1099 Form PDF

What is the 1099 Form Pdf

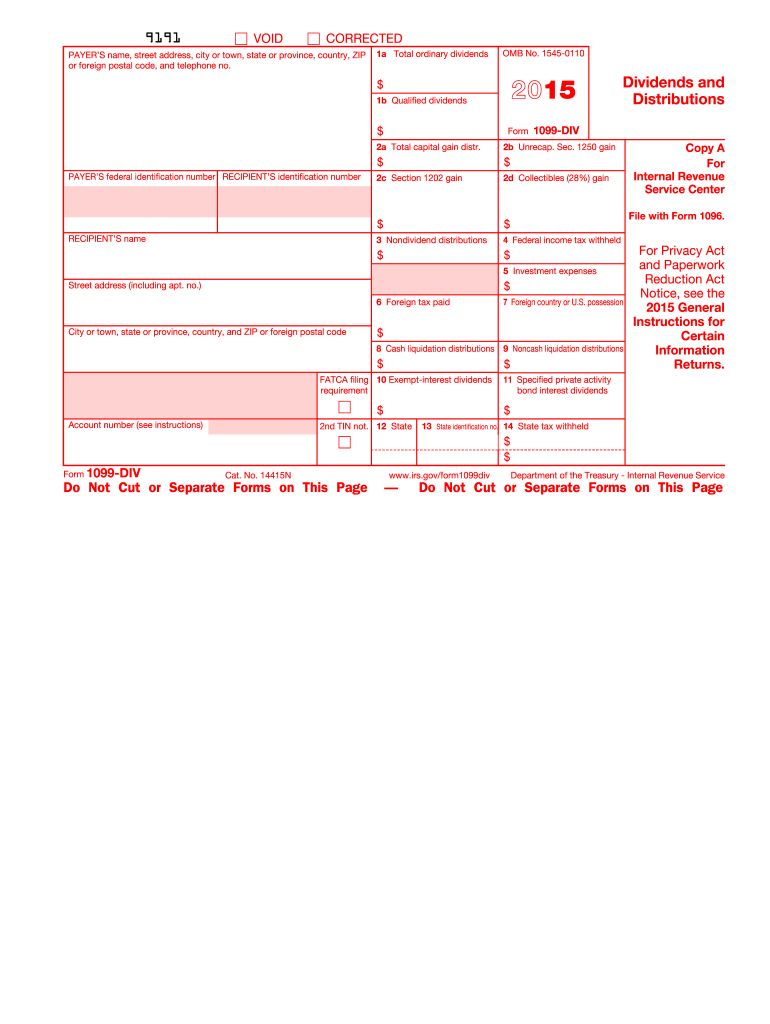

The 1099 form pdf is a tax document used in the United States to report various types of income received by individuals and businesses that are not classified as wages. This form is essential for freelancers, independent contractors, and other non-employee workers who earn income from sources other than traditional employment. The 1099 form pdf serves as a record for both the payer and the recipient and is crucial for accurate tax reporting. Various types of 1099 forms exist, each designated for specific income types, including interest, dividends, and non-employee compensation.

How to use the 1099 Form Pdf

Using the 1099 form pdf involves several steps to ensure accurate completion and submission. First, obtain the correct version of the form, which may vary based on the type of income being reported. Next, fill in the required fields, including the payer's and recipient's information, the amount paid, and any applicable tax identification numbers. It is important to ensure that all information is accurate to avoid issues with the IRS. After completing the form, it can be submitted electronically or via mail, depending on the preferences of the parties involved.

Steps to complete the 1099 Form Pdf

Completing the 1099 form pdf involves a systematic approach to ensure compliance with IRS regulations. Follow these steps:

- Obtain the correct 1099 form pdf from the IRS website or a trusted source.

- Fill in the payer's name, address, and taxpayer identification number (TIN).

- Enter the recipient's name, address, and TIN.

- Indicate the amount paid in the appropriate box, depending on the type of income.

- Include any additional information required, such as state tax withheld, if applicable.

- Review the completed form for accuracy before submission.

Legal use of the 1099 Form Pdf

The legal use of the 1099 form pdf is governed by IRS regulations, which stipulate that it must be used to report payments made to non-employees. This includes payments for services rendered, rent, prizes, and other types of income. It is important to issue the form by the deadline set by the IRS to avoid penalties. Additionally, both the payer and recipient must retain copies of the form for their records, as it serves as proof of income for tax purposes.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 form pdf are critical to ensure compliance with IRS regulations. Generally, the form must be issued to recipients by January thirty-first of the year following the tax year. Additionally, the form must be filed with the IRS by the end of February if submitted by paper, or by March thirty-first if filed electronically. It is essential to adhere to these deadlines to avoid potential penalties and interest charges.

Who Issues the Form

The 1099 form pdf is typically issued by businesses, organizations, or individuals who have paid non-employees for services or other income. This includes companies hiring freelancers, landlords collecting rent, and any entity making payments that fall under the reporting requirements of the IRS. It is the responsibility of the payer to ensure that the form is completed accurately and submitted on time to both the recipient and the IRS.

Quick guide on how to complete 1099 form pdf

Complete 1099 Form Pdf effortlessly on any device

Digital document management has become favored by companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents swiftly without interruptions. Manage 1099 Form Pdf on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest way to modify and eSign 1099 Form Pdf effortlessly

- Obtain 1099 Form Pdf and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with features that airSlate SignNow provides specifically for this purpose.

- Generate your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Leave behind concerns about lost or misplaced files, tedious document searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign 1099 Form Pdf and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1099 form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1099 form 2015 pdf used for?

The 1099 form 2015 pdf is used to report various types of income other than wages, salaries, and tips. Businesses use this form to report payments made to independent contractors and freelancers. This ensures that both the payer and the recipient are compliant with IRS regulations regarding income reporting.

-

How can I obtain a 1099 form 2015 pdf?

You can easily obtain a 1099 form 2015 pdf by downloading it from the IRS website or other reliable sources that provide tax documents. Additionally, using airSlate SignNow allows you to create, edit, and eSign the form digitally, streamlining the process for your business needs.

-

Is airSlate SignNow suitable for handling 1099 form 2015 pdf documents?

Yes, airSlate SignNow is an effective solution for handling 1099 form 2015 pdf documents. With our platform, businesses can securely send and eSign their tax forms, ensuring a seamless and compliant process. You can easily manage all your document workflows from one convenient platform.

-

What are the pricing options for using airSlate SignNow for 1099 form 2015 pdf management?

airSlate SignNow offers various pricing plans that cater to different business sizes and needs. Whether you're a small business or a large enterprise, you can find an affordable option that provides all the necessary features for managing 1099 form 2015 pdf documents. Our transparent pricing ensures you only pay for what you use.

-

Can I integrate airSlate SignNow with accounting software for 1099 form 2015 pdf?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software to help streamline your document management process. This integration allows you to efficiently generate and send 1099 form 2015 pdf directly from your accounting system, simplifying your workflow.

-

What features does airSlate SignNow offer for managing 1099 form 2015 pdf?

airSlate SignNow offers features like customizable templates, easy eSigning, and document tracking for managing 1099 form 2015 pdf. These tools enhance the efficiency of your document workflows, allowing you to process forms quickly and securely. Plus, you can automate reminders for recipients to sign, ensuring timely submissions.

-

How secure is the airSlate SignNow platform for handling sensitive forms like 1099 form 2015 pdf?

The airSlate SignNow platform prioritizes security and compliance, implementing industry-standard encryption and security measures. Your 1099 form 2015 pdf and other sensitive documents are protected throughout the signing and storage processes. Additionally, we adhere to all relevant regulations to safeguard your information.

Get more for 1099 Form Pdf

Find out other 1099 Form Pdf

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed