Deed of Partnership for Running a Home Care Nursing Form

What is the Deed of Partnership for Running a Home Care Nursing Business?

A deed of partnership is a legal document that outlines the terms and conditions under which partners operate a business together. In the context of a home care nursing business, this deed specifies the roles, responsibilities, and profit-sharing arrangements among the partners. It serves as a foundational agreement that governs the partnership's operations and helps prevent disputes by clearly defining each partner's contributions and obligations.

Key Elements of the Deed of Partnership for Running a Home Care Nursing Business

When drafting a deed of partnership for a home care nursing business, several key elements should be included:

- Names of Partners: Clearly list all partners involved in the business.

- Business Purpose: Define the specific services provided by the home care nursing business.

- Capital Contributions: Detail the financial contributions each partner is making to the business.

- Profit Sharing: Outline how profits and losses will be distributed among partners.

- Decision-Making Process: Specify how decisions will be made, including voting rights and procedures.

- Duration of Partnership: State whether the partnership is for a fixed term or indefinite.

- Dispute Resolution: Include a process for resolving disagreements among partners.

Steps to Complete the Deed of Partnership for Running a Home Care Nursing Business

Completing a deed of partnership involves several important steps:

- Gather Information: Collect necessary details about each partner, including names, addresses, and contributions.

- Draft the Document: Create a draft of the deed, incorporating all key elements and ensuring clarity.

- Review and Revise: Have all partners review the draft and suggest any necessary changes.

- Consult Legal Advice: Consider seeking legal counsel to ensure compliance with state laws and regulations.

- Sign the Document: Once finalized, all partners should sign the deed in the presence of a witness.

- Store Securely: Keep the signed deed in a safe place, as it serves as a vital reference for the partnership.

Legal Use of the Deed of Partnership for Running a Home Care Nursing Business

The legal use of a deed of partnership is crucial for establishing the legitimacy of the business arrangement. This document is recognized by courts and can be used as evidence in case of disputes. It is important to ensure that the deed complies with local laws and regulations governing partnerships in the home care sector. This compliance helps protect the partners' interests and ensures that the business operates within the legal framework.

Examples of Using the Deed of Partnership for Running a Home Care Nursing Business

Examples of how a deed of partnership can be utilized in a home care nursing business include:

- Defining the scope of services offered, such as personal care, companionship, and medical assistance.

- Establishing a framework for hiring additional staff and managing employee responsibilities.

- Creating guidelines for financial management, including budgeting and accounting practices.

- Setting protocols for compliance with healthcare regulations and standards.

State-Specific Rules for the Deed of Partnership for Running a Home Care Nursing Business

Each state in the U.S. has its own regulations regarding partnership agreements. It is essential to research and understand the specific rules applicable in the state where the home care nursing business operates. This may include requirements for registration, licensing, and adherence to healthcare laws. Ensuring that the deed of partnership aligns with state regulations is vital for the legal operation of the business.

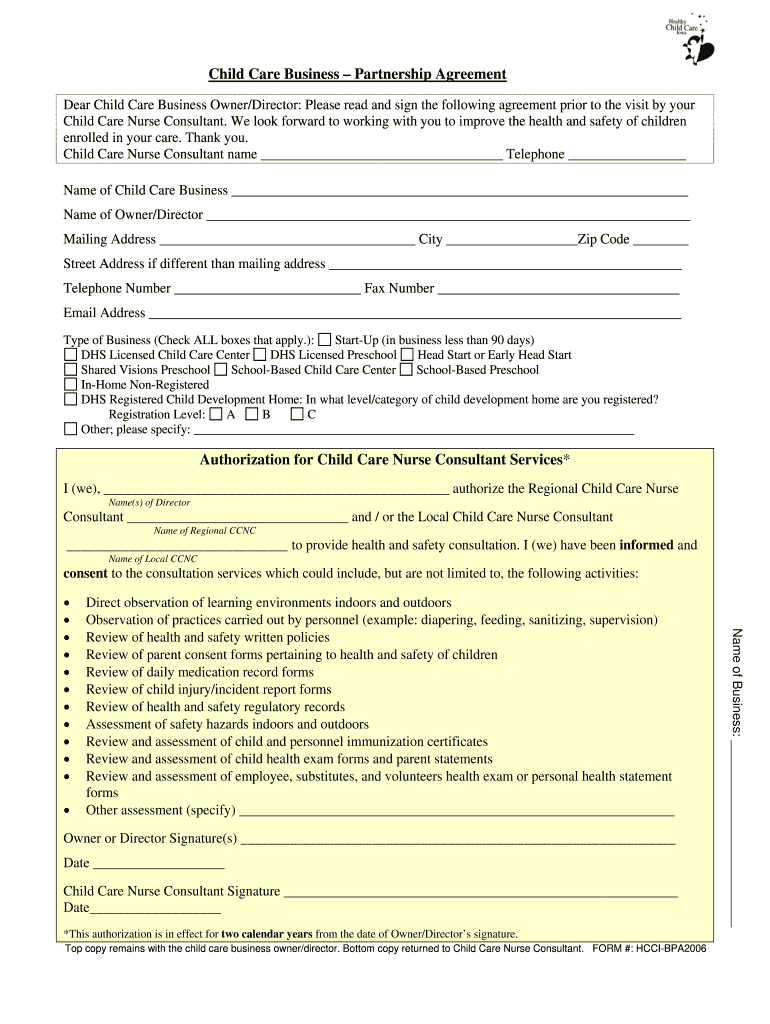

Quick guide on how to complete sample of partnership agreement for child care business form

Manage Deed Of Partnership For Running A Home Care Nursing wherever, whenever

Your daily organizational tasks may necessitate extra attention when handling state-specific business paperwork. Regain your work hours and reduce paper-related expenses linked with document-driven processes using airSlate SignNow. airSlate SignNow offers a wide range of pre-loaded business forms, including Deed Of Partnership For Running A Home Care Nursing, that you can utilize and distribute to your business collaborators. Manage your Deed Of Partnership For Running A Home Care Nursing smoothly with powerful editing and eSignature functionalities, and send it directly to your recipients.

How to obtain Deed Of Partnership For Running A Home Care Nursing in just a few clicks:

- Choose a form applicable to your state.

- Click on Learn More to view the document and confirm its accuracy.

- Select Get Form to begin working on it.

- Deed Of Partnership For Running A Home Care Nursing will automatically appear in the editor. No additional steps are necessary.

- Utilize airSlate SignNow’s advanced editing tools to complete or modify the form.

- Locate the Sign feature to create your signature and eSign your document.

- When prepared, click Done, save your modifications, and access your document.

- Share the form via email or SMS, or use a link-to-fill option with your partners or allow them to download the paperwork.

airSlate SignNow signNowly saves your time managing Deed Of Partnership For Running A Home Care Nursing and enables you to find necessary documents in a single location. A comprehensive library of forms is organized and tailored to address essential business processes vital for your organization. The enhanced editor minimizes the risk of errors, as you can swiftly rectify errors and review your documents on any device before sending them out. Start your free trial today to explore all the advantages of airSlate SignNow for your everyday business operations.

Create this form in 5 minutes or less

FAQs

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

How can I see a sample or example of the PA application form to file for child support?

Pennsylvania Child Support ProgramThis website can provide you with all the forms online. You can see them there.

-

How can I get a lot of people to fill out my Google form survey for a research paper?

First of all, to get a lot of responses for your survey don't forget to follow main rules of creating a survey. Here are some of them:Create and design an invitation page, sett the information about why it is so important for you to get the answers there; also write the purpose of your survey.Make your survey short. Remember that people spend their time answering questions.Preset your goal, decide what information you want to get in the end. Prepare list of questions, which would be the most important for you.Give your respondents enough time to answer a survey.Don't forget to say "Thank you!", be polite.Besides, if you want to get more responses, you can use these tips:1.The first one is to purchase responses from survey panel. You can use MySurveyLab’s survey panel for it. In this case you will get reliable and useful results. You can read more about it here.2.If you don’t want to spent money for responses, you can use the second solution. The mentioned tool enables sharing the survey via different channels: email (invitations and e-mail embedded surveys, SMS, QR codes, as a link.You can share the link on different social media, like Twitter, Facebook, Facebook groups, different forums could be also useful, Pinterest, LinkedIn, VKontakte and so on… I think that if you use all these channels, you could get planned number of responses.Hope to be helpful! Good luck!

-

What forms do I need to fill out to get a judge to grant permission to take a child out of the country for a 2-week vacation when the other parent doesn't want to?

There are no specific forms for that and the courts will not be involved in adjudicating fights between parents over a two week holiday. This is not something you just send in to get a stamp. There would be a hearing and a full court case. This will be a very expensive holiday!I suggest you contact a lawyer if you want to pursue this, or go somewhere else for your holiday.

-

How can I sue someone for not filling out a change of address form and using my address as their business address (moved a year ago, CA)?

I do not think you have a lawsuit just because someone did not file a change of address with USPS. As per the previous answer, you would have to had suffered financial loss or injury due to the situation.As information, it is illegal to file a forwarding request on behalf of another person unless you have a power of attorney or are otherwise authorized to do so.To help stop receiving mail for previous residents write “Not at this address” on any first class mail and place it with outgoing mail. and write the names of those who should be receiving mail at your address on the mailbox (you may place it inside the flap where it is only visible to the carrier).Please note that any mail which has “or current resident”, or similar phrasing, will still be delivered to you even though it may also have the previous residents name. If you don’t want it, toss it into recycling.

-

As a child removed from their parent's care, due to abuse, and put in some sort of foster care, how did things work out for you in the end?

I was removed from my parent’s home at Age thirteen. I couldn’t have been more relieved. Nine months later I returned home, but things were never the same. The first time my Dad and Stepmother became upset with me and my sister they threatened foster care. And, that’s just what happened. I was back in foster care, tried living with my biological mother, then back into foster care. I went through a lot. Something in me kept pushing me along though. I never felt satisfied with what I saw, and believed their had to be more out there than what I saw.In the end, I’d have to say things did work out, relatively speaking. Of course, I had my share of issues. I had next to no support system, and still in the process of trying to figure out who I was, where I belonged, and of all those fun things. But, there are some major game changers that I was able to avoid.I grew up with a strong work ethic, so that worked in my favor. When I graduated from high school at eighteen. I already had a job and was able to rent an apartment the day following graduation. With out this, who knows what direction I could have gone. Maybe I would have went the homeless route, or welfare.I also never became pregnant until much later in life. Had I - my whole life would have turned upside down.My friends and I, during some of my teenage years, were into plenty of drugs and alcohol. It was the 70’s after all. While there were fun times, most were not if I was to be honest. I eventually left that world too. About ten years later, my best friend from that time consequently died from complications of drinking.With everything I experienced up until the age of eighteen, I could have easily gone down a different road.Ultimately, we do choose the direction in which we want to go. But so many factors play into those decisions and some adolescents truly aren’t capable of making right choices when they need to. I believe it would be completely unfair of me to credit myself for things working out the way they did.A couple big problems is that many foster children have never been taught to think of themselves in a worthy way; they often have little to no self value. Loving parental guidance is often a foreign concept. Well, the list goes on.Success for us, and/or things turning out good in the end, can look different from let’s say, a child in the Beaver Cleaver household. And don’t let anyone tell you that doesn’t exist. It does! I’ve met them. But I digress…In my late twenties I finally went to college and became an elementary teacher. Ironically, I was the first of five siblings to go to college.I want to acknowledge God in all of this. I don’t know where I’d be without him!

-

How can I take my child (16yrs) to the U.S if my immigrant visa is approved? My husband, a US citizen, filled out form I 130 for me and mentioned this child as migrating in future.

Just petition using a I-130 yourself. Read the instructions very carefully. I am not sure but it’s possible that the affidavit of support will need to be filled by your husband since he is the citizen and he filled one for you - again, check the instructions very carefully. It should be a pretty clear, straightforward process.Your child is still well below the age limit and should be fine. If there are any problems, do the same thing you did with your own process - use the numbers you are given to check on the process and if you see it stuck call to make sure they have everything they need early.It is my understanding that the age limit of the child is based on the petition date, so go ahead and do it.You still have plenty of time at 16, just don’t delay.

Create this form in 5 minutes!

How to create an eSignature for the sample of partnership agreement for child care business form

How to create an electronic signature for your Sample Of Partnership Agreement For Child Care Business Form online

How to make an eSignature for your Sample Of Partnership Agreement For Child Care Business Form in Chrome

How to generate an electronic signature for putting it on the Sample Of Partnership Agreement For Child Care Business Form in Gmail

How to create an electronic signature for the Sample Of Partnership Agreement For Child Care Business Form right from your mobile device

How to make an eSignature for the Sample Of Partnership Agreement For Child Care Business Form on iOS

How to make an electronic signature for the Sample Of Partnership Agreement For Child Care Business Form on Android devices

People also ask

-

What is a Deed Of Partnership For Running A Home Care Nursing?

A Deed Of Partnership For Running A Home Care Nursing is a legal document that outlines the terms of the partnership between individuals or entities providing home care services. This deed helps define each partner's roles, responsibilities, and share of profits, ensuring a clear understanding for all parties involved in the business.

-

How can airSlate SignNow help with creating a Deed Of Partnership For Running A Home Care Nursing?

airSlate SignNow simplifies the process of creating a Deed Of Partnership For Running A Home Care Nursing by providing customizable templates that ensure all necessary legal elements are included. With its intuitive interface, users can easily fill in their specific details and generate a legally binding document quickly.

-

What are the benefits of using airSlate SignNow for a Deed Of Partnership For Running A Home Care Nursing?

Using airSlate SignNow for your Deed Of Partnership For Running A Home Care Nursing offers several benefits, including time-saving automation, secure eSignatures, and cloud storage for easy access. These features enhance collaboration between partners and streamline the documentation process, making it efficient and hassle-free.

-

Is airSlate SignNow affordable for startups in the home care nursing sector?

Yes, airSlate SignNow offers a cost-effective solution for startups needing a Deed Of Partnership For Running A Home Care Nursing. With various pricing plans tailored to different business sizes, you can find an option that suits your budget while still accessing essential features to manage your documents.

-

Can I integrate airSlate SignNow with other software for my home care nursing business?

Absolutely! airSlate SignNow offers seamless integrations with various software applications commonly used in the home care nursing sector. This capability allows you to streamline your workflow and manage your Deed Of Partnership For Running A Home Care Nursing alongside other essential business tools.

-

How secure is my information when using airSlate SignNow for a Deed Of Partnership For Running A Home Care Nursing?

Security is a top priority for airSlate SignNow. When you use the platform for your Deed Of Partnership For Running A Home Care Nursing, your data is protected with advanced encryption and compliance with industry standards. This ensures that all sensitive information remains confidential and secure.

-

What if I need to make changes to my Deed Of Partnership For Running A Home Care Nursing?

Making changes to your Deed Of Partnership For Running A Home Care Nursing is easy with airSlate SignNow. You can quickly edit your document online, and once the revisions are made, you can resend it for eSignature to ensure all partners agree to the updated terms.

Get more for Deed Of Partnership For Running A Home Care Nursing

- Gc 040 form

- Tr 205 fillable editable and saveable california judicial council forms

- Fl 103 form

- Ud 105 2014 2019 form

- Virginia experience verification form state legal forms

- New mexico continuing education course state legal forms

- Missouri standardized credentialling form state legal forms

- Attachment j6 small business subcontracting plan hanford site hanford form

Find out other Deed Of Partnership For Running A Home Care Nursing

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself