Horry County Hospitality Tax Form

What is the Horry County Hospitality Tax Form

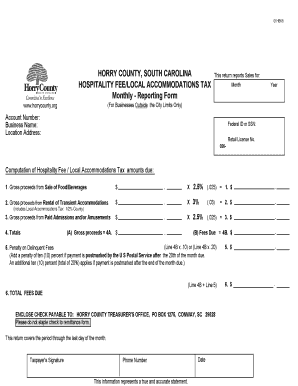

The Horry County Hospitality Tax Form is a document used by businesses in Horry County, South Carolina, to report and remit hospitality taxes. This tax is levied on accommodations and food services, contributing to local tourism initiatives and infrastructure. Understanding the purpose of this form is crucial for compliance and ensuring that businesses contribute their fair share to the community.

How to use the Horry County Hospitality Tax Form

Using the Horry County Hospitality Tax Form involves several steps to ensure accurate reporting. First, businesses must gather all relevant financial information regarding their hospitality services. This includes total sales, applicable tax rates, and any exemptions. Once the information is compiled, the form can be filled out electronically or manually. It is essential to double-check all entries for accuracy before submission to avoid penalties.

Steps to complete the Horry County Hospitality Tax Form

Completing the Horry County Hospitality Tax Form requires careful attention to detail. Follow these steps:

- Gather necessary financial documents, including sales records and receipts.

- Calculate total taxable sales and the corresponding hospitality tax owed.

- Fill out the form with accurate figures, ensuring all sections are completed.

- Review the form for any errors or omissions.

- Submit the form by the designated deadline to avoid penalties.

Legal use of the Horry County Hospitality Tax Form

The Horry County Hospitality Tax Form must be used in accordance with local and state tax laws. This includes adhering to deadlines for submission and ensuring that all reported figures are truthful and accurate. Failing to comply with these legal requirements can result in penalties, including fines and interest on unpaid taxes. Understanding the legal implications of this form is vital for any business operating in the hospitality sector.

Filing Deadlines / Important Dates

Filing deadlines for the Horry County Hospitality Tax Form are crucial for compliance. Typically, businesses must submit their forms quarterly, with specific due dates set by the local tax authority. It is important to mark these dates on your calendar to ensure timely submission and avoid potential penalties. Staying informed about any changes to these deadlines can help businesses maintain compliance.

Form Submission Methods (Online / Mail / In-Person)

The Horry County Hospitality Tax Form can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission via the official county website, which is often the fastest method.

- Mailing the completed form to the designated tax office address.

- In-person submission at the local tax office for those who prefer direct interaction.

Choosing the right submission method can enhance efficiency and ensure that the form is received on time.

Quick guide on how to complete horry county hospitality tax form 17027947

Effortlessly Create Horry County Hospitality Tax Form on Any Device

Online document handling has gained traction among businesses and individuals. It offers an ideal eco-conscious substitute to traditional printed and signed documents, as you can obtain the necessary form and securely preserve it online. airSlate SignNow provides you with all the tools required to generate, modify, and electronically sign your documents promptly without complications. Manage Horry County Hospitality Tax Form on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The Easiest Way to Alter and Electronically Sign Horry County Hospitality Tax Form Without Hassle

- Locate Horry County Hospitality Tax Form and click on Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Craft your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to deliver your form—via email, text message (SMS), an invite link, or download it to your computer.

Eliminate the stress of lost or mismanaged files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Horry County Hospitality Tax Form to ensure excellent communication at every stage of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the horry county hospitality tax form 17027947

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Horry County hospitality tax?

The Horry County hospitality tax is a charge imposed on accommodations and food services within the county. This tax is aimed at generating funds to support tourism and enhance local infrastructure. Understanding the Aorrry County hospitality tax is essential for business owners in the industry to ensure compliance and effective financial planning.

-

How does the Horry County hospitality tax impact my business?

The Horry County hospitality tax can signNowly affect your pricing structure and profit margins, as it is typically passed on to consumers. Businesses must account for this tax when setting rates for lodging and dining. This impact emphasizes the need for efficient document management solutions like airSlate SignNow to streamline contracts and agreements.

-

What features does airSlate SignNow offer for businesses dealing with the Horry County hospitality tax?

airSlate SignNow provides seamless eSigning and document management capabilities, which can help businesses effectively manage invoices and tax documentation related to the Horry County hospitality tax. With features like templates and automated workflows, businesses can ensure compliance while maintaining efficiency. This makes it easier to handle tax reporting and financial records.

-

Is airSlate SignNow compatible with other tax management tools for Horry County hospitality tax?

Yes, airSlate SignNow integrates smoothly with various accounting and tax management software that can assist in handling the Horry County hospitality tax. This integration helps streamline workflows, making it easier to manage tax documentation and financial reports without disruption. By utilizing such integrations, businesses can ensure they meet local tax obligations.

-

How can airSlate SignNow help simplify compliance with the Horry County hospitality tax?

By using airSlate SignNow, businesses can automate the document signing process, ensuring that all necessary agreements related to the Horry County hospitality tax are legally compliant. Automated reminders and tracking features enhance oversight, allowing companies to stay on top of documentation and deadlines. This contributes to overall compliance and reduces potential penalties.

-

What are the cost benefits of using airSlate SignNow for handling Horry County hospitality tax documents?

airSlate SignNow offers a cost-effective solution for managing documents related to the Horry County hospitality tax, reducing the need for physical paperwork. By digitizing document signing and management, businesses can save on printing and storage costs. This streamlined approach ultimately contributes to enhanced operational efficiency and savings.

-

Can airSlate SignNow assist in tracking Horry County hospitality tax payment deadlines?

Indeed, airSlate SignNow can help businesses manage and track critical deadlines related to Horry County hospitality tax payments. By using automated reminders and calendar integrations, you can ensure that tax filings are submitted on time, minimizing the risk of late fees. Staying organized with airSlate SignNow allows businesses to focus on growth rather than paperwork.

Get more for Horry County Hospitality Tax Form

- Atv bill of sale to print form

- Form saps

- Ala fl alameda superior court state of california alameda courts ca form

- Usaid 303mav form

- C 257 form

- Merchant mariner oath pdf form

- Payg payment summary statement australian taxation office ato gov form

- Tr 12 affidavit to a fact rev 12 21 this publication will address whether sales or compensating use tax is due on a particular form

Find out other Horry County Hospitality Tax Form

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form