T777 Form 2012-2026

What is the T777 Form

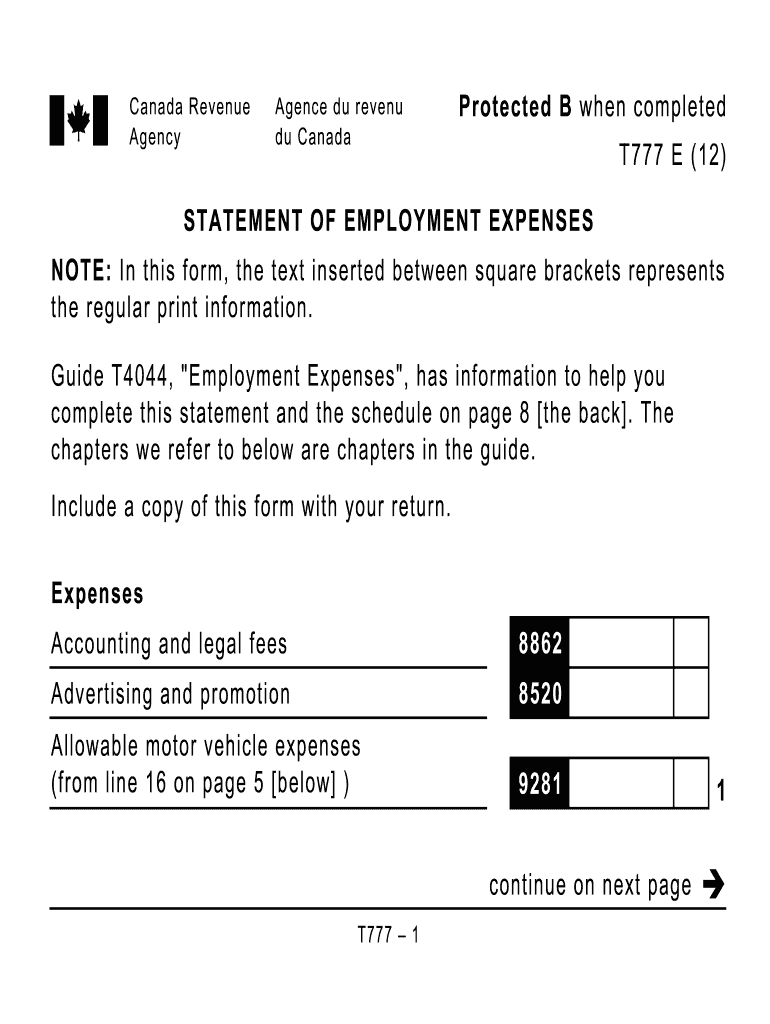

The T777 form, also known as the Statement of Employment Expenses, is a tax document used by employees in Canada to claim work-related expenses. This form is essential for individuals who incur expenses while performing their job duties that are not reimbursed by their employer. The T777 form allows taxpayers to detail these expenses, which can include costs for supplies, travel, and other necessary expenditures related to their employment.

How to use the T777 Form

Using the T777 form involves several steps to ensure that all relevant expenses are accurately reported. Taxpayers must first gather all necessary receipts and documentation related to their employment expenses. Once the form is obtained, individuals will fill out the required sections, detailing each expense and providing the corresponding amounts. It is crucial to keep records of all expenses claimed, as they may be requested by the Canada Revenue Agency (CRA) for verification purposes.

Steps to complete the T777 Form

Completing the T777 form requires careful attention to detail. Here are the steps to follow:

- Obtain the T777 form from the Canada Revenue Agency website or through tax preparation software.

- Fill in personal information, including your name, address, and social insurance number.

- List all eligible employment expenses in the designated sections, ensuring to provide accurate amounts.

- Attach any necessary documentation, such as receipts, to support your claims.

- Review the form for accuracy before submission.

Legal use of the T777 Form

The T777 form is legally recognized for claiming employment expenses under Canadian tax law. To ensure compliance, taxpayers must adhere to the guidelines set forth by the Canada Revenue Agency. This includes only claiming expenses that are directly related to employment duties and maintaining proper documentation to substantiate claims. Failure to comply with these regulations may result in penalties or disallowance of claimed expenses.

Required Documents

When completing the T777 form, certain documents are necessary to support your claims. These may include:

- Receipts for all claimed expenses, such as travel, supplies, and home office costs.

- A signed T2200 form from your employer, which certifies that you are required to incur these expenses as part of your job.

- Any additional documentation that may be relevant to your specific claims.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the T777 form. Generally, the deadline for submitting your tax return, including the T777 form, is April 30 of the following year. If you are self-employed, the deadline is June 15, but any taxes owed must still be paid by April 30 to avoid interest charges. Being mindful of these dates ensures timely filing and compliance with tax regulations.

Quick guide on how to complete t777 form

Complete T777 Form effortlessly on any device

Digital document management has become widely adopted by businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the proper form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents quickly and efficiently. Handle T777 Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to edit and eSign T777 Form with ease

- Access T777 Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all details and press the Done button to save your changes.

- Select your preferred method for sending your form, via email, SMS, or invite link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign T777 Form to guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t777 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the t777s form and why is it important?

The t777s form is a tax-related document used in Canada that helps individuals claim expenses for employment purposes. Understanding this form is crucial for employees, as it allows them to maximize their tax deductions and ultimately save money on their taxes. airSlate SignNow ensures you can easily complete and submit your t777s form securely online.

-

How can airSlate SignNow help with filling out the t777s form?

airSlate SignNow provides an intuitive platform to fill out your t777s form digitally, making the process quick and efficient. Our eSignature feature allows you to securely sign documents and submit them directly from our platform. Additionally, our templates guide you through the necessary fields, reducing the chances of errors.

-

Are there any costs associated with using the t777s form on airSlate SignNow?

Using airSlate SignNow to fill out and eSign your t777s form comes with a variety of pricing plans tailored to meet individual and business needs. While we offer a free trial, our subscription options provide cost-effective solutions that ensure you have the tools needed to complete your t777s form and other necessary documents. Explore our pricing page to find the best plan for you.

-

What additional features does airSlate SignNow offer for the t777s form?

In addition to eSigning the t777s form, airSlate SignNow provides features such as document templates, cloud storage, and collaboration tools. These functionalities not only streamline the process but also enhance the overall user experience when managing tax forms and other essential documents. You'll benefit from a complete digital solution all in one place.

-

Is the t777s form secure with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes the security of your personal information, especially when it comes to sensitive documents like the t777s form. We utilize advanced encryption methods and comply with industry security standards to ensure your data is protected throughout the signing and submission process.

-

Can I integrate airSlate SignNow with other software to manage my t777s form?

Yes, airSlate SignNow offers integrations with various business applications, allowing you to seamlessly manage your t777s form alongside your other documentation needs. Whether you use CRMs, cloud storage, or accounting software, our platform can connect with them to enhance your workflow. Check our integrations section for more details.

-

What benefits does using airSlate SignNow for the t777s form provide?

Using airSlate SignNow for your t777s form offers signNow benefits, including time savings and reduced paperwork. The platform allows for easy collaboration, quick document turnaround times, and secure storage. Ultimately, this means less hassle and more efficiency when managing your tax-related forms.

Get more for T777 Form

Find out other T777 Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT