Form 8283 PDF

What is the Form 8283 Pdf

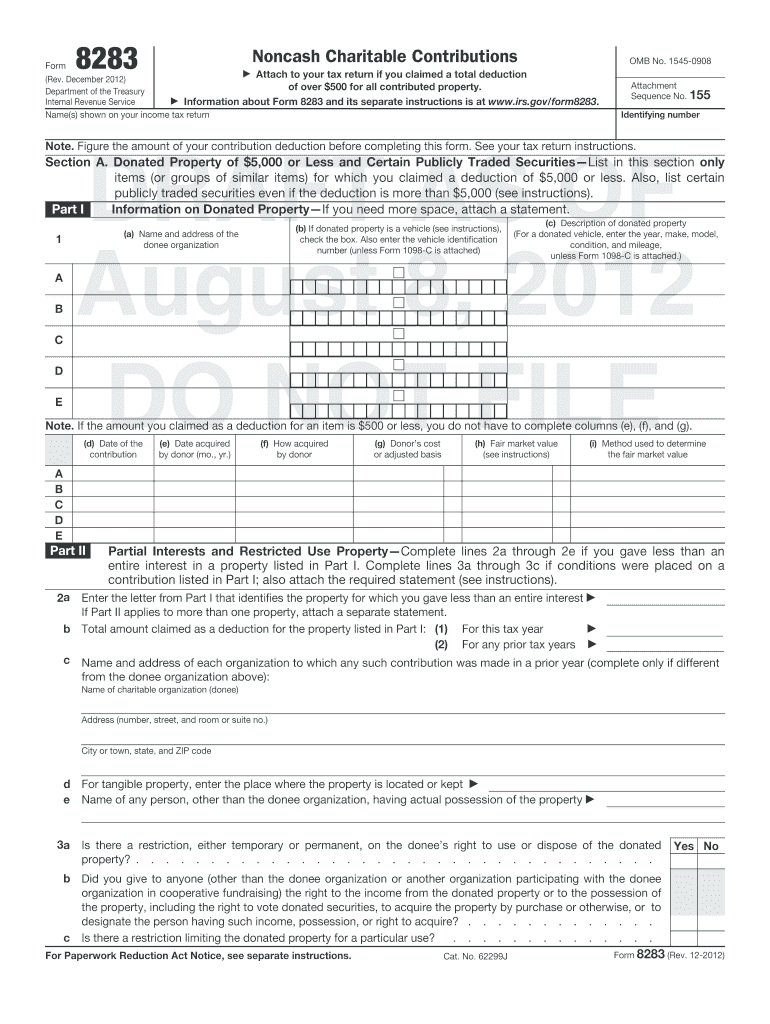

The Form 8283 is a document used by taxpayers in the United States to report noncash charitable contributions. This IRS form is essential for individuals who donate property, such as stocks, real estate, or other assets, valued at more than five hundred dollars. The form provides detailed information about the donated items, including descriptions, fair market values, and the method used to determine those values. Proper completion of Form 8283 is crucial for ensuring compliance with IRS regulations and for claiming deductions on tax returns.

How to use the Form 8283 Pdf

To use the Form 8283 effectively, taxpayers should first gather all necessary documentation related to their noncash contributions. This includes appraisals, receipts, and any relevant correspondence with the charitable organization. Once the information is collected, users can fill out the form by providing details about the donated items, the charity, and the date of the contribution. It is important to ensure that all information is accurate and complete to avoid issues with the IRS. After filling out the form, it must be signed and submitted along with your tax return.

Steps to complete the Form 8283 Pdf

Completing the Form 8283 involves several key steps:

- Gather documentation for the donated items, including appraisals and receipts.

- Fill out the identification section, including your name, Social Security number, and the charity's information.

- Provide detailed descriptions of the donated property, including the condition and fair market value.

- Indicate how the value was determined, whether through appraisal or other methods.

- Sign and date the form, ensuring that all information is accurate before submission.

Legal use of the Form 8283 Pdf

The legal use of Form 8283 is governed by IRS guidelines, which require accurate reporting of noncash donations to ensure compliance with tax laws. To be considered valid, the form must be filled out completely and submitted with the appropriate tax return. Additionally, if the total deduction for any item or group of similar items is more than five thousand dollars, a qualified appraisal must be included with the form. Failure to comply with these requirements can result in penalties or disallowance of the deduction by the IRS.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with Form 8283. The form should be submitted along with your annual tax return, which is typically due on April fifteenth. If you file for an extension, the deadline for submitting Form 8283 will also extend to the new due date of your tax return. It is advisable to keep track of any changes in IRS regulations regarding deadlines to ensure timely compliance and avoid penalties.

Required Documents

When completing Form 8283, several documents are necessary to support your claims. These include:

- Receipts from the charitable organization confirming the donation.

- Appraisals for items valued over five thousand dollars.

- Documentation detailing how the fair market value was determined.

- Any correspondence with the charity regarding the donation.

Quick guide on how to complete form 8283 pdf

Easily prepare Form 8283 Pdf on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed files, allowing you to obtain the correct version and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Access Form 8283 Pdf on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign Form 8283 Pdf effortlessly

- Locate Form 8283 Pdf and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional hand-signed signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred delivery method for your form: email, text message (SMS), an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all of your document management requirements in just a few clicks from any device you select. Edit and electronically sign Form 8283 Pdf and guarantee outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8283 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 8283 fillable and how can I use it?

A form 8283 fillable is an electronic version of the IRS Form 8283 that allows users to report noncash charitable contributions. By using airSlate SignNow, you can easily fill out, sign, and send the form securely, ensuring all required information is included and accurately formatted.

-

Is there a cost associated with using the form 8283 fillable on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including access to the form 8283 fillable feature. You can choose a plan that best suits your usage, whether for individual purposes or for a larger team, ensuring cost-effectiveness.

-

What features does the airSlate SignNow form 8283 fillable offer?

The airSlate SignNow form 8283 fillable allows users to easily input data, digitally sign the document, and manage submissions. Additionally, it offers templates, cloud storage, and tracking capabilities to simplify the process of submitting the form.

-

What are the benefits of using an airSlate SignNow form 8283 fillable?

Using an airSlate SignNow form 8283 fillable provides a streamlined approach to handling noncash donation reporting. It enhances efficiency, ensures compliance, and reduces errors compared to paper-based forms, making it an ideal solution for busy professionals.

-

Can I integrate the form 8283 fillable with other applications?

Yes, airSlate SignNow offers integrations with various platforms and applications, enhancing the usability of the form 8283 fillable. Whether you use CRM software or cloud services, you can seamlessly connect your workflows to improve efficiency.

-

How secure is the data when using the form 8283 fillable on airSlate SignNow?

airSlate SignNow prioritizes security with the form 8283 fillable. All data is encrypted and stored securely, ensuring that your sensitive information, including financial details related to noncash contributions, is protected against unauthorized access.

-

Can I access the form 8283 fillable from multiple devices?

Absolutely! The airSlate SignNow form 8283 fillable is cloud-based, allowing you to access it from any device with internet connectivity. Whether you're using a desktop, tablet, or smartphone, you can easily manage your forms on the go.

Get more for Form 8283 Pdf

- Enhanced resident assessment form eraf

- Instructions payment of dues fazaia housing scheme form

- Allergovit bestellformular

- Gulu university application form

- Dj ash x chas in the mix mp3 song upd download form

- Form rp 466 a vol application for volunteer firefightersambulance workers and their surviving spouse exemption revised 1225

- Rp 459 c ins 909 form

- Use schedule a2 to report modifications to the deductions for certain sport form

Find out other Form 8283 Pdf

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy