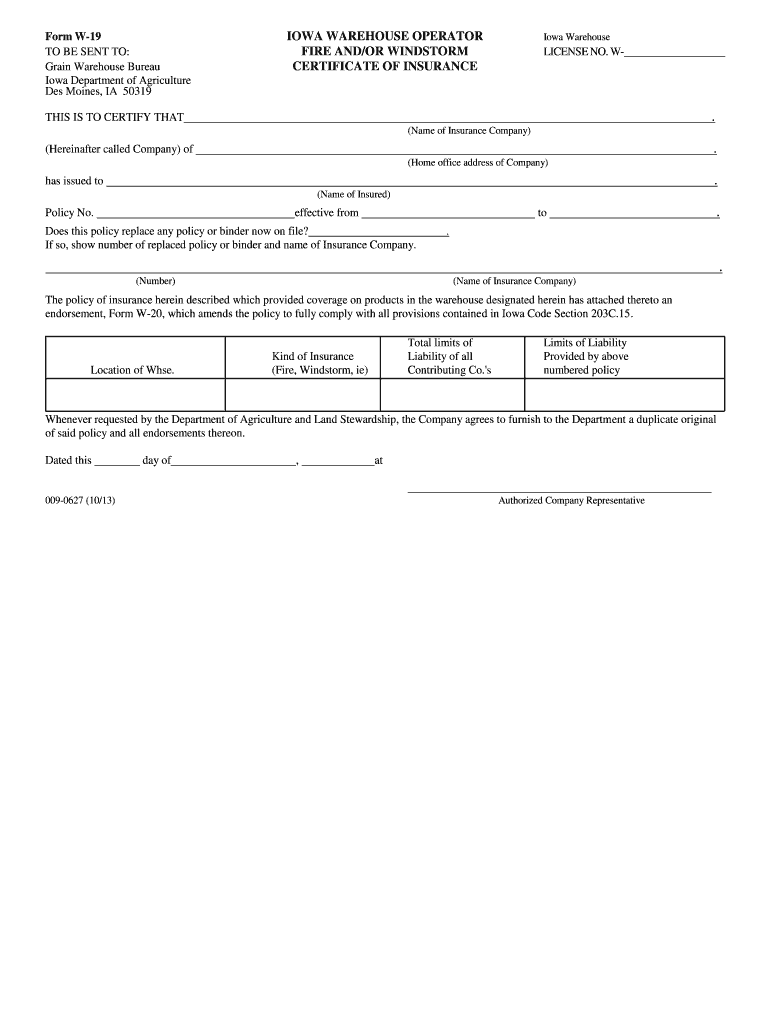

W 19 Form

What is the W-19 Form

The W-19 form is a tax document used by individuals and businesses in the United States to certify their foreign status. This form is particularly important for non-resident aliens who receive income from U.S. sources. By completing the W-19 form, taxpayers can claim a reduced withholding tax rate or exemption from withholding on certain types of income. Understanding the purpose and function of the W-19 form is crucial for compliance with U.S. tax regulations.

How to Use the W-19 Form

Using the W-19 form involves several key steps. First, individuals must accurately fill out the form with their personal information, including name, address, and taxpayer identification number. Next, they need to indicate their foreign status and the type of income they are receiving. Once completed, the form should be submitted to the withholding agent or financial institution that requires it. Proper use of the W-19 form helps ensure that the correct amount of tax is withheld from income earned in the U.S.

Steps to Complete the W-19 Form

Completing the W-19 form requires attention to detail. Follow these steps for accurate submission:

- Provide your full name and address in the designated fields.

- Enter your taxpayer identification number, if applicable.

- Indicate your foreign status by checking the appropriate box.

- Specify the type of income you will receive, such as dividends or interest.

- Sign and date the form to certify that the information is correct.

After completing these steps, ensure that you submit the form to the appropriate party to avoid any issues with withholding taxes.

Legal Use of the W-19 Form

The W-19 form is legally binding when filled out correctly and submitted to the relevant parties. It serves as a declaration of foreign status, allowing individuals to benefit from reduced withholding rates under tax treaties. Compliance with IRS regulations is essential, as inaccuracies or omissions may lead to penalties or increased tax liabilities. Understanding the legal implications of the W-19 form ensures that taxpayers protect their rights while fulfilling their obligations.

Filing Deadlines / Important Dates

Filing deadlines for the W-19 form can vary depending on the type of income and the withholding agent's requirements. It is essential to submit the form before the income payment is made to ensure that the correct withholding rate is applied. Generally, forms should be submitted as soon as the income is anticipated, especially if the income is subject to withholding. Keeping track of these deadlines helps prevent unnecessary tax complications.

Required Documents

When submitting the W-19 form, certain documents may be required to support your claim of foreign status. These may include:

- A valid passport or government-issued identification.

- Proof of residency in your home country.

- Any applicable tax treaties that may affect withholding rates.

Having these documents ready can facilitate a smoother process when completing and submitting the W-19 form.

Quick guide on how to complete w 19 form

Complete W 19 Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage W 19 Form on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to change and electronically sign W 19 Form with ease

- Locate W 19 Form and click Get Form to begin.

- Utilize the resources we offer to complete your form.

- Emphasize key portions of the documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes moments and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and electronically sign W 19 Form and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w 19 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W19 form and why is it important?

A W19 form is a tax document utilized by U.S. businesses to signNow that certain payments made to foreign entities are subject to withholding tax. It's important as it helps businesses comply with IRS regulations and avoid potential tax liabilities. Properly completing the W19 form ensures that your entity can benefit from reduced withholding rates under applicable tax treaties.

-

How can airSlate SignNow assist with W19 forms?

AirSlate SignNow simplifies the process of preparing and sending W19 forms by offering user-friendly templates and eSignature capabilities. Users can easily fill out the W19 form, send it to recipients for signature, and track its status in real-time. This streamlines the workflow and enhances document management efficiency for businesses.

-

Are there any costs associated with using airSlate SignNow to manage W19 forms?

Yes, there are various pricing plans available for airSlate SignNow based on the features you need. These plans offer flexibility to businesses of all sizes, ensuring that managing your W19 forms and other documents is both cost-effective and efficient. It’s recommended to check the pricing page for detailed information on options that suit your business needs.

-

What features does airSlate SignNow offer for W19 forms?

AirSlate SignNow offers a range of features for managing W19 forms, including customizable templates, secure eSignatures, and document sharing capabilities. Additionally, the platform provides integration with various applications, enhancing productivity. These features ensure that your W19 forms are handled seamlessly and securely.

-

Can I integrate airSlate SignNow with other applications for managing W19 forms?

Yes, airSlate SignNow offers integration with numerous applications such as CRM systems and cloud storage services. By integrating these applications, you can streamline the process of managing W19 forms within your existing workflow. This ability to connect with other tools enhances overall productivity and efficiency in your document signing process.

-

Is airSlate SignNow secure for handling W19 forms?

Absolutely! AirSlate SignNow prioritizes security by employing encryption and compliance measures to protect sensitive data, including W19 forms. The platform conforms to industry standards to ensure that your documents are safe during transmission and storage. This security framework gives businesses the confidence they need when dealing with important tax documents.

-

How long does it take to complete and send a W19 form using airSlate SignNow?

Completing and sending a W19 form using airSlate SignNow can take just minutes due to its intuitive interface and customizable templates. You can easily fill in the necessary fields and send the form for eSignature without extensive preparation time. This efficiency allows businesses to expedite their document workflows related to tax compliance.

Get more for W 19 Form

- Size chart form

- Vr 018 6 04 mva marylandgov form

- Provider dispute resolution request healthcare partners form

- Ga rush spirit order form back

- Super bill treasure coast ultrasound form

- 2017 easp form

- Personal bank account statement form

- Sea waybill for combined transport or port to port wec lines form

Find out other W 19 Form

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online