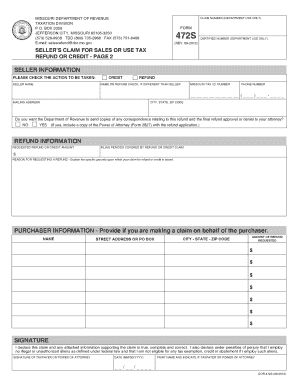

Form 472s

What is the Form 472s

The Form 472s is a document used by the Missouri Department of Revenue to report and claim certain tax credits. This form is essential for individuals and businesses seeking to take advantage of specific tax benefits offered by the state. Understanding the purpose of this form is crucial for ensuring compliance and maximizing eligible deductions.

How to use the Form 472s

Using the Form 472s involves accurately filling out the required sections to report your tax credit claims. It is important to provide all necessary information, including your identification details and the specific credits you are claiming. Ensure that you follow the guidelines provided by the Missouri Department of Revenue to avoid errors that could delay processing.

Steps to complete the Form 472s

Completing the Form 472s requires careful attention to detail. Here are the steps to follow:

- Download the form from the Missouri Department of Revenue website or access it through authorized platforms.

- Fill in your personal information, including name, address, and Social Security number.

- Identify the specific tax credits you are claiming by referencing the instructions provided with the form.

- Provide any supporting documentation required to substantiate your claims.

- Review the completed form for accuracy before submission.

Legal use of the Form 472s

The legal use of the Form 472s is governed by Missouri tax laws. To ensure that your submission is valid, it must comply with the relevant regulations regarding tax credits. This includes providing accurate information and submitting the form within the designated time frame. Failure to adhere to these legal requirements may result in penalties or denial of claims.

Key elements of the Form 472s

Understanding the key elements of the Form 472s is essential for successful completion. Important components include:

- Identification Information: Personal details that identify the taxpayer.

- Credit Claims: Specific tax credits being claimed, which must be clearly indicated.

- Supporting Documentation: Any additional paperwork required to validate the claims made on the form.

Form Submission Methods

The Form 472s can be submitted through various methods, including:

- Online Submission: Utilizing the Missouri Department of Revenue's online portal for electronic filing.

- Mail: Sending a printed version of the form to the appropriate department address.

- In-Person: Delivering the form directly to a local Department of Revenue office.

Quick guide on how to complete form 472s

Effortlessly Prepare Form 472s on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly and efficiently. Manage Form 472s on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to edit and eSign Form 472s with ease

- Find Form 472s and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate the worry of lost or misplaced files, the hassle of searching through forms, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Form 472s and ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 472s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 472s and how can airSlate SignNow help with it?

The form 472s is a crucial document used for various financial reporting needs. airSlate SignNow streamlines the process of creating, sending, and signing form 472s, making it easy for users to manage their documentation efficiently and securely.

-

Are there any costs associated with using airSlate SignNow for form 472s?

Yes, airSlate SignNow offers a range of pricing plans, providing flexibility based on your business needs. Whether you're a small business or a larger organization, you can find a plan that allows you to manage and eSign form 472s without breaking the bank.

-

What are the main features of airSlate SignNow for handling form 472s?

airSlate SignNow offers features such as customizable templates, advanced security measures, and automated workflows for form 472s. These functionalities ensure that your document management process is not only efficient but also compliant with industry standards.

-

How does airSlate SignNow ensure the security of form 472s?

Security is a top priority for airSlate SignNow. The platform utilizes encryption protocols and secure storage practices to protect form 472s and other sensitive documents, ensuring that your data remains confidential and secure.

-

Can I integrate airSlate SignNow with other applications for form 472s?

Absolutely! airSlate SignNow supports integration with various applications, allowing you to seamlessly manage form 472s alongside your other business tools. This makes it easier to streamline your workflows and improve efficiency.

-

What advantages does airSlate SignNow provide for managing form 472s?

Using airSlate SignNow offers several advantages, such as increased speed in processing form 472s, reduced paper usage, and enhanced collaboration among team members. These benefits ultimately lead to improved productivity and lower operational costs.

-

Is it easy to use airSlate SignNow for first-time users dealing with form 472s?

Yes, airSlate SignNow is designed with user-friendliness in mind. First-time users will find it intuitive to navigate the platform and manage their form 472s with minimal training, ensuring a smooth onboarding process.

Get more for Form 472s

- Sv 109 notice of court hearing private postsecondary school violence prevention form

- Download volunteer application stonecrest medical center form

- California residential lease agreement 1 grant of lease form

- Lansing urgent care patient registration form

- Authorization for anaphylaxis action plan form

- Ds 5535 supplemental questions for visa applicants form

- Nsfas applications consent form

- Rlz 1 s v 10 summary of source deductions and employer contributions form

Find out other Form 472s

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form