Mary Kay Tax Worksheet 2016

What is the Mary Kay Tax Worksheet

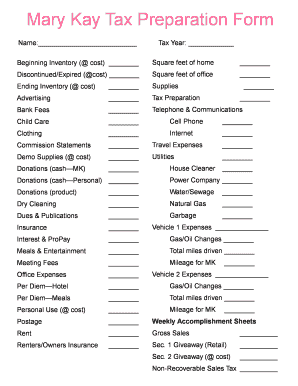

The Mary Kay Tax Worksheet is a specialized document designed for independent beauty consultants associated with Mary Kay Inc. This worksheet helps consultants track their income and expenses related to their Mary Kay business. It serves as a tool to simplify the tax preparation process, ensuring that all relevant financial information is organized and easily accessible during tax season. This form is crucial for accurately reporting earnings and claiming deductions, which can significantly impact the overall tax liability for consultants.

How to use the Mary Kay Tax Worksheet

Using the Mary Kay Tax Worksheet involves several straightforward steps. First, gather all financial records, including sales receipts, expense invoices, and any other relevant documents. Next, input your total sales figures and categorize your expenses, such as inventory costs, marketing expenses, and travel costs. The worksheet is structured to guide you through each section, helping you to ensure that no income or expense is overlooked. After completing the worksheet, review it for accuracy before using it to prepare your tax return.

Steps to complete the Mary Kay Tax Worksheet

Completing the Mary Kay Tax Worksheet requires careful attention to detail. Follow these steps for effective completion:

- Start with your personal information, including your name and Social Security number.

- Document your total income from sales, including any commissions earned.

- List all business-related expenses, categorizing them appropriately.

- Calculate your net income by subtracting total expenses from total income.

- Ensure all entries are accurate and complete before finalizing the worksheet.

Legal use of the Mary Kay Tax Worksheet

The Mary Kay Tax Worksheet is legally recognized as a valid document for tax reporting purposes. To ensure its legal standing, it is essential to complete the worksheet accurately and retain supporting documentation for all reported figures. This includes receipts and invoices that justify the expenses claimed. Compliance with IRS regulations is crucial, as accurate reporting can help avoid potential penalties or audits. It is advisable to consult with a tax professional if there are uncertainties regarding the completion of the worksheet.

Filing Deadlines / Important Dates

Filing deadlines for the Mary Kay Tax Worksheet align with the standard tax deadlines set by the IRS. Typically, individual tax returns are due on April fifteenth of each year. However, if you require an extension, you may file for one, which extends the deadline to October fifteenth. It is important to keep track of these dates to avoid late fees and penalties. Additionally, staying informed about any changes in tax laws or deadlines is beneficial for timely and accurate filing.

IRS Guidelines

The IRS provides specific guidelines for reporting income and expenses related to self-employment, which applies to Mary Kay consultants. It is crucial to familiarize yourself with these guidelines to ensure compliance. This includes understanding what qualifies as deductible expenses and how to report income accurately. The IRS also emphasizes the importance of maintaining thorough records, which can be facilitated by using the Mary Kay Tax Worksheet. Adhering to these guidelines can help minimize the risk of audits and ensure that all tax obligations are met.

Quick guide on how to complete mary kay tax worksheet 398227997

Accomplish Mary Kay Tax Worksheet effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the right format and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your papers swiftly and without obstacles. Manage Mary Kay Tax Worksheet on any gadget with the airSlate SignNow applications for Android or iOS and streamline any document-related task today.

The simplest method to modify and electronically sign Mary Kay Tax Worksheet without effort

- Acquire Mary Kay Tax Worksheet and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Don’t worry about lost or mislaid documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Mary Kay Tax Worksheet and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mary kay tax worksheet 398227997

Create this form in 5 minutes!

How to create an eSignature for the mary kay tax worksheet 398227997

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of mary kay tax for Mary Kay consultants?

Understanding mary kay tax is crucial for Mary Kay consultants as it helps them manage their income and expenses more effectively. This knowledge allows them to maximize their deductions and save money during tax season. Furthermore, being informed about mary kay tax obligations can prevent potential penalties and ensure compliance with IRS regulations.

-

How can airSlate SignNow help with mary kay tax documentation?

AirSlate SignNow streamlines the process of managing documents related to mary kay tax, enabling consultants to sign and send important files securely. By providing eSignature capabilities, it helps ensure that tax forms and related documents are completed accurately and efficiently. This not only saves time but also keeps consultants organized during tax season.

-

What features does airSlate SignNow offer for managing mary kay tax-related forms?

AirSlate SignNow offers various features to facilitate the handling of mary kay tax-related forms, including template management, document sharing, and electronic signing. These tools simplify the preparation of tax forms and make it easy to collaborate with accountants or financial advisors. By leveraging these features, consultants can enhance productivity while remaining compliant with their tax requirements.

-

Is there any pricing model for airSlate SignNow that benefits Mary Kay consultants dealing with mary kay tax?

Yes, airSlate SignNow offers flexible pricing plans catering to the needs of Mary Kay consultants managing mary kay tax. This cost-effective solution provides features that help streamline tax documentation without breaking the bank. Consultants can choose a plan that aligns with their business size and frequency of use, making it an economical option for handling tax-related tasks.

-

What are the benefits of using airSlate SignNow for mary kay tax filing?

Utilizing airSlate SignNow for mary kay tax filing presents several benefits, including reduced paperwork, faster signing processes, and secure document storage. These features enhance the filing experience by ensuring documents are easily accessible and safely stored. Additionally, the platform's efficiency can help consultants meet deadlines and reduce stress during tax season.

-

Can airSlate SignNow integrate with other financial tools to assist with mary kay tax?

Absolutely! AirSlate SignNow can integrate with various financial tools that assist with mary kay tax, such as accounting software and budget management systems. These integrations allow for seamless data transfer and better financial tracking, helping consultants stay organized. By using these tools in conjunction, consultants can simplify their approach to managing taxes.

-

How secure is airSlate SignNow when handling documents for mary kay tax?

AirSlate SignNow prioritizes security when handling documents for mary kay tax through advanced encryption and compliance with industry standards. This ensures that sensitive tax information remains confidential and protected from unauthorized access. By using airSlate SignNow, consultants can have peace of mind knowing that their documents are secure while they focus on their business.

Get more for Mary Kay Tax Worksheet

- Two party water system users agreement island county public health islandcountyeh form

- Status conference questionnaire form

- Caade code of ethics california association for alcoholdrug caade form

- Florida proof loss form

- New blank purchase contract from glvar 2016 form

- How to fill the form of bomb theart checklist

- 105 waiver application form

- Online fillable petition to contest notice of delinquency and drivers license suspension form

Find out other Mary Kay Tax Worksheet

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF