P46 Car Form

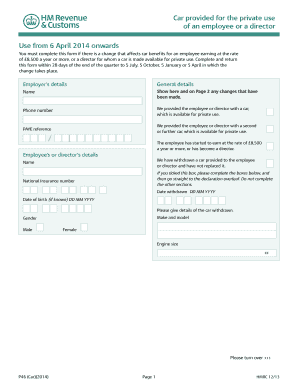

What is the P46 Car?

The P46 Car is a tax form used in the United Kingdom, specifically designed for employees who receive a company car. This form helps employers report the necessary details regarding the car provided to the employee, including its value and any associated benefits. The information on the P46 Car is crucial for calculating the employee's tax liabilities related to the car benefit, ensuring compliance with tax regulations.

How to use the P46 Car

Using the P46 Car involves several steps that both employers and employees must follow. Employers need to complete the form with accurate details about the car, including its make, model, and any relevant financial information. Employees should ensure that the information provided reflects their actual use of the vehicle. Once completed, the form must be submitted to the appropriate tax authority to maintain compliance and avoid penalties.

Steps to complete the P46 Car

Completing the P46 Car requires careful attention to detail. Here are the steps involved:

- Gather necessary information about the car, including its registration number, make, model, and year.

- Determine the car's value and any associated benefits provided to the employee.

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the relevant tax authority.

Legal use of the P46 Car

The legal use of the P46 Car is governed by tax regulations that require accurate reporting of company car benefits. Employers must ensure that the information submitted is truthful and complies with the guidelines set forth by tax authorities. Failure to adhere to these regulations can result in penalties for both the employer and the employee, making it essential to maintain accurate records and timely submissions.

IRS Guidelines

While the P46 Car is primarily a UK form, understanding IRS guidelines is important for U.S. taxpayers who may have similar reporting requirements for company vehicles. The IRS provides specific instructions on how to report vehicle benefits, including the valuation of the vehicle and the tax implications for employees. Familiarizing oneself with these guidelines can help ensure compliance and avoid potential tax issues.

Filing Deadlines / Important Dates

Filing deadlines for the P46 Car are crucial to ensure compliance with tax regulations. Employers should be aware of the specific dates by which the form must be submitted to avoid penalties. Typically, these deadlines align with the end of the tax year, but it is important to verify the exact dates each year to ensure timely filing.

Quick guide on how to complete p46 car

Complete P46 Car effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage P46 Car on any device using airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The simplest way to modify and eSign P46 Car effortlessly

- Find P46 Car and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or redact private information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about missing or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from any device you prefer. Modify and eSign P46 Car while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the p46 car

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the p46 form download and why is it important?

The p46 form download is a document used by employees to provide their employer with necessary information regarding their tax code. It's important as it ensures that the correct tax is deducted from your salary, helping you avoid issues with HMRC.

-

How can I access the p46 form download using airSlate SignNow?

To access the p46 form download, simply navigate to the templates section in airSlate SignNow. From there, you can easily download the form, fill it out, and send it for electronic signature, streamlining your document management process.

-

Is the p46 form download free with airSlate SignNow?

Yes, the p46 form download is available for free as part of the airSlate SignNow solution. We provide a cost-effective way for businesses to manage their documents and forms without hidden fees.

-

What features does airSlate SignNow offer for managing the p46 form download?

airSlate SignNow offers features such as document editing, eSignatures, and secure storage for the p46 form download. These tools make it easy to customize the form, track its status, and ensure compliance with regulations.

-

Can I integrate airSlate SignNow with other applications for the p46 form download?

Absolutely! airSlate SignNow seamlessly integrates with popular applications such as Google Drive and Salesforce, allowing you to manage your p46 form download alongside your other important documents.

-

Is there customer support available for the p46 form download?

Yes, airSlate SignNow provides dedicated customer support to assist you with any questions regarding the p46 form download. Our team is available via chat, email, and phone to ensure you have a smooth experience.

-

What are the benefits of using airSlate SignNow for the p46 form download?

Using airSlate SignNow for the p46 form download offers numerous benefits, including time-saving electronic signatures, easy document collaboration, and increased compliance with tax regulations. It enhances your workflow efficiency and reduces paper usage.

Get more for P46 Car

- Dd form 137 3 2018 2019

- Facility information enrollment information 360care

- 1 form ssa 2018 2019

- Free pregnancy verification form pdf word eforms free

- Books about khula nama sample form

- Application for bmcc i 20 deadlines form

- Nj seller disclosure form 2012 2019

- Employment verification wi 2014 2019 form

Find out other P46 Car

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement