Truth in Lending Form

What is the Truth In Lending Form

The Truth In Lending Form is a crucial document designed to promote transparency in lending practices. It provides borrowers with essential information about the terms and costs associated with a loan. This form outlines the annual percentage rate (APR), finance charges, total payments, and other key details that help consumers make informed decisions when borrowing money. By ensuring that these details are clearly presented, the form aims to protect consumers from deceptive lending practices.

How to Use the Truth In Lending Form

Using the Truth In Lending Form involves several straightforward steps. First, you need to obtain the form from your lender or financial institution. Once you have the form, carefully review the information provided, including the loan amount, interest rate, and repayment terms. It's important to compare these details with other loan offers to ensure you are getting the best deal. If you have questions about any section of the form, do not hesitate to ask your lender for clarification.

Steps to Complete the Truth In Lending Form

Completing the Truth In Lending Form requires attention to detail. Here are the essential steps:

- Gather necessary information, including your personal details and loan specifics.

- Fill in the required fields accurately, ensuring that all information matches your financial records.

- Review the completed form for any errors or omissions.

- Submit the form as instructed by your lender, whether online or in person.

Taking the time to complete the form carefully can help prevent delays in the loan approval process.

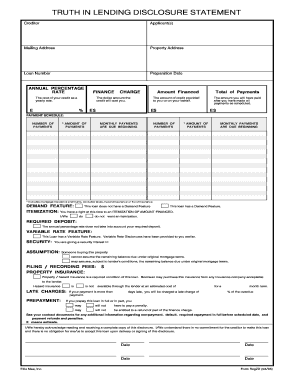

Key Elements of the Truth In Lending Form

The Truth In Lending Form includes several key elements that are essential for understanding the loan agreement. These elements typically consist of:

- Loan Amount: The total amount borrowed.

- Annual Percentage Rate (APR): The cost of borrowing expressed as a yearly interest rate.

- Finance Charges: Total costs associated with the loan, including interest and fees.

- Payment Schedule: Information on when payments are due and how much they will be.

- Total Payments: The total amount you will pay over the life of the loan.

Understanding these elements is vital for making informed borrowing decisions.

Legal Use of the Truth In Lending Form

The Truth In Lending Form is governed by federal regulations, specifically the Truth in Lending Act (TILA). This legislation mandates that lenders provide borrowers with clear and accurate information about loan terms. Compliance with TILA is essential for lenders to avoid penalties and ensure that borrowers are well-informed. The legal use of the form helps to create a fair lending environment and protects consumers from misleading practices.

Digital vs. Paper Version

Both digital and paper versions of the Truth In Lending Form serve the same purpose, but they offer different advantages. The digital version allows for easier completion and submission, often streamlining the process. It can also include features like electronic signatures, which enhance convenience. On the other hand, the paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the format, it is important to ensure that all information is accurate and complete.

Quick guide on how to complete truth in lending form

Complete Truth In Lending Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools to create, revise, and electronically sign your documents swiftly without delays. Manage Truth In Lending Form on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Truth In Lending Form with ease

- Obtain Truth In Lending Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal significance as a traditional ink signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Truth In Lending Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the truth in lending form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a truth in lending form?

The truth in lending form is a disclosure document that provides essential information about the costs and terms of a loan. This form ensures transparency between the lender and borrower, detailing annual percentage rates, payment schedules, and total loan costs. With airSlate SignNow, you can easily create and send a truth in lending form to streamline your lending processes.

-

How can airSlate SignNow help with truth in lending forms?

airSlate SignNow offers a user-friendly platform for creating, sending, and eSigning truth in lending forms. By utilizing our digital tools, businesses can ensure compliance and accuracy while reducing paperwork. The ease of use allows both lenders and borrowers to engage in a seamless signing experience.

-

Is there a cost associated with using airSlate SignNow for truth in lending forms?

Yes, airSlate SignNow provides flexible pricing plans for businesses, allowing you to choose options that fit your budget for managing truth in lending forms. Our plans are designed to be cost-effective while offering robust features for document management and eSigning. Visit our pricing page for more details on the best plan for your needs.

-

What features does airSlate SignNow offer for truth in lending forms?

airSlate SignNow offers features such as customizable templates, secure eSignature capabilities, and real-time tracking of truth in lending forms. Our platform also includes integration options with other software, making it easy to manage your documents. These features enhance efficiency and ensure all relevant information is easily accessible.

-

Are truth in lending forms customizable on airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your truth in lending forms to include all necessary details specific to your lending practices. This flexibility ensures that you can tailor the forms to meet your unique business needs while maintaining compliance with legal requirements.

-

Can I integrate airSlate SignNow with other applications for truth in lending forms?

Yes, airSlate SignNow offers seamless integration with various applications, enhancing the functionality of your truth in lending forms. You can connect with CRM systems, payment processors, and other business tools, allowing for streamlined workflows and efficient document handling. Explore our integrations to see how we can fit into your existing processes.

-

What are the benefits of using airSlate SignNow for truth in lending forms?

Using airSlate SignNow for truth in lending forms offers numerous benefits, including increased efficiency, improved accuracy, and enhanced security. By digitizing the process, businesses can reduce the time spent on paperwork and minimize errors. Additionally, our secure platform protects sensitive information, ensuring compliance with industry standards.

Get more for Truth In Lending Form

Find out other Truth In Lending Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation