W4p Form

What is the W4p Form

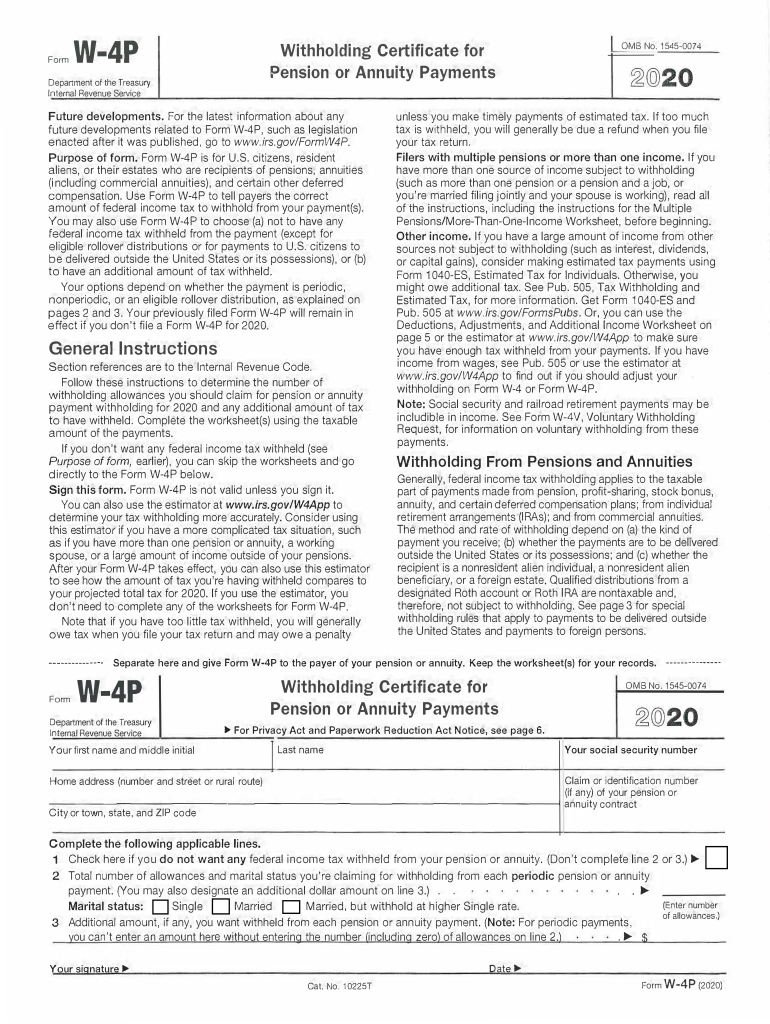

The W4p form, officially known as the IRS Form W-4P, is a federal tax form used by individuals to request federal income tax withholding on certain types of payments. This form is particularly relevant for those receiving pensions, annuities, or other retirement benefits. By completing the W4p form, taxpayers can indicate their withholding preferences, which helps ensure that the correct amount of tax is withheld from their payments throughout the year.

How to use the W4p Form

Using the W4p form involves a few straightforward steps. First, obtain the form from the IRS website or a tax professional. Next, fill out the required personal information, including your name, address, and Social Security number. Indicate the type of payments you are receiving and specify your withholding allowances. Finally, sign and date the form before submitting it to the payer of your pension or annuity. It is essential to keep a copy for your records.

Steps to complete the W4p Form

Completing the W4p form requires careful attention to detail. Follow these steps:

- Download the form from the IRS website.

- Fill in your personal information, including your full name and address.

- Provide your Social Security number to ensure accurate processing.

- Specify the type of payments you are receiving, such as pensions or annuities.

- Determine your withholding allowances based on your tax situation.

- Sign and date the form to validate your request.

- Submit the completed form to the appropriate payer.

Legal use of the W4p Form

The W4p form is legally recognized by the IRS as a valid method for taxpayers to communicate their withholding preferences. When filled out correctly and submitted to the appropriate payer, it ensures compliance with federal tax regulations. It is important to note that providing false information on the form can lead to penalties, including fines and increased tax liabilities. Therefore, accuracy is paramount when completing the W4p form.

IRS Guidelines

The IRS provides specific guidelines for completing the W4p form. Taxpayers should refer to the IRS instructions accompanying the form for detailed information on how to calculate withholding allowances. Additionally, the IRS recommends reviewing the form annually or whenever there is a significant change in income or tax situation. Staying informed about IRS updates can help ensure that taxpayers remain compliant with current tax laws.

Filing Deadlines / Important Dates

While the W4p form does not have a specific filing deadline, it is crucial to submit it to the payer before the first payment is issued. This ensures that the correct amount of federal income tax is withheld from the outset. For retirees or those transitioning to pension payments, submitting the form promptly can help avoid under-withholding and potential tax liabilities during the tax season.

Quick guide on how to complete w4p form

Effortlessly prepare W4p Form on any device

Managing documents online has gained popularity among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed paperwork, allowing you to retrieve the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without any delays. Handle W4p Form on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign W4p Form with ease

- Find W4p Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight signNow sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes merely seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Revise and eSign W4p Form and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w4p form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W-4 form and why is it important?

The W-4 form is a tax form used by employees to indicate their tax situation to their employer. This form dictates how much federal income tax should be withheld from your paycheck. Properly filling out your W-4 form ensures that you pay the right amount of taxes during the year, helping you avoid overpaying or underpaying.

-

How can airSlate SignNow help me complete my W-4 form?

airSlate SignNow provides an easy-to-use platform that allows you to fill out and electronically sign your W-4 form. Our solution enables you to complete your tax forms in a secure environment, ensuring that your information is protected. Plus, with our user-friendly interface, filling out the W-4 form becomes a straightforward task.

-

Is there a cost associated with using airSlate SignNow for my W-4 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Depending on your requirements, you can choose from monthly or annual subscriptions that provide access to features for handling your W-4 form. The cost is designed to be cost-effective while delivering value through comprehensive eSigning capabilities.

-

What features does airSlate SignNow offer for managing W-4 forms?

airSlate SignNow offers several features specifically for managing W-4 forms, including customizable templates, automated workflows, and secure storage. These features streamline the completion process, ensuring that you can handle multiple W-4 forms efficiently. Additionally, you can track the status of your W-4 submissions for better management.

-

Can I integrate airSlate SignNow with other applications for my W-4 forms?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and CRM systems. These integrations enable you to easily access and manage your W-4 forms alongside other essential documents and workflows, enhancing your overall productivity and organization.

-

What are the benefits of eSigning my W-4 form with airSlate SignNow?

eSigning your W-4 form with airSlate SignNow offers numerous benefits such as faster processing and enhanced security. You can quickly send, sign, and return your W-4 form without the need for physical paperwork, reducing delays in payroll processing. Moreover, electronic signatures are legally binding, making them a reliable alternative.

-

How secure is my information when using airSlate SignNow for W-4 forms?

Your information is highly secure with airSlate SignNow. We employ industry-standard encryption and security protocols to ensure that your W-4 forms and personal details remain protected at all times. Compliance with data protection regulations further guarantees that your sensitive information is handled with the utmost care.

Get more for W4p Form

Find out other W4p Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT