Self Employment Short If You're Self Employed, Have Relatively Simple Tax Affairs and Your Annual Business Turnover Was below 73 2019

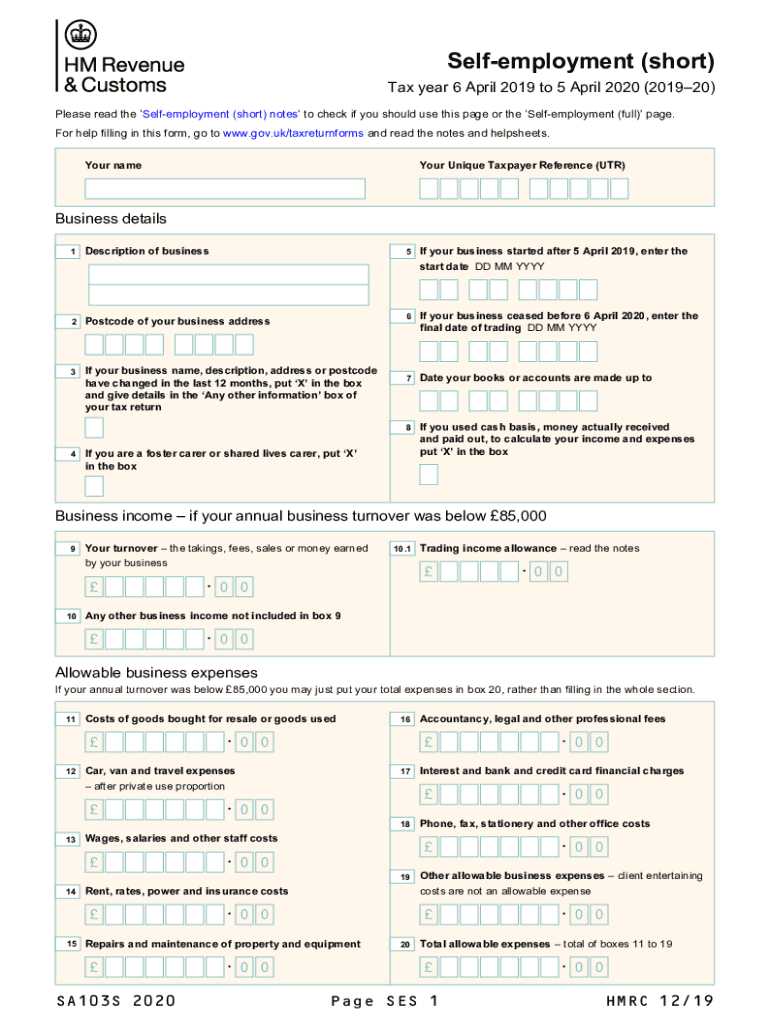

Understanding the SA103S Form

The SA103S form is designed for self-employed individuals in the United States who have relatively simple tax affairs and an annual business turnover below seventy-three thousand dollars. This short version of the self-employment supplementary pages simplifies the process of filing a tax return, making it more accessible for those who do not have complex financial situations. It is essential for taxpayers to understand the specific requirements and eligibility criteria associated with this form to ensure proper completion and compliance with tax regulations.

Steps to Complete the SA103S Form

Completing the SA103S form involves several straightforward steps:

- Gather necessary documents, including records of income and expenses.

- Fill out the form with accurate information regarding your business turnover and expenses.

- Ensure all calculations are correct to avoid discrepancies.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either electronically or by mail.

Following these steps can help streamline the filing process and reduce the risk of errors that could lead to penalties.

Legal Use of the SA103S Form

The SA103S form is legally binding when filled out and submitted correctly. To ensure its legal standing, it is crucial to comply with all relevant tax laws and regulations. This includes providing accurate information and maintaining proper documentation of income and expenses. Utilizing a reliable electronic signature tool, such as airSlate SignNow, can enhance the legal validity of your submission by providing a secure and verifiable signature.

Required Documents for the SA103S Form

When preparing to fill out the SA103S form, certain documents are essential:

- Records of all income received from self-employment activities.

- Receipts and invoices for business-related expenses.

- Bank statements reflecting business transactions.

- Any previous tax returns that may provide context for your current filing.

Having these documents organized and readily available can facilitate a smoother completion process.

Filing Deadlines for the SA103S Form

It is important to be aware of the filing deadlines associated with the SA103S form to avoid penalties. Typically, the deadline for submitting your self-assessment tax return, including the SA103S, is January thirty-first of the year following the tax year in question. If you are filing online, ensure that your submission is completed by this date to maintain compliance with IRS regulations.

Eligibility Criteria for the SA103S Form

To be eligible for the SA103S form, you must meet specific criteria:

- You must be self-employed with a relatively simple tax situation.

- Your annual business turnover must be below seventy-three thousand dollars.

- You should not have complicated deductions or multiple sources of income that require a more detailed form.

Meeting these criteria ensures that you can utilize the SA103S form effectively for your tax filing needs.

Digital vs. Paper Version of the SA103S Form

When deciding between the digital and paper versions of the SA103S form, consider the benefits of each. The digital version offers convenience and efficiency, allowing for quicker submissions and easier tracking of your filing status. In contrast, the paper version may be preferred by those who are more comfortable with traditional methods or do not have reliable internet access. Regardless of the method chosen, ensure that the form is completed accurately to comply with tax regulations.

Quick guide on how to complete self employment short 2020 if youre self employed have relatively simple tax affairs and your annual business turnover was

Accomplish Self employment Short If You're Self employed, Have Relatively Simple Tax Affairs And Your Annual Business Turnover Was Below 73 effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without delays. Manage Self employment Short If You're Self employed, Have Relatively Simple Tax Affairs And Your Annual Business Turnover Was Below 73 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest method to alter and eSign Self employment Short If You're Self employed, Have Relatively Simple Tax Affairs And Your Annual Business Turnover Was Below 73 with ease

- Locate Self employment Short If You're Self employed, Have Relatively Simple Tax Affairs And Your Annual Business Turnover Was Below 73 and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Decide how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the risk of lost or misplaced documents, laborious form hunting, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Self employment Short If You're Self employed, Have Relatively Simple Tax Affairs And Your Annual Business Turnover Was Below 73 and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct self employment short 2020 if youre self employed have relatively simple tax affairs and your annual business turnover was

Create this form in 5 minutes!

How to create an eSignature for the self employment short 2020 if youre self employed have relatively simple tax affairs and your annual business turnover was

The way to create an eSignature for your PDF document online

The way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

How to create an eSignature for a PDF file on Android OS

People also ask

-

What is sa103s, and how can it benefit my business?

The sa103s is a specific form required by HMRC for self-employed individuals to report their income. Using airSlate SignNow, you can easily upload, sign, and send your sa103s documents securely. This efficiency helps save time and streamline your tax reporting process.

-

How much does it cost to use airSlate SignNow for sa103s?

airSlate SignNow offers a cost-effective pricing model tailored for businesses needing to manage documents like the sa103s. Our plans start at competitive rates, allowing you to choose a package that fits your budget without compromising on features required for effective document management.

-

Can I integrate airSlate SignNow with other tools for managing my sa103s?

Yes, airSlate SignNow seamlessly integrates with various applications to enhance your workflow for managing sa103s. Whether you use accounting software or other project management tools, these integrations help streamline the entire process from document creation to submission.

-

What features does airSlate SignNow offer for handling sa103s?

airSlate SignNow provides a range of features specifically designed for managing forms like sa103s. These include customizable templates, eSignature capabilities, document tracking, and secure cloud storage, all aimed at simplifying your document management experience.

-

Is it easy to eSign my sa103s using airSlate SignNow?

Absolutely! airSlate SignNow is designed for an easy-to-use experience, allowing you to eSign your sa103s with just a few clicks. The intuitive interface guides you through the signing process, ensuring you can complete your form quickly and accurately.

-

What security measures are in place for managing my sa103s with airSlate SignNow?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like sa103s. We employ robust encryption standards and compliance protocols to ensure that your documents are safe and secure during storage and transmission.

-

Can I access my submitted sa103s from mobile devices?

Yes, airSlate SignNow is accessible on mobile devices, allowing you to manage your sa103s on the go. This flexibility means you can review, sign, and send documents at your convenience, making it easier to stay on top of your taxes.

Get more for Self employment Short If You're Self employed, Have Relatively Simple Tax Affairs And Your Annual Business Turnover Was Below 73

- Transcript information office of the registrar baylor

- Application for membership application for membership form

- Membership application stone bank fire department form

- Guide to withdrawal form vissf

- Project request form elizabeth city state universityproject registration form forcecom24 project documentation templates free

- Covid 19 informationus embassy ampamp consulates in japan

- Call 800 245 3117 ext form

- Macquarie withdrawal form bank with macquariemacquarie

Find out other Self employment Short If You're Self employed, Have Relatively Simple Tax Affairs And Your Annual Business Turnover Was Below 73

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document