Did State of Indiana Send You a Letter for Taxes 2008-2026

Understanding the Indiana Property Tax Appeal Process

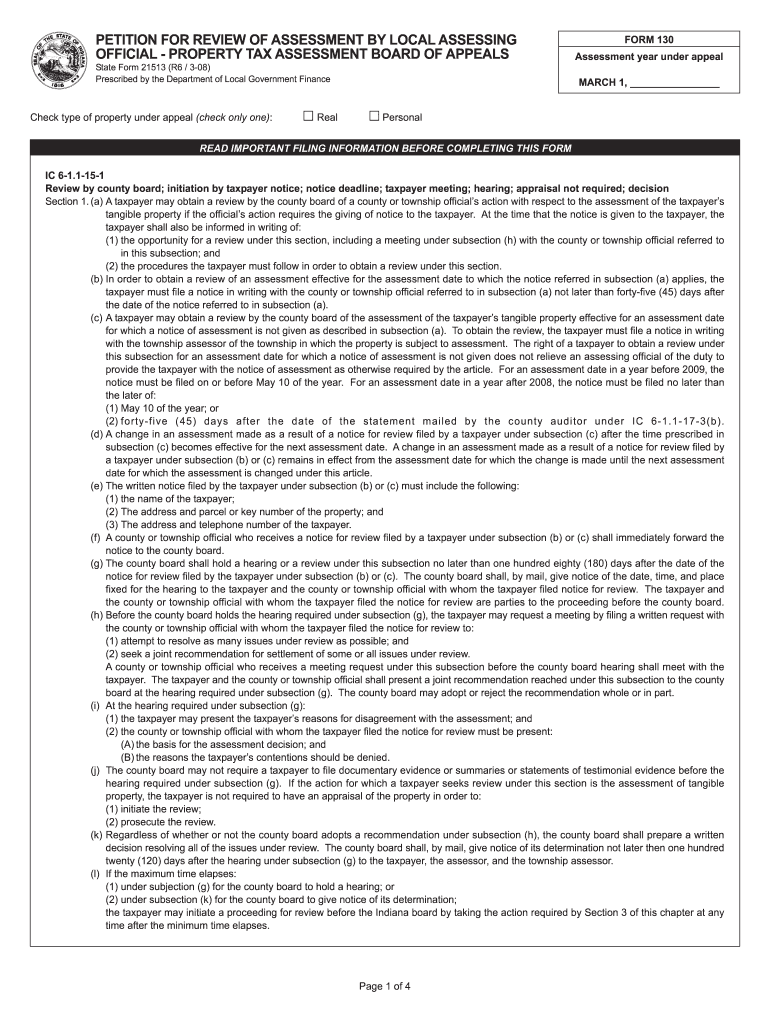

The Indiana property tax appeal process allows taxpayers to contest their property assessments, which can affect their tax obligations. If you believe your property has been overvalued, you can submit the Indiana property tax appeal form 130. This form is essential for initiating your appeal and must be completed accurately to ensure your case is considered by the local assessment board.

Key Elements of Form 130

Form 130 requires specific information to be valid. Key elements include:

- Property Identification: You must provide details about the property in question, including its address and parcel number.

- Assessment Information: Include the current assessed value as stated in your property tax notice.

- Reason for Appeal: Clearly state the grounds for your appeal, such as incorrect valuation or assessment errors.

- Signature: Your signature is required to validate the form and confirm that the information provided is accurate.

Steps to Complete Form 130

Completing the Indiana property tax appeal form 130 involves several steps:

- Gather necessary documents, including your property tax statement and any evidence supporting your claim.

- Fill out the form with accurate information, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Sign the form to authenticate it.

- Submit the completed form to your local county assessor’s office by the specified deadline.

Submission Methods for Form 130

You can submit the Indiana property tax appeal form 130 through various methods:

- Online Submission: Some counties may allow electronic submission via their official websites.

- Mail: You can send the completed form via postal service to your county assessor's office.

- In-Person: Visit your local assessor’s office to submit the form directly.

Legal Use of Form 130

The Indiana property tax appeal form 130 is legally recognized for contesting property assessments. To ensure its validity, it must comply with local regulations and be submitted within the required time frame. Failure to adhere to these legal guidelines may result in your appeal being dismissed.

Filing Deadlines for Form 130

It is crucial to be aware of the filing deadlines associated with the Indiana property tax appeal form 130. Typically, the form must be submitted within a specific period following the receipt of your property tax notice. Check with your local county assessor for exact dates to avoid missing the deadline.

Quick guide on how to complete state of indiana form 130 short

Complete Did State Of Indiana Send You A Letter For Taxes effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Did State Of Indiana Send You A Letter For Taxes on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Did State Of Indiana Send You A Letter For Taxes easily

- Obtain Did State Of Indiana Send You A Letter For Taxes and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional ink signature.

- Verify all the details and click the Done button to save your modifications.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Did State Of Indiana Send You A Letter For Taxes and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the state of indiana form 130 short

How to create an eSignature for your State Of Indiana Form 130 Short in the online mode

How to make an electronic signature for the State Of Indiana Form 130 Short in Chrome

How to generate an electronic signature for putting it on the State Of Indiana Form 130 Short in Gmail

How to make an eSignature for the State Of Indiana Form 130 Short straight from your mobile device

How to make an electronic signature for the State Of Indiana Form 130 Short on iOS devices

How to create an eSignature for the State Of Indiana Form 130 Short on Android devices

People also ask

-

What should I do if the State of Indiana sent me a letter for taxes?

If you received a letter from the State of Indiana for taxes, it’s important to read it carefully to understand the issue. airSlate SignNow can help you quickly sign and send any necessary documents or forms in response. Make sure to address any deadlines mentioned in the letter to avoid penalties.

-

How can airSlate SignNow assist with tax-related documents for Indiana?

airSlate SignNow simplifies the process of managing tax-related documents by allowing you to eSign and send forms securely. If you’re dealing with a situation like 'Did State Of Indiana Send You A Letter For Taxes,' our platform ensures you can respond quickly and efficiently, streamlining your tax processes.

-

Is airSlate SignNow cost-effective for small businesses handling tax documents?

Yes, airSlate SignNow offers a cost-effective solution suitable for small businesses managing tax documents. By using our eSignature service, you can reduce printing and mailing costs while ensuring compliance when responding to inquiries like 'Did State Of Indiana Send You A Letter For Taxes.'

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features, including customizable templates, secure eSignature options, and document tracking. These features can be particularly beneficial if you’re addressing queries such as 'Did State Of Indiana Send You A Letter For Taxes,' allowing for efficient document handling and submission.

-

Can I integrate airSlate SignNow with my existing tax software?

Absolutely! airSlate SignNow integrates seamlessly with various tax software solutions, enhancing your workflow efficiency. This is especially useful for those who have received inquiries like 'Did State Of Indiana Send You A Letter For Taxes,' as you can handle everything within your existing systems.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption and complies with industry standards, ensuring that your sensitive tax documents are protected. This is crucial when responding to letters like 'Did State Of Indiana Send You A Letter For Taxes,' where confidentiality is key.

-

What type of support does airSlate SignNow provide for tax-related questions?

airSlate SignNow offers comprehensive customer support to assist you with any tax-related questions. Whether you’re unsure about responding to 'Did State Of Indiana Send You A Letter For Taxes' or need help with our features, our support team is readily available to guide you.

Get more for Did State Of Indiana Send You A Letter For Taxes

- Application date my form

- Ngb form 34 1 2013 2019

- New enterprise incentive scheme neis loan application form

- Affidavit of political status act of state templates form

- Adult sts discharge form ucla department of surgery surgery medsch ucla

- How to check treasury challa in bihar form

- Airport entry pass online form

- Request for certificate of free sale kansas form

Find out other Did State Of Indiana Send You A Letter For Taxes

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word