St 587 2019

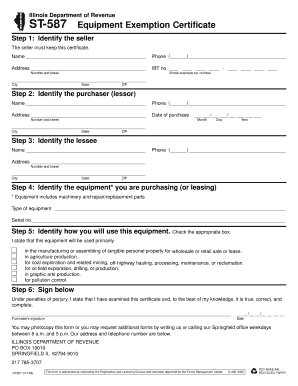

What is the St 587?

The St 587 form, also known as the Illinois Tax Exempt Certificate, is a document used by businesses and organizations in Illinois to claim exemption from sales tax. This form is primarily utilized by entities that are not required to pay sales tax on certain purchases, such as non-profit organizations, government agencies, and educational institutions. By completing the St 587, these organizations can ensure compliance with Illinois tax regulations while minimizing their tax liabilities.

How to use the St 587

To effectively use the St 587 form, eligible organizations must fill it out accurately and provide it to their suppliers when making tax-exempt purchases. The form serves as proof of the organization’s tax-exempt status, allowing vendors to exempt the sales tax from the total purchase price. It is important to ensure that all information on the form is complete and correct to avoid any issues with tax compliance. The St 587 must be presented at the time of purchase, as it cannot be submitted retroactively.

Steps to complete the St 587

Completing the St 587 form involves several key steps:

- Download the St 587 form from a reliable source or obtain a physical copy.

- Fill in the organization’s name, address, and tax identification number.

- Specify the type of organization and the reason for the tax exemption.

- Provide the signature of an authorized representative of the organization.

- Review the completed form for accuracy before submitting it to the vendor.

Legal use of the St 587

The legal use of the St 587 form is governed by Illinois tax laws. Organizations must ensure that they meet the eligibility criteria for tax exemption to use this form legitimately. Misuse of the St 587, such as submitting it when not eligible for tax exemption, can lead to penalties and fines. It is crucial for organizations to maintain proper documentation and records related to their tax-exempt purchases to substantiate their claims if questioned by tax authorities.

Key elements of the St 587

Several key elements must be included in the St 587 form to ensure its validity:

- Organization Information: Name, address, and tax identification number.

- Type of Organization: Indicate whether the organization is a non-profit, government entity, or educational institution.

- Reason for Exemption: Clearly state the reason for claiming tax exemption.

- Authorized Signature: The form must be signed by an authorized representative.

Form Submission Methods

The St 587 form can be submitted in various ways, depending on the vendor's requirements. Typically, the form is presented directly to the vendor at the time of purchase. Some vendors may allow for electronic submission, while others may require a physical copy. It is advisable for organizations to confirm with their suppliers regarding the preferred submission method to ensure compliance and acceptance of the tax exemption.

Quick guide on how to complete st 587

Accomplish St 587 effortlessly on any device

Web-based document management has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed materials, allowing you to access the necessary template and securely retain it online. airSlate SignNow equips you with all the resources required to generate, modify, and electronically sign your documents promptly without hurdles. Manage St 587 on any device with airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to modify and electronically sign St 587 with ease

- Find St 587 and click Get Form to begin.

- Employ the tools we provide to fill out your form.

- Mark signNow portions of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, and mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign St 587 and ensure smooth communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct st 587

Create this form in 5 minutes!

How to create an eSignature for the st 587

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ST 587 form Illinois?

The ST 587 form Illinois is a document used to signNow that a business entity has not maintained a physical presence in Illinois and is therefore exempt from some taxes. This form is crucial for businesses seeking tax benefits while operating in the state. Understanding the ST 587 form Illinois helps ensure compliance and avoid unnecessary penalties.

-

How can I fill out the ST 587 form Illinois using airSlate SignNow?

With airSlate SignNow, you can easily fill out the ST 587 form Illinois online. The platform provides user-friendly templates and robust editing tools to ensure all required information is accurately entered. Once completed, you can eSign and send the form quickly and securely.

-

What are the benefits of using airSlate SignNow for the ST 587 form Illinois?

Using airSlate SignNow for the ST 587 form Illinois allows businesses to streamline their document management processes. The platform provides a cost-effective solution to create, send, and eSign documents, which enhances efficiency and saves time. This can boost overall productivity and help maintain compliance with state regulations.

-

Is there a cost associated with using airSlate SignNow for the ST 587 form Illinois?

Yes, there is a pricing structure for using airSlate SignNow, which offers various plans to cater to different business needs. The pricing is competitive, and the value provided in terms of features and efficiency makes it a worthwhile investment when handling the ST 587 form Illinois. You can choose a plan that aligns best with your business requirements.

-

Can airSlate SignNow integrate with other software for the ST 587 form Illinois?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, making it easy to manage the ST 587 form Illinois along with your other business documents. This integration allows for better workflow automation and enhances collaboration across departments, improving overall operational efficiency.

-

What features does airSlate SignNow offer for managing the ST 587 form Illinois?

airSlate SignNow offers robust features for managing the ST 587 form Illinois, including customizable templates, eSignature capabilities, and document tracking. These features simplify the entire process from preparation to signing, ensuring that your form is handled efficiently and securely.

-

How does eSigning the ST 587 form Illinois work in airSlate SignNow?

eSigning the ST 587 form Illinois in airSlate SignNow is straightforward. Once the form is prepared, you can send it to the relevant parties for their electronic signatures. The platform complies with legal standards for eSignatures, providing a secure and efficient way to finalize the document.

Get more for St 587

- Jud ct 100515769 form

- Apex innovations nih stroke scale answers test a hnewaus form

- Prerequisite waiver request form eastfield college efc dcccd

- Commercial information sheet

- Rental move in and move out checklist form

- T burnaby burnaby form

- Nevadaamp39s electronic filing declaration form

- Blank restraining order form 2017 2019

Find out other St 587

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online