary personal information, including tribal affiliation and the type of exemption being claimed. After filling out the form, it should be submitted to the appropriate state agency or entity that requires it, such as the Arizona Department of Transportation for vehicle-related exemptions.

Steps to Complete the Tribal Exemption Form AZ

Completing the Tribal Exemption Form AZ involves several key steps:

- Gather necessary documentation, such as proof of tribal membership.

- Download or obtain the 48 7701 form from a reliable source.

- Fill out the form with accurate personal information and details regarding the exemption being claimed.

- Review the completed form for accuracy and completeness.

- Submit the form to the relevant authority, ensuring that any required supporting documents are included.

Legal Use of the Tribal Exemption Form AZ

The legal use of the Tribal Exemption Form AZ is governed by state laws and regulations that recognize the tax privileges of Native American individuals. When properly completed and submitted, this form can serve as a valid claim for tax exemptions. It is essential for users to understand that misuse or incorrect submission of this form may lead to legal repercussions, including penalties or denial of the claimed exemptions. Therefore, ensuring compliance with all relevant laws is crucial.

Eligibility Criteria

To qualify for the Tribal Exemption Form AZ, individuals must meet specific eligibility criteria, which typically include:

- Being a member of a federally recognized Native American tribe.

- Providing proof of tribal membership, such as a tribal identification card.

- Using the exemption for eligible transactions, such as purchasing goods or registering vehicles.

Required Documents

When completing the Tribal Exemption Form AZ, certain documents are required to support the claim. These may include:

- A valid tribal identification card or certificate of tribal enrollment.

- Proof of residency, if applicable.

- Any additional documentation that may be required by the agency processing the exemption.

Form Submission Methods

The Tribal Exemption Form AZ can be submitted through various methods, depending on the requirements of the agency involved. Common submission methods include:

- Online submission through the relevant state agency's website.

- Mailing the completed form to the appropriate address.

- In-person submission at designated offices or agencies.

Quick guide on how to complete tribal exemption form az

Effortlessly Prepare Tribal Exemption Form Az on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to quickly create, edit, and eSign your documents without delay. Handle Tribal Exemption Form Az on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Edit and eSign Tribal Exemption Form Az with Ease

- Obtain Tribal Exemption Form Az and click on Get Form to begin.

- Utilize the provided tools to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all information and click the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Tribal Exemption Form Az to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tribal exemption form az

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the native american tax exemption form az?

The native american tax exemption form az is a document that allows eligible Native American individuals to claim exemptions on certain taxes. This form is essential for those seeking to benefit from tax regulations specific to Native American residents in Arizona. Completing and submitting this form correctly is crucial for ensuring compliance and maximizing potential tax benefits.

-

How do I complete the native american tax exemption form az?

To complete the native american tax exemption form az, gather the necessary personal information, including your tribal affiliation and any relevant financial details. Follow the instructions provided on the form carefully to ensure all sections are filled out accurately. If you're utilizing airSlate SignNow, the platform streamlines the process, allowing for easy electronic signatures and secure document management.

-

Are there any fees associated with the native american tax exemption form az?

The native american tax exemption form az itself does not typically incur any fees for submission to the relevant tax authority. However, if you choose to utilize services that facilitate the eSigning and management of this form, such as airSlate SignNow, there may be associated costs for those services. It's advisable to review pricing details before committing to any platform.

-

What are the benefits of using airSlate SignNow for the native american tax exemption form az?

Using airSlate SignNow for the native american tax exemption form az provides a user-friendly interface for document management. Benefits include secure eSigning, real-time tracking, and easy access to templates specifically designed for tax forms. This streamlines the process, reduces the risk of errors, and ensures that your paperwork is submitted accurately and efficiently.

-

Can I integrate airSlate SignNow with other software for the native american tax exemption form az?

Yes, airSlate SignNow offers various integrations that can enhance your experience with the native american tax exemption form az. You can easily connect with CRMs, cloud storage solutions, and productivity tools to facilitate better document workflows. This integration capability allows for seamless data transfer and more efficient processing of your tax exemption forms.

-

Is eSigning legally valid for the native american tax exemption form az?

Yes, eSigning your native american tax exemption form az using airSlate SignNow is legally valid. The platform complies with eSignature laws, ensuring that your electronic signature holds the same legal weight as a traditional handwritten signature. This can save time and effort when submitting sensitive documents to tax authorities.

-

How can I track the status of my native american tax exemption form az submission?

AirSlate SignNow provides tools to track the status of your native american tax exemption form az submission in real-time. You'll receive notifications when your document is viewed, signed, or completed, allowing you to stay informed throughout the process. This feature helps ensure that you can follow up promptly if any issues arise with your submission.

Get more for Tribal Exemption Form Az

Find out other Tribal Exemption Form Az

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself