Kcb Student Loans Form

What is the KCB Student Loan?

The KCB student loan is a financial product offered by KCB Bank designed to assist students in funding their education. This loan can cover tuition fees, textbooks, and other educational expenses. It is tailored to meet the financial needs of students, enabling them to pursue their academic goals without the burden of immediate repayment. The loan is available to both undergraduate and postgraduate students enrolled in accredited institutions.

How to Obtain the KCB Student Loan

To obtain the KCB student loan, applicants must follow a straightforward process. First, students need to gather necessary documentation, including proof of enrollment in an accredited institution and identification. Next, they can complete the KCB loan application online, providing all required details about their financial situation and educational background. After submission, the bank will review the application, and if approved, funds will be disbursed directly to the educational institution.

Steps to Complete the KCB Student Loan Application

Completing the KCB student loan application involves several key steps:

- Gather necessary documents, such as identification and proof of enrollment.

- Visit the KCB Bank website to access the loan application form.

- Fill out the application form with accurate personal and financial information.

- Submit the application electronically for processing.

- Await feedback from KCB Bank regarding the status of the application.

Legal Use of the KCB Student Loan

The KCB student loan is legally binding once the application is approved and the loan agreement is signed. It is essential for borrowers to understand the terms and conditions outlined in the agreement, including repayment schedules and interest rates. Compliance with these terms is crucial to avoid penalties and ensure a smooth repayment process. The loan must be used solely for educational purposes as stipulated in the agreement.

Eligibility Criteria for the KCB Student Loan

Eligibility for the KCB student loan typically includes the following criteria:

- The applicant must be a registered student at an accredited educational institution.

- Applicants should demonstrate a need for financial assistance.

- Good credit history may be required, or a co-signer may be necessary for those without established credit.

- Age restrictions may apply, often requiring applicants to be at least eighteen years old.

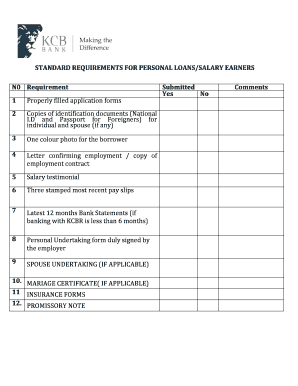

Required Documents for the KCB Student Loan

When applying for the KCB student loan, applicants must provide several key documents:

- Proof of identity, such as a government-issued ID or passport.

- Proof of enrollment in an accredited institution, such as an acceptance letter or student ID.

- Financial statements that demonstrate the applicant's financial situation.

- Any additional documents requested by KCB Bank during the application process.

Quick guide on how to complete kcb student loans

Complete Kcb Student Loans effortlessly on any platform

Digital document management has gained popularity among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Kcb Student Loans on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to alter and eSign Kcb Student Loans with ease

- Obtain Kcb Student Loans and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Kcb Student Loans to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kcb student loans

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the eligibility requirements for a KCB Bank student loan?

To qualify for a KCB Bank student loan, applicants typically need to be enrolled in an accredited institution and provide proof of their course registration. Additionally, applicants may need to meet credit and income criteria established by KCB Bank. It’s advisable to contact the bank directly for the most accurate and detailed requirements.

-

What features does the KCB Bank student loan offer?

The KCB Bank student loan comes with various features, including flexible repayment options and competitive interest rates. Borrowers may enjoy grace periods and possibly deferment options while they are still in school. These features help students manage their finances more effectively during their studies.

-

How can I apply for a KCB Bank student loan?

Applying for a KCB Bank student loan can be done online through their official banking portal. You'll need to gather required documentation such as your ID, proof of enrollment, and any additional financial information. It's a straightforward process, and customer service representatives are available to assist you if needed.

-

What are the interest rates for KCB Bank student loans?

The interest rates for KCB Bank student loans can vary depending on several factors, including the type of loan and the borrower's credit history. Typically, rates are competitive and designed to support students in achieving their educational goals. Always check with KCB Bank for the most current rates.

-

What are the repayment options for KCB Bank student loans?

KCB Bank provides several repayment options for their student loans, allowing students to choose plans based on their financial situations. Options may include immediate repayments, interest-only payments during school, or deferred payments until graduation. It's essential to discuss these options with a KCB Bank representative.

-

Are there any benefits to choosing a KCB Bank student loan?

One of the signNow benefits of a KCB Bank student loan is the personalized service provided by their representatives, who can guide you through the loan process. Additionally, competitive interest rates and flexible repayment plans make this a viable option for students. These factors combined can ease financial stress during your studies.

-

Can KCB Bank student loans be used for online courses?

Yes, KCB Bank student loans can generally be used for a variety of educational programs, including online courses from accredited institutions. As long as the program meets KCB Bank's eligibility criteria, students pursuing online education can benefit from this financing option. Always verify specifics with KCB Bank before proceeding.

Get more for Kcb Student Loans

- Complete release of liability and taos ski valley skitaos form

- Cbs1 6 15 mandatory 1 16 form

- Iowa forcible entry detainer form

- Envision math grade 4 answer key envision math grade 4 answer key form

- Respiratory query form

- Consumer information statement cis for consumers seeking to purchase dpr delaware

- License plate applicationpub hawaiian humane society hawaiianhumane form

- Southport sharks employment application form

Find out other Kcb Student Loans

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile